|

| By Gavin Magor |

In music, Aerosmith makes us “Dream On.”

But when it comes time to “Stream On,” there’s no need to dream.

Not when the profits recur as regularly as Netflix’s (NFLX) billing cycle.

If you subscribe to this video streaming giant, you know that it often asks if you’re still watching.

That happens if you haven’t interacted with your remote for 90 minutes or about three episodes of a TV show. One thing I can say with conviction is that I’ve never stopped watching this stock.

Not even after it ran above $1,200 a share this month.

NFLX is up more than 38% year to date.

And its latest run should go into another season at least.

After all, Netflix is one of the largest stocks by market cap in the entire stock market universe at $524 billion.

More importantly …

We Just Upgraded NFLX … Twice!

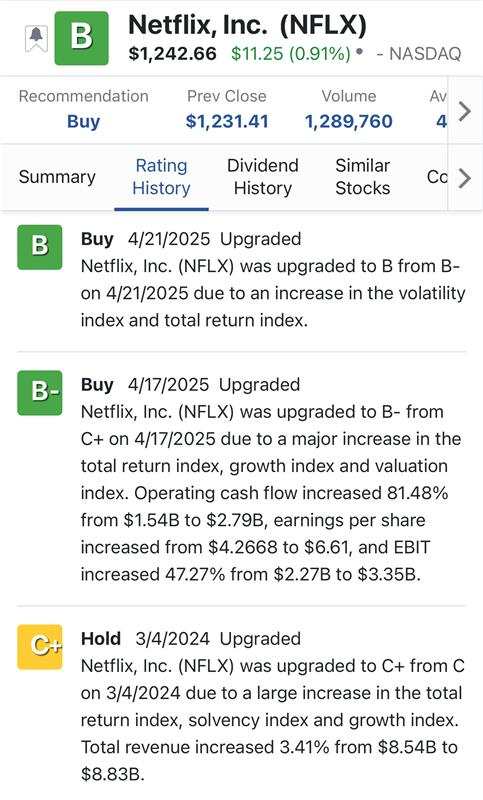

The Weiss Stock Ratings upgraded NFLX to “Buy” not once but twice this quarter.

First to a “B-” and then to a “B.”

The last time it was a “Buy” was in February 2022.

It was a “Hold” before that.

In Netflix’s April 21 “Buy” upgrade, we stated that …

Netflix was upgraded to ‘B-’ from ‘C+’ on 4/17/2025 due to a major increase in the total return index, growth index and valuation index.

Operating cash flow increased 81.48% from $1.54B to $2.79B, earnings per share increased from $4.2668 to $6.61.

And EBIT increased 47.27% from $2.27B to $3.35B.

And then a few days later …

Netflix was upgraded to ‘B’ from ‘B-’ on 4/21/2025 due to an increase in the volatility index and total return index.

NFLX has held on to that coveted “B” rating ever since.

It’s not any surprise to see this blue chip standing pat in “Buy” territory.

In addition to its impressive financials — which included 32% revenue growth in Q1 2025 — the company is becoming flusher with cash.

- It has a massive subscriber base of over 300 million in 190 countries. That’s a ton of recurring revenue at very enticing profit margins.

- Also, the company has cracked down on account sharing over the past few years. While that may be unfortunate for mooching family members, it’s GREAT for investors.

- Plus, it has another avenue to attract more subscriptions … and more cash. That is, its new “ad supported” (i.e., cheaper) subscriptions.

On top of all this, its customer retention rate, to quote Bloomberg, is “unparalleled.”

The fundamentals are obviously solid.

On top of that …

Its Chart Looks Good, Too

This is some healthy-looking price appreciation.

Especially when you consider the S&P 500 is only up about 2% versus its 38% climb in 2025.

Its next earnings report is due out on Thursday, July 17 after the market closes.

And if it continues to report solid cash flow, subscriber numbers and shareholder returns, NFLX should be able to hold on to its “Buy” rating.

Which, in my humble opinion, is the best reward of all.

After all, every stock rated "Buy" by Weiss Ratings has delivered an extraordinary average return of 303% — that’s even including all the losers — over the past 22 years.

‘Stream’ Until