|

| By Sean Brodrick |

Ever since the consumer price index (CPI) — a measure of inflation — came in a bit hot last week, stocks have been on the back foot.

Rallies are met with selling. It’s like the S&P 500 keeps stepping on rakes.

We aren’t in a bear market, but the mood on Wall Street has shifted negatively.

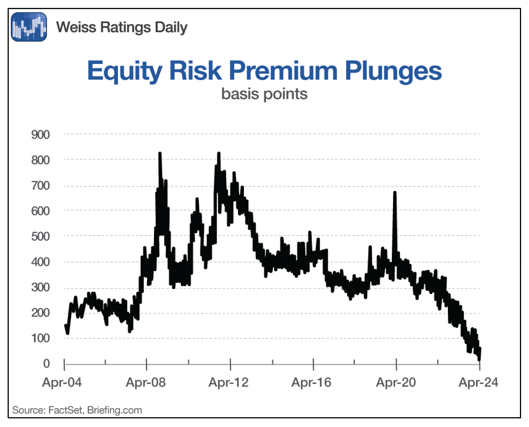

What’s changed? The equity risk premium, that’s what.

The equity risk premium is the extra return investors can expect to earn when they invest in the stock market compared to boring government bonds. The premium hovered between 5.3% and 5.7% since 2011, until very recently.

However, bond yields have started soaring as investors began to price in that. Thanks to higher inflation, the Fed would put off cutting its benchmark interest rate — or not cut it at all this year.

As a result, the yield on the 10-year recently rallied to 4.64%, a five-month high. And the equity risk premium, well … look at the chart …

With bond yields rising, the ERP is diving to its lowest levels in more than 20 years.

The equity risk premium is still positive, so investors are still incentivized to invest in the stock market. But it’s only 30 basis points now. And the higher bond yields go, the lower the equity risk premium will go.

This has capped the rally in stocks for now. We probably need equity risk premium to go higher for stocks to rally again.

Beyond Inflation

Inflation isn’t the only thing driving yields higher and bonds and stocks lower.

There’s also the fact that U.S. debt is rising faster now than it did before the pandemic. It’s estimated that debt held by the public could increase from just under 100% of GDP today to more than 170% in 30 years.

All that debt now must be financed at higher yields, leading to even bigger deficits.

This makes some investors think the U.S. government is in a debt trap.

Sure, some of the people saying this include the same doom-meisters who cry “Apocalypse!” at hourly interviews. But even a stopped clock is right twice a day. That’s why Wall Street is worried, and physical gold is in high demand … with prices setting new record highs.

On the Other Hand

The rise in bond yields is happening even though the U.S. economy is outperforming the rest of the world and stock earnings are generally coming in strong. There’s the potential for the U.S. to grow its way out of this problem.

But in the short term, you can see how rising rates could continue to bully stocks.

How to Invest

In the short term, if you’re buying stocks, it might be smart to buy those that aren’t sensitive to interest rates.

Also, you might want to buy gold. Physical gold is going up, helped by a number of forces: Central bank gold purchases, followed by investor and retail purchases of gold in China and then fears about the U.S. debt growing out of control.

That last one is important because some fear the U.S. will need to monetize the debt — buy Treasuries on the open market. The Fed already did this during the credit crisis. It was called quantitative easing. This would lower yields in the short term but balloon the debt longer term.

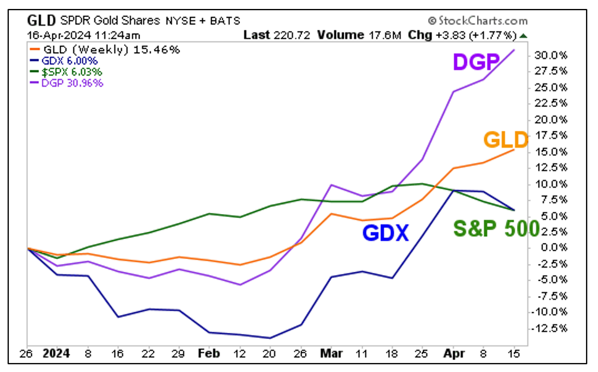

In that scenario, gold looks very good. Some ways to play it: Buy the SPDR Gold Shares (GLD).

If you have an appetite for higher risk and potential reward, you could also use the DB Gold Double Long ETN (DGP). Remember, leveraged ETFs are for short-term hold only. And you better be right.

I’ve put both these funds on a performance chart with the S&P 500 and the VanEck Gold Miners ETF (GDX), which holds a basket of precious metals mining stocks …

You can see that so far this year, the GDX and S&P 500 have nearly the same gain, about 6%. Gold, as tracked by GLD, is up 15%, and the double-long gold fund, DGP, is up 30%.

The bottom line is that with high rates hitting stocks in the face with a rake, the yellow metal is your golden parachute.

All the best,

Sean

P.S. Gold isn’t the only thing rising due to inflation and interest rate worries. You might have seen that Bitcoin is already up 50% just this year. That’s after an enormous 2023. However, there are better ways to play this rally. Click here to see what could possibly be 205x better gains than Bitcoin.