Why President Trump Is Going to Rock the Gold Market

|

| By Sean Brodrick |

President Trump just opened the door to much higher gold prices, and he probably doesn’t even realize it.

How’d that happen? I’ll get to that. I’ll even give you THREE ways to play this move.

First, let’s talk about central banks and gold.

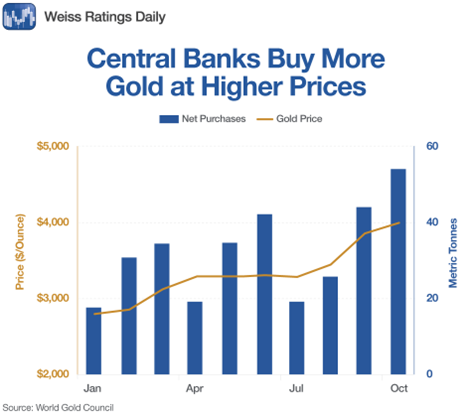

Central bank gold buying is picking up speed.

Just in 2025 alone, we saw central banks, as a group, add …

- January: +17 metric tonnes

- February: +31 tonnes

- March: +34 tonnes

- April: +19 tonnes

- May: +20 tonnes

- June: +22 tonnes

- July: +10 tonnes

- August: +19 tonnes

- September: +39 tonnes

- October: +53 tonnes

Here’s a chart …

As gold prices go higher, central bank purchases of the yellow metal are accelerating!

Central banks were buying 20 tonnes when gold was at $2,700. Now they’re buying 55 tonnes at $4,000.

I don’t blame them. They can print money for “free” and exchange that for the hard currency of gold.

The Bank of Sean

Heck, I’d do the same thing.

Let’s say I had a bank with a money-printing press in my garage.

We’ll call it the Bank of Sean — or BS.

And if I could print as much money as I wanted to buy gold? Man, BS would be leading the charge on precious metals.

Will this continue? I firmly believe so.

Central banks are buying hand over fist, with several analyses citing 2025 purchases running around 900-1,000 tonnes for the year.

That strongly suggests even more buying in 2026.

So how does Trump figure into this?

In a new interview, Trump confirmed that backing an “immediate” reduction in interest rates is a litmus test for his Fed Chair nominee.

Trump has repeatedly criticized the current Fed as “too late” on cuts. And rate-cut advocate Kevin Hassett is a leading contender to be the new Fed Chair — reinforcing expectations of a more explicitly pro-easing Fed leadership.

Such a shift in policy bias would mean a blast-off for gold, via lower real yields, a potentially weaker dollar and especially concerns about Fed independence.

Such a Fed won’t be pricing interest rates for market conditions. It will be pricing rates to please Trump.

As long as the economy keeps ticking along, that’s a recipe for higher inflation.

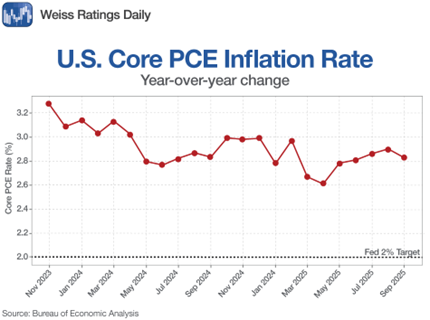

There are many ways to measure inflation.

The metric the Fed prefers is Core CPE, or “Core Personal Consumption Expenditures.”

That bottomed in April and was recently 2.8%. That’s well above the Fed’s 2% target.

Explicitly stating the Fed Chair MUST deliver rate cuts will kneecap central bank independence.

Several banks and research houses flag this as a potential accelerator for gold.

Back in September, Goldman Sachs said a material erosion of Fed independence could trigger a flight from Treasuries and equities into gold.

Goldman’s upside scenarios were $5,000 per ounce, as gold becomes insurance against policy-driven currency and rate distortions.

I wonder what Goldman Sachs thinks of President Trump’s “litmus test.”

Direct Monetary Impact on Gold

What’s more, lower rates reduce the opportunity cost of holding non-yielding gold.

This relationship is already visible in 2025 as rate-cut bets, and the October cut coincided with record or near-record gold prices.

The market is just starting to price in a lower-for-longer real-rate environment.

One result should be a weaker or more volatile dollar, alongside concerns about fiscal deficits and long-run currency debasement.

That makes gold look more attractive.

Hey, you know one way that the U.S. could slow down the decline in the U.S. dollar? It could buy more gold, just like the other central banks!

Geopolitics & Safe-Haven Flows

Rising geopolitical tensions are already pushing investors toward gold as a politically neutral safe haven.

That’s another reason why gold is showing 60% returns so far this year.

Add a Fed under political pressure to cut rates — and perhaps keep them low regardless of inflation — and that’s rocket fuel on an already blazing fire.

In other words, the gold bull of 2025 may only be the warm-up act. The main event begins in 2026.

How You Can Play It

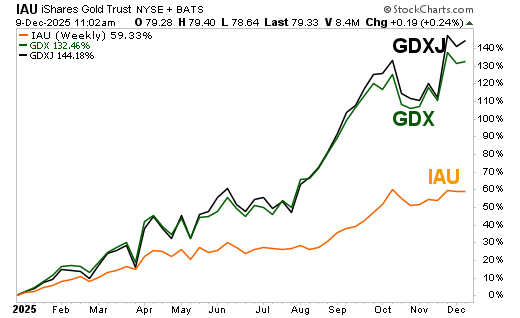

The obvious ETF to play this is the SPDR Gold Shares (GLD).

Instead, I’d recommend the iShares Gold Trust (IAU).

You get the same performance, because both funds hold physical gold.

But the GLD has an expense ratio of 0.4%, while the IAU’s expense ratio is just 0.25%.

Gold and the IAU are up nearly 60% this year. Nice!

You know what’s even nicer? The performance in gold miners!

The Van Eck Gold Miners ETF (GDX) is up 132% so far this year.

If you think that’s good, the Van Eck Junior Gold Miners (GDXJ) is up 144%!

Those are great gains for all three.

You know what? I believe 2026 could be even better.

President Trump’s “litmus test” could be the spark for the next bonfire of red-hot prices.

All the best,

Sean

P.S. These ETFs hold some of the biggest names in the precious metals mining world.

But larger gains will come from smaller stocks leveraged even more to gold.

I recently put together several reports identifying which ones you’ll want to own for this next leg higher.

You can learn what they are here.