|

| By Sean Brodrick |

America is barrelling down the road toward higher gasoline prices. I expect we could see $5/gallon gasoline this summer. It starts with OPEC+’s latest production cuts — which sent oil to its biggest one-day gain in more than a year on Monday — but there is much more to it than that.

On Sunday, OPEC+ — which includes the Organization of the Petroleum Exporting Countries plus a group of nations led by Russia — said it would reduce production by a further 1.15 million barrels per day beginning in May and lasting through the end of the year.

OPEC slashed production targets by 2 million bpd in November. More recently, Russia said it was extending a 500,000 bpd cut through the end of the year. Now, the total pledged output cuts by the group equal 3.66 million bpd — around 3.7% of global demand — and these are expected to remain in place until the end of the year.

To be sure, OPEC was nowhere near meeting its production targets anyway. In fact, even before the cuts were announced, OPEC’s production dropped 70,000 bpd in March. That’s a whopping 926,000 bpd short of the group production quota.

So, in effect, OPEC+ is cutting 117,000 bpd from current production. But that is happening when global oil demand is rising, as China emerges from its COVID-19 lockdown and buys a lot of oil. In fact, the International Energy Agency said last month it expects global oil demand to rise an additional 2 million bpd to 102 million bpd this year.

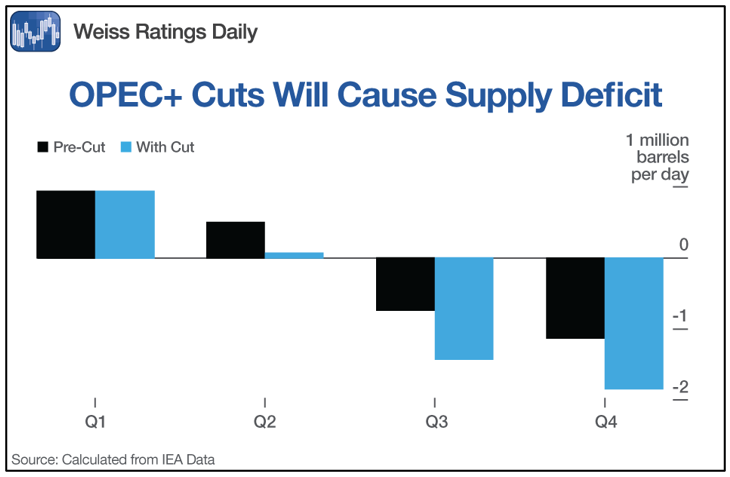

The combination of cuts and rising demand means production will fall short of supply. Stockpiles can make up for it in the short term. But by Q4 of this year, if nothing changes, production will be nearly 2 million bpd short of demand.

Click here to see full-sized image.

Marketwatch.com reports that the trigger for the OPEC+ oil production move was a comment by U.S. Energy Secretary Jennifer Granholm last month that the U.S. would not refill the Strategic Petroleum Reserve this year. Also, there was a huge, short position in oil, and the feeling is that Saudi Arabia wanted to punish traders who bet against it.

But the OPEC cuts are just one bullish factor for oil. Others are …

European Refineries Are on Strike

& Reserves Are Low

According to analysts at Wood Mackenzie, that means Europe’s gasoline exports to the U.S. are set to decline by as much as 100,000 bpd from March to April. And that comes at a time when U.S. gasoline stockpiles are at a nine-year seasonal low and demand is up from a year earlier.

Tempering the bullish fever is plenty of oil in commercial stockpiles. At the start of April, global onshore crude stockpiles were about 140 million barrels above the level seen a year earlier.

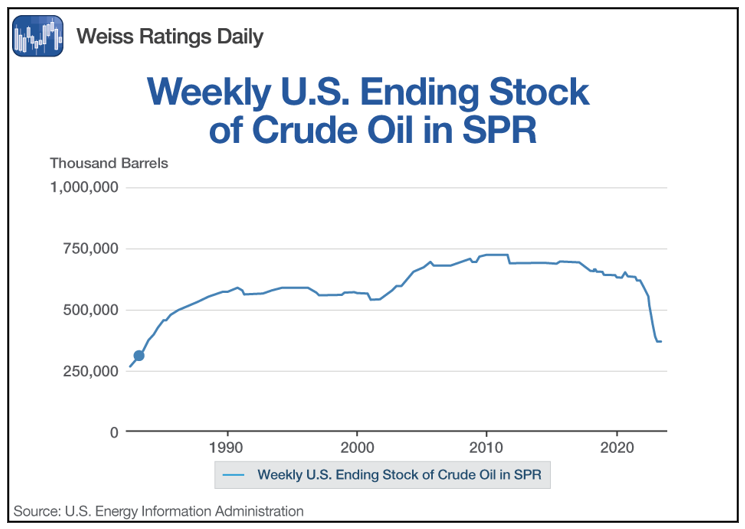

But one stockpile we normally count on is depleted. I’m talking about the U.S. Strategic Petroleum Reserve. Team Biden emptied much of it out, putting the SPR is at its lowest level since 1983. And as Granholm said, the SPR is probably not going to be refilled this year. That removes the safety cushion that can stabilize the U.S. market during times of supply disruption.

Click here to see full-sized image.

Without that SPR cushion, when we have a crisis, oil prices could soar. And that is the thing about oil: A crisis always comes along eventually.

