|

| By Mahdis Marzooghian |

It wasn’t too long ago when cannabis stocks were hailed as “green gold” and the next hot investment trend.

Experts and analysts were convinced cannabis companies and multi-state operators would soon bypass the roadblocks and federal restrictions and go on to rally even further.

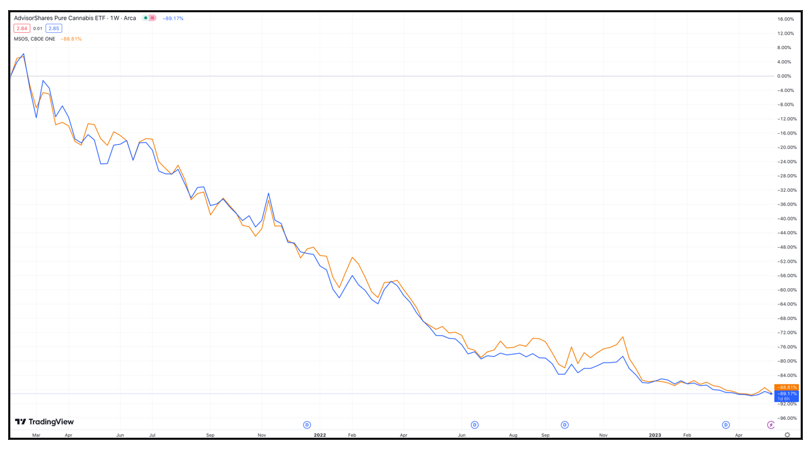

Instead, over the past year, the industry was led downward by two of the largest ETFs in the space:

• The AdvisorShares Pure US Cannabis ETF (MSOS) took a nearly 60% nosedive.

• The AdvisorShares Pure Cannabis ETF (YOLO) — which includes cannabis and ancillary companies in the U.S., Canada and the rest of the world — is down around nearly 57%.

• Overall, cannabis stocks fell by a whopping 70% in 2022, compared to the broader market’s 20% drop.

Click here to see full-sized image.

The picture is even more grim the farther you zoom out. Since peaking in February 2021, those ETFs are both down around 89%!

So, what exactly happened?

Well, cannabis producers in the U.S. and Canada are struggling with scarce capital, weak retail pricing stemming from gross oversupply and obstinate federal restrictions here in the U.S.

The Federal Hurdle

While cannabis companies in both the U.S. and Canada saw a sharp rise in their share prices over the last quarter of 2020 and into the first two months of 2021, everyone soon had to take off their rose-colored glasses, despite having a Democrat in the White House.

Indeed, investors and companies in the U.S. had to face the grim reality of how difficult it would be to move forward on federal legalization in the U.S.

Last year ended in disappointment, as Congress’ last minute omnibus spending bill excluded a measure that would allow federally-illegal operators to use federally-regulated banks.

But the sector also saw some progress, with President Biden asking federal agencies to determine whether marijuana should be “rescheduled” as a less-serious drug under federal law.

According to Barron’s, rescheduling would stop short of comprehensive legalization, but would remove the heavy burden of unfair federal tax treatment the state-licensed operators have to deal with.

And per Cantech Letter, things have been running much more smoothly at the state level, with more states legalizing pot for either medical or adult use and MSOs building out their empires of production, distribution and retail across the country.

However, these same companies still face significant hurdles in terms of banking and capital investment, fueled by the fact that marijuana still remains a Schedule I narcotic at the U.S. federal level, despite rescheduling rumblings that may be a long way off.

And while Canada’s legal weed industry is growing and consolidating, supply overflow remains an issue. Industry darlings like Canopy Growth (WEED.TO), Aurora Cannabis (TRUL) and Cronos Group (CRON.TO) have scaled down operations in an attempt to become profitable.

But even so, it should be noted that all three of these stocks are rated “D” and “E+” by Weiss, meaning stay far away from them.

All this boils down to a waiting game for both the industry and for investors.

So, with everything at a standstill and lack of interest in the space, it might be best to perhaps hold on to some of the stronger names in your portfolio if you’ve held them for a while and venture into safer, more reliable spaces.

Speaking of which, here’s …

What to Invest in Right Now

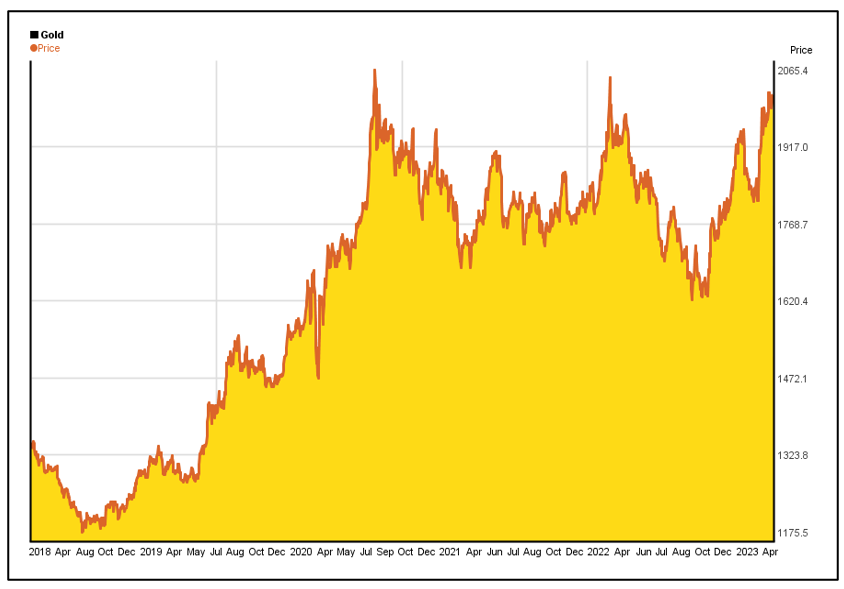

While the “green gold” stocks aren’t doing your portfolio any favors right now, good old fashioned yellow gold is doing rather well.

