|

| By Jon Markman |

The new artificial intelligence software from Google is impressive. Naysayers are doubting, again. This is a BIG opportunity for investors.

Engineers at Google on Wednesday revealed Gemini AI, the company's answer to ChatGPT, the chatbot from OpenAI.

Tech pundits say the presentation was a fraud, the implication being that Google’s AI is all smoke and mirrors.

Skeptics are completely missing the point. Here’s why …

Un-Fake News

The breathless headlines are everywhere. Gemini is a fake.

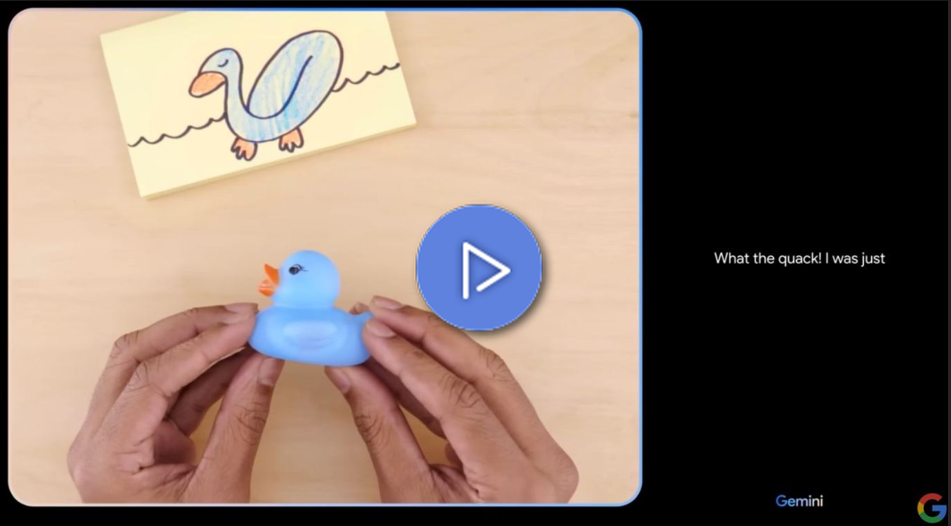

Apparently, parts of the Gemini presentation last week were edited to make it seem like the AI software tool was able to listen and quickly respond to the presenter in a now viral video.

The implication is that Google remains far behind OpenAI in the race for AI supremacy … and that its AI technology, in general, is simply not that impressive.

A writer at Ars Technica opines: “Over the past year, upstart OpenAI has embarrassed Google by pulling ahead in generative AI technology.”

Another at TechCrunch concludes: “In actuality, [the video] was a series of carefully tuned text prompts with still images, clearly selected and shortened to misrepresent what the interaction is actually like.”

To be clear, the video presentation was designed to shine the most favorable light on AI software developed by DeepMind, a company under Google’s parent company Alphabet’s (GOOGL) umbrella.

DeepMind is the evolution of the same engineering team that developed the foundational tools used by OpenAI to build ChatGPT. DeepMind is also the company behind AlphaFold, an AI software tool used to solve the protein folding problem.

Proteins fold into shapes that determine their function. For 50 years, biologists struggled to understand this seemingly random process. Solving the folding problem could lead to faster drug discoveries and huge advances in material science.

AlphaFold was launched in 2021. Within two years, DeepMind gave scientists access to over 200 million protein predictions. Some 98.5% of the 3D structures for human proteins can currently be predicted.

It’s simply not true that Google is behind in AI. It’s also a gross misrepresentation that the firm’s AI accomplishments, thus far, have been unimpressive.

This kind of negativity fits a pattern.

In 2018, Google launched Duplex, an AI software tool that provided a talking personal assistant to Android smartphone users. This assistant was able to dial telephone numbers and make appointments.

Human respondents were none the wiser that they were conversing with a computer.

Tech journalists immediately questioned the presentation. Vanity Fair implied the presentation was fake. Within two years, the product was in use at commercial call centers.

Investors Should Choose Optimism

Naysayers routinely diminish the accomplishments of Google and other large tech companies. They are especially skeptical about AI, despite all the evidence of its use cases. Negativity is easy. It aligns well with failure.

This is the beginning of a technology revolution. Generative AI is real, impressive … and it will change the way all computing occurs in the future.

This means a new generation of semiconductors, software and a revamping of the entire $1 trillion datacenter complex. Investors should welcome negativity from pundits because it keeps stock prices cheaper, for now.

For almost a decade, I have been recommending investors buy shares of Nvidia (NVDA). Back then, the company was virtually alone in AI development.

Naysayers scoffed that the technology would never amount to anything … that the investment made by Nvidia executives was lost. Shares have risen 12,480% since my initial recommendation.

This technology cycle will have similar winners. Some, if you can believe it, will even be megacompanies already, like Alphabet.

But the only way to get this next round of gains is to invest with optimism … and shut out the naysayers.

All the best,

Jon D. Markman

P.S. The tech cycle — with AI at the center of it — is something that will be so obvious in a few years that it might end up in elementary school textbooks. My colleague Sean Brodrick just identified a cycle like this that comes with a $13 trillion windfall opportunity. Click here to check it out before those future kids read about it.