Why Spooner’s Rebellion Still Presents Opportunity

|

| By Nilus Mattive |

It was 1844, and Lysander Spooner was upset. The lawyer and outspoken anarchist was tired of paying ridiculous postage rates, especially given so many signs of corruption and ineptitude inside the United States Postal Service.

Today, I want to tell you the story of a rebellion, investigation and profit potential …

The Rebellion

In a letter dated Jan. 11, 1844, Spooner informed the U.S. postmaster general that he was starting his own letter service between Boston and Baltimore.

At the time, mailing a letter between those two points through the post office would cost a person more than a quarter of a day’s wages. That’s precisely why private individual letter carriers were already operating in a legal gray area to provide the same service as the post office at lower rates.

But Spooner wasn’t just looking to start his own small-time operation carrying random pieces of mail back and forth. He was going to start a full-blown company, and he expected the U.S. Postal Service to retaliate with a lawsuit.

In fact, his notice dared them to do so by saying his goal was “to agitate the question and test the constitutional right of free competition in the business of carrying letters.”

While he waited for a response, Spooner’s new American Letter Mail Company began carrying letters between several different destinations in the northeastern United States. And it did so for 5 cents versus U.S. Postal Service rates that were more than three times higher.

The Investigation

It took but a few days for the U.S. Congress to start investigating the topic of private mail companies. And although — or perhaps because — his company was flourishing, Spooner and some of his employees were eventually arrested while transporting letters on a railroad.

The government was clearly going to defend its monopoly on the mail. So, it adopted some of the innovations that Spooner’s company had developed — including the idea of prepaying for postage. Congress also decided to fix letter prices at 5 cents for a 500-mile radius, matching Spooner’s rates.

And the government kept charging Spooner with individual infractions for every single letter that he delivered … creating endless legal hurdles and burdensome costs.

In the end, Spooner had forced the U.S Postal Service to become leaner and more efficient. He had lowered rates for citizens, and the official U.S. mail system went from running deficits to surpluses within just three years.

Yet Spooner and his company were also squashed in the process.

What does this story have to do with today?

Everything.

The Profit Opportunity

Here we are 180 years later, and we still have a government-run mail service that is littered with inefficiencies and ended fiscal year 2023 in the red by $6.5 billion … despite ever-rising stamp prices.

Meanwhile, it is still illegal for anyone else to deliver a letter for less than six times the amount of a one-ounce piece of First Class mail carried by the U.S. Postal Service.

Yet private-sector mail businesses continue to compete and succeed anyway!

Most people love seeing a United Parcel Service (UPS), FedEx (FDX) or an Amazon.com (AMZN) truck pulling up to their house, because it means something good is about to arrive.

And there is no doubt that this type of event has become ever more commonplace in perfect lockstep with the popularity of online shopping.

But here’s the thing: Online shopping still has plenty of room for future growth, which suggests these companies have the same type of runway as Spooner saw.

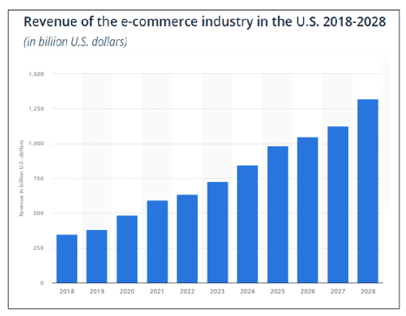

By 2028, U.S. e-commerce sales is expected to reach $1.3 trillion. Just 10 years ago, that’s how much the entire world spent on internet purchases.

In 2014, global e-commerce retail sales totaled about $1.34 trillion. By 2021, they had risen roughly fourfold to $5.21 trillion.

And it’s estimated they will increase another 56% by 2026.

This trend isn’t going away. Spooner’s rebellion is something modern investors should know about. There’s still money to be made.

Best wishes,

Nilus

P.S. The U.S. government is not so different today as it was in Spooner’s. In fact, here’s another story you should hear about.