If you’re looking for an alternative investment that will also keep your portfolio afloat during tough economic times, look no further than the yellow metal.

In my article from a few weeks back, I mentioned how gold is a hot-ticket item not just with investors, but also with central banks, especially during recessionary times.

And not only that, right now all signals point to the U.S. defaulting on its massive debt, which will lead to government shutdowns and a whole mess of other issues. Well historically, gold and gold miners do very well in this kind of environment.

In fact, when nearly every major stock index plunged during the 2011 debt crisis, gold and gold miners were way up. You can also see in the chart below how the price of gold has steadily risen over the past five years:

Click here to see full-sized image.

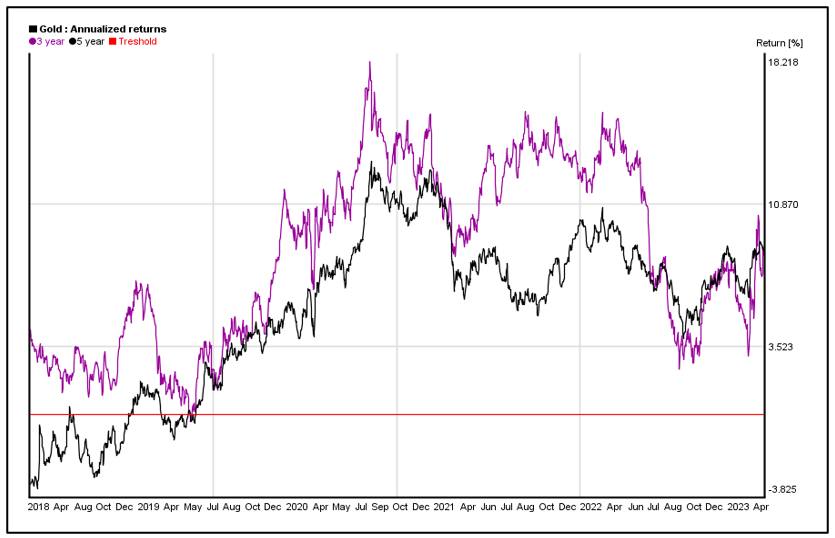

Plus, here’s a look at gold’s five-year annualized return rate:

Click here to see full-sized image.

And while there are a lot of options out there, you can start small with a reliable gold mining stock. In fact, I’ve got just the one in mind …

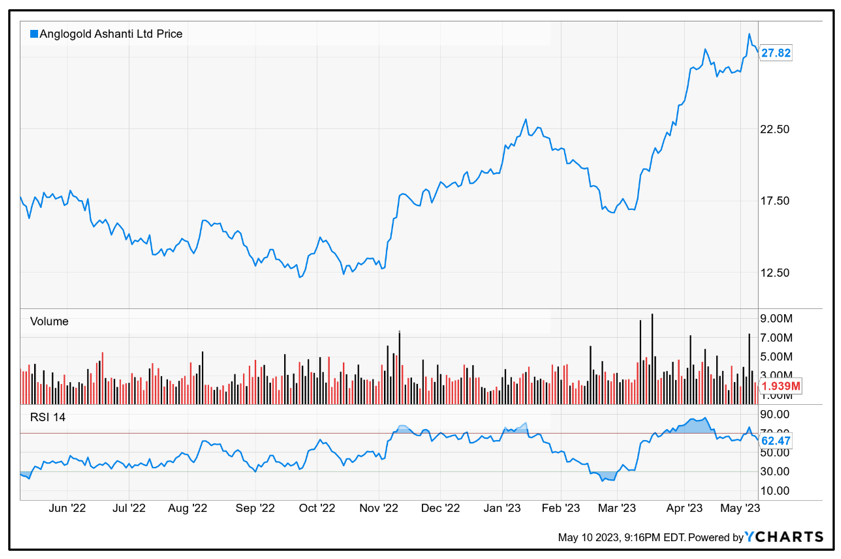

AngloGold Ashanti (AU) is rated a solid “Hold” right now on Weiss Ratings, which means it’s also priced reasonably, sitting around $27 a share right now.

Based in Johannesburg, South Africa, the company operates gold mines in Africa, Australia and the Americas. Here’s a look at its one-year chart:

Click here to see full-sized image.

AngloGold has a modest earnings forecast, but it also has a stronger record of increasing earnings per share. The company has posted positive EPS every year since 2015, while sales have been increasing overall since 2018.

To ice the cake, AU pays a 2.4% dividend yield, but the amount can vary drastically from year to year.

The stock’s current P/E is 28.7, which is pretty moderate. P/E values have ranged between six and well over 400 during the last five years.

So, if you’re looking to diversify your portfolio with some alternative investments during these uncertain times, cannabis — or “green gold” — stocks may no longer be the answer.

But you can always bet on yellow gold.

All the best,

Mahdis Marzooghian

Assistant Managing Editor

Weiss Ratings Daily

P.S. Another way to ensure you’re putting your money in the right place is my colleague Chris Coney’s strategy for going after capital appreciation AND yields. You can receive 18%+ when you want to add income to your portfolio. Click here to learn more.