|

| By Sean Brodrick |

As I write this, gold prices are edging higher again. Today, I’m going to share charts from a presentation I gave Resource Trader Members last week, showing something very curious about gold — and where the yellow metal might be headed.

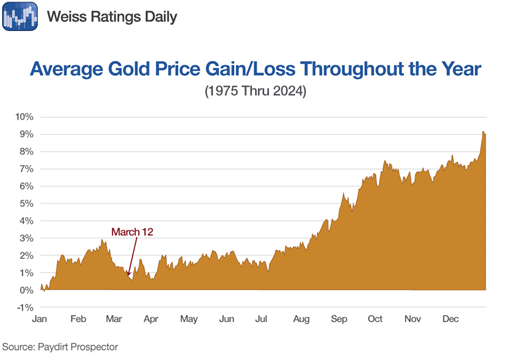

The first thing you need to know is that seasonally speaking, gold shouldn’t be rallying at all. This is the weak time of the year for gold, as you can see from this chart …

Gold usually doesn’t start making significant gains until April, if then. To be sure, this is an average, and every year is different. But this rally at this time of year is kind of a shocker!

What makes this year different?

Chaos as Policy

I’m pretty sure President Trump and his team have set out to “break” the U.S. government. That’s what Elon Musk’s Department of Government Efficiency, or DOGE, is all about.

Their plan is to rebuild and restructure the government, only leaner. President Trump says we’ll be much better off when it’s all said and done. In the short term, it’s chaos.

Meanwhile, the White House’s on-again, off-again approach to tariffs with our major trading partners is so chaotic, it can barely be called a policy.

Chaos scares investors. And that is one of the major forces driving gold higher.

Also, tariff-sparked trade disputes come at a time when economic news — from consumer and small business confidence to stubborn inflation — fuel fears of a potential economic downturn.

Indeed, more voices on Wall Street warn of stagflation and perhaps recession.

Even President Trump refused — twice — to rule out an economic contraction this year. Add that to DOGE, tariffs and weaker economic data, and you have multiple reasons for the stock market to sell off as it has recently.

More Fed Rate Cuts

All this raises the odds of the Fed cutting benchmark interest rates this year.

As recently as Feb. 12, the market was pricing in only one rate cut. While Fed Chair Powell said recently that the Fed wants to take it slow on rate cuts, the market is now pricing in three cuts in 2025, starting in June.

Combined with the rate cuts that began last year, America is on a rate-cut cycle.

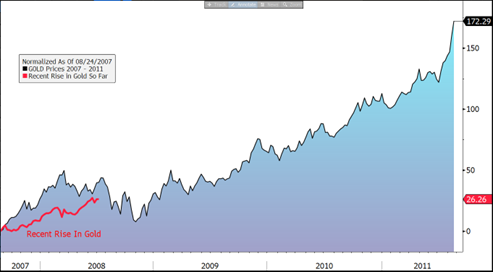

And that brings me to my second chart. This shows the action in gold when the Fed embarked on a rate-cut cycle in 2007.

From September 2007 to January 2008, the Fed cut its benchmark rate by 1.75%, or 175 basis points. But the effects were felt far beyond, all the way to 2011.

Here’s a chart showing what happened to gold prices from 2007 to 2011 and a red line showing what has happened to gold in the current rate-cutting cycle.

They say history doesn’t repeat, but it rhymes. A similar move today would bring gold to $6,902 an ounce.

Now, we don’t know exactly how much gold will run this time around. But odds are it’s going a LOT higher.

How You Can Play This

If the past is a guide, gold will more than double. So, an easy way to play this is through the SPDR Gold Shares (GLD).

It has a Weiss Rating of “B-” and an expense ratio of just 0.4%, which is pretty cheap.

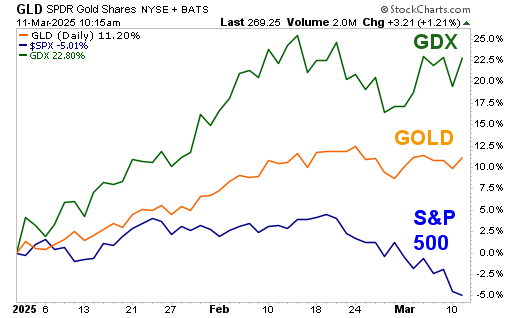

And if you have the stomach for more risk, the VanEck Gold Miners ETF (GDX) has more than doubled the performance of gold so far this year, as you can see from this next chart …

Gold was recently up 11.2% this year — very nice when you consider that the S&P 500 was down 5% at the same time. The GDX racked up a 22.8% gain over the same time frame.

To be sure, when gold pulls back, as happened on Monday, gold miners get stomped.

Savvy investors will use those pullbacks to enter new positions in gold miners. Or buy gold or the GLD. Your returns are going to be great!

The next thing that could move the gold market will be the U.S. Consumer Price Index data, which comes out TODAY, and the Producer Price Index print on Thursday. Let’s see how that goes.

And may the next shock be a pleasant one in your portfolio.

All the best,

Sean

P.S. You know what else is doing better than anyone expected? The IPO market.

So far in 2025, there have been 36 IPOs in the U.S. — up 64% year over year. Of course, investing in an IPO is never as lucrative as investing before an IPO.

That’s exactly what my colleague, Chris Graebe, does for a living. And he just found his favorite opportunity of the year. Check it out here.