|

| By Sean Brodrick |

Oil ripped higher last week. And though it is pulling back this week, I’d expect higher prices if things go from bad to more violent in the Middle East. That could drive oil prices to $100 a barrel or higher.

I’ll give you three reasons why. And I’ll also give you an idea of how you can play it.

First, it’s not just Iran’s oil that is at risk.

Iran pumps about 3.2 million barrels per day (bpd) — around 3% of the world’s total. Due to Western sanctions, more than 90% of the 1.7 million bpd it exports goes to China.

Loss of Iranian exports would force China to bid against buyers for other sources of oil, pressuring prices higher.

That would move oil prices higher … but it’s just the start.

The real problem is that there’s no rule any conflict has to stop at Iran’s and Israel’s borders. The Middle East produces about 31.5% of the world's oil. And Iran has long-standing feuds with its oil-rich neighbors Saudi Arabia and Iraq.

A conflict escalation could prompt Iran to block the Strait of Hormuz — through which a fifth of the world’s oil supply passes every day — or attack Saudi oil infrastructure. That’s exactly what Iran did back in 2019.

What happened then was the Iran-backed Houthi rebels in Yemen launched drone strikes on the oil processing facilities in Abqaiq and Khurais in eastern Saudi Arabia.

Sure, the Houthis said they did it, but we know who gave them the drones and told them what to hit.

This time around, who knows what Iran could attack? And that uncertainty is one of the reasons oil could go much higher.

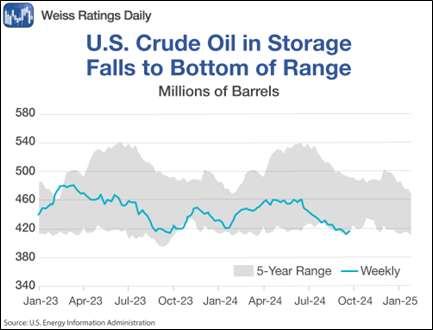

Second, U.S. oil stockpiles are low.

Despite a rise in the last week, crude oil stocks are still below the bottom of the five-year range.

What this does is squeeze any margin of safety in the global oil supply.

The United States is now the world's largest producer of oil and natural gas. It is averaging exports of 4.2 million barrels per day this year.

If there is a crisis in Iran, and America’s oil stocks are low, that could accelerate global oil prices.

Third, Wall Street is starting to bet on higher prices.

Even after the recent rally, the price of oil is still down 14% from its April high. So, it raises eyebrows that Bloomberg reports more traders are adding $100-per-barrel crude calls traded this week.

Maybe those traders are listening to Citigroup, which wrote a note to clients saying, “any closure of the Strait of Hormuz would represent a tipping point for the global oil market.”

Goldman Sachs recently published the opinion that if Iranian oil production dropped by a million barrels a day, it would send oil prices higher by $20 a barrel.

And research firm Clearview said that event could send oil prices over $100 a barrel.

There are estimates that go higher. In a worst-case scenario of a sustained and large Middle East oil supply disruption, the international oil price could jump to around $150 a barrel, according to the World Bank.

This is not the consensus view, at least not yet. But in the case of a widening conflict with Iran, a crude oil target of $100 or higher is probably the smart view.

What You Can Do

You can hedge against higher oil prices through any number of oil-leveraged ETFs. The Energy Select Sector SPDR Fund (XLE) is the biggest.

It holds a basket of the best oil & gas stocks. It sports a dividend yield of 3.39% — more than double the 1.32% yield of the S&P 500.

And it recently broke its downtrend …

You can see the XLE pushed up through the downtrend, and now is pulling back to test that former resistance as support.

If oil does go over $85, $90, $95 a barrel, that could send the XLE much, much higher.

To be sure, I’d be happy to be wrong. I’d be much happier if peace broke out in the Middle East.

But if bad things are likely to happen, it’s just smart to protect yourself … and make sure that the next gusher is in your portfolio.

All the best,

Sean

P.S. And if a 3.39% dividend yield still doesn’t solve your income problems, I urge you to check out the Great Income Solution Summit that aired yesterday.

You can still watch it (for now) and act on what we’ve found. Click here to check it out.