|

| By Sean Brodrick |

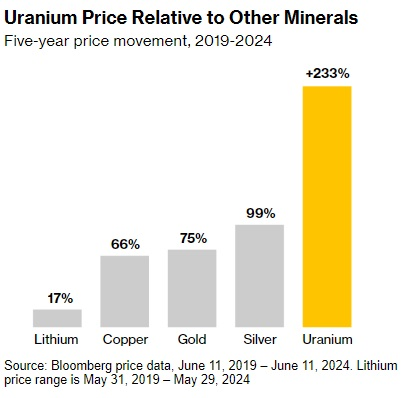

What’s the best-performing metal of the past five years?

If you think it’s lithium, copper or gold, nope, nope and nope.

Even silver, which enjoyed a great run recently, isn’t at the top.

The metal performance that shines the most over the past five years is uranium, up 233%, as this chart from Bloomberg shows.

Now, it’s not all bullish news. Uranium made a double-top in January and February at $105.50 per pound.

It has since recoiled and drifted in a range for more than a month, recently at $83.50.

But you know what? You ain’t seen nothin’ yet.

There are forces in play that will send uranium much, much higher.

To be sure, the price I’m talking about here is the “spot price,” as opposed to the long-term contract prices utilities that use uranium for nuclear power buy the energy metal at. Long-term contract prices are generally lower, though not a lot lower.

Uranium is very illiquid in global markets. It is also hard to store, being radioactive.

So, most folks invest in uranium through ETFs like the Sprott Physical Uranium Trust (SRUUF), which holds uranium oxide and uranium hexafluoride in licensed facilities, or the Sprott Uranium Miners ETF (URNM), which holds a basket of miners.

Or, they buy Cameco (CCJ), the biggest uranium miner in the Western world.

So why did uranium prices surge? And why did they pull back?

Basically, the pandemic caused uranium mines to shut down, interrupting the global supply chain. That caused the price surge.

But mines reopened, and the supply chain rebalanced.

Nothing travels in a straight line. And the new baseline price for uranium is much higher than it used to be.

Now, though, three important forces are lining up to send uranium running again.

More Nuclear Power Plants Are Being Built

Today, 440 nuclear power reactors operate in 32 countries, providing about 10% of the world’s electricity. But more are coming — a lot more.

In fact, 62 atomic power plants are under construction around the world. Most are in Asia, and 28 are in China. The World Nuclear Association says 28 of those power plants will come online by the end of 2026.

Another 110 nuclear power plants are in the planning stage and a whopping 343 new nuke plants are proposed. That’s A LOT of future demand.

Government Flips the Switch to Support Uranium

While Kazakhstan mines more uranium than Russia, Russia is a major supplier of the world’s nuclear fuel. It provides 38% of global uranium conversion and 46% of enrichment (that’s how you turn uranium into nuclear fuel).

Due to Russia’s invasion of Ukraine and the general awfulness of Russian leader Vladimir Putin, America wants to source its uranium elsewhere. So, three things happened …

- The U.S. Department of Energy is directing $3.4 billion to ramp up domestic uranium production.

- The U.S. Senate is fast-tracking the deployment of a new fleet of advanced nuclear reactors.

- And this year, Congress passed bipartisan legislation to ban uranium imports from Russia. It goes into effect Aug. 11. There are exceptions and loopholes. But this lights a fire under U.S. and Canadian uranium miners.

Kazakhstan Casts a Shadow Over Production

This month, Kazakhstan, the world’s largest uranium-producing country, surprised everyone by hiking uranium extraction taxes.

The tax goes from 6% to 9% … but could go as high as 18% depending on how much uranium a mine produces.

To avoid paying higher taxes, uranium miners in Kazakhstan will have every incentive to keep production just below the next tax bracket.

This dampens uranium exploration and mining in the world’s biggest uranium producer.

Each of these things caused short-term moves in uranium and miners. But I believe the big move is coming.

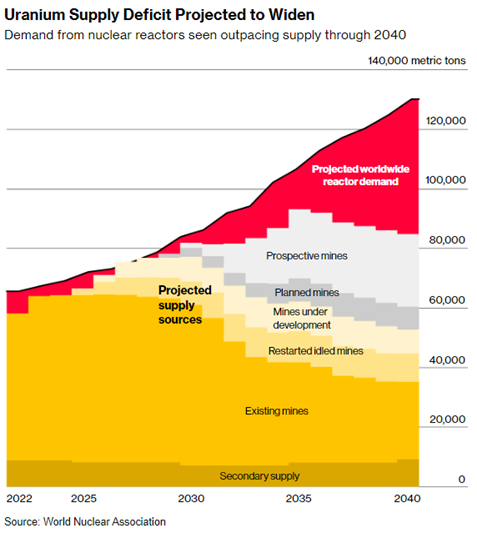

That’s because this chart shows how global production will have a hard time keeping up with what we know will be the big ramp-up in uranium demand.

Uranium demand is rising faster than miners can pull the metal out of the ground. And that will light a fire under prices.

An easy way to play this is with a fund I mentioned earlier, the Sprott Uranium Miners ETF (URNM).

Weiss Ratings gives it a “C+,” and its dividend yield of 3.52% is more than its expense ratio of 0.75%.

The fund has been pulling back since making a high in May. But it’s also testing common support levels that market technicians watch, as you can see from this weekly chart.

URNM has dropped below the 38.2% Fibonacci retracement, as it’s called, and seems likely to test the 50% retracement.

That would be a great place for a bounce.

Considering the bullish fundamentals, it’s not a matter of “if” but “when.”

The bigger gains will come in individual miners, especially those that can bring new production online in the next few years.

I have a list of those. You should make your own list. Or just buy the URNM. But don’t ignore this incredibly bullish move in uranium.

All the best,

Sean

P.S. I have more specific plays on uranium I’ve already shared with readers. But with this BOOM, more are likely. To get in on those — and to see my recent presentation on the $2 trillion China exodus — click here.