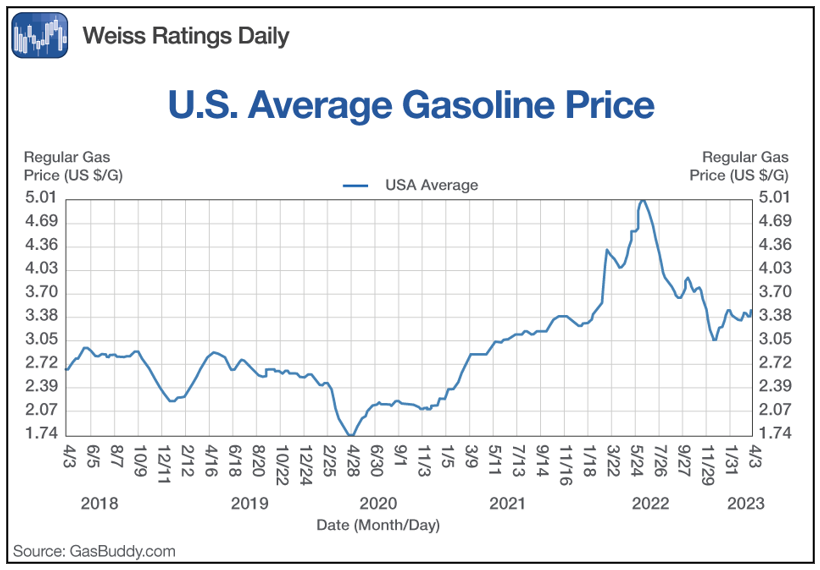

Meanwhile, tighter oil supplies eventually put the squeeze on the gas pump. Recently, the average U.S. price of gasoline was $3.50/gallon. That’s 21% higher than the five-year average for this time of year, according to AAA.

Click here to see full-sized image.

What’s more, gasoline inventories are already getting squeezed, down 2.9 million barrels in the latest Energy Information Administration report. That’s down 5.1% from a year ago and 4% below the five-year average.

And it can get worse! I believe we have the ingredients for at least $120 oil by the end of the summer. The last time that happened, the average price of gasoline topped $5/gallon.

Can oil prices go higher, taking gasoline prices along for the ride? Sure … but remember, the higher oil prices go, the greedier oil suppliers get. We will see more production eventually. I just wonder where oil will top out when that happens.

Now, there are risks to this bullish scenario. One reason I think OPEC+ is cutting production is because it sees the potential for weakness in the global economy. Though the stronger demand we are seeing out of China may prove those fears false.

The other risk is that stubbornly strong oil prices may remove any leeway the Federal Reserve has to cut interest rates. Remember, the Fed is still trying to bring inflation under control. The market has priced in four rate cuts by the Fed this year, and I already thought that was optimistic. If the Fed keeps rates too high for too long, a recession may become a self-fulfilling prophecy.

Seize the Opportunity in Oil

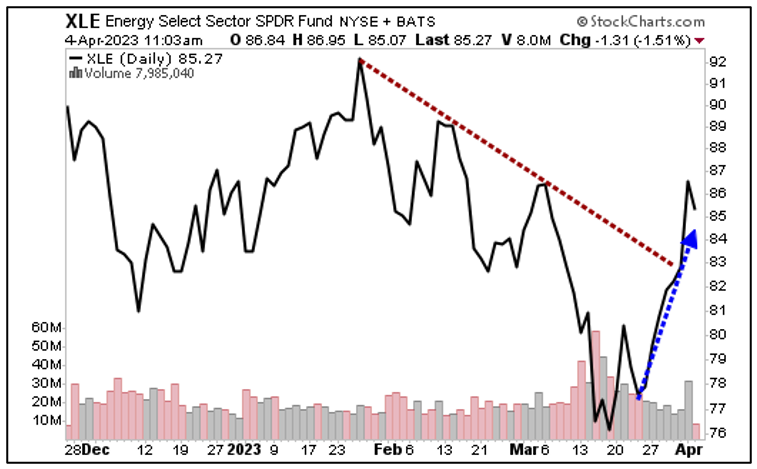

But let’s put those fears aside and seize the opportunity we have here. Let’s look at the Energy Select Sector SPDR Fund (XLE), a basket of leading energy stocks.

Click here to see full-sized image.

You can see the XLE was already rallying off its lows, and the OPEC+ news sent it surging through its downtrend. My preliminary target on the XLE is $109. It could go higher than that.

And if I’m wrong about the timing of the next oil rally? Well, the XLE has a fat 4.64% dividend yield, so you’ll be paid to wait.

You could always drill down into the XLE’s holdings to buy individual energy names. Individual stocks carry more risk but offer bigger rewards.

Whatever you do, don’t miss out on this next big leg higher in oil. Mark my words, we’ll see $5/gallon gasoline this year. You can prepare and profit or end up running on empty.

Speaking of preparing and profiting, my colleague and Startup Investing Specialist Chris Graebe announced a huge opportunity in private equity crowdfunding last week.

Equity crowdfunding, an alternative funding that allows regular, nonaccredited investors to invest in early, pre-IPO companies, is a rapidly growing space. And he’s found a company poised to disrupt a $100 billion industry. Click here to learn more about how to claim an early stake.

Best wishes,

Sean

P.S. I will be speaking at the Las Vegas MoneyShow April 24–26 and sharing my best investment ideas for 2023. Don’t miss out — make your reservations now! I always have a great time in Vegas, and I hope you join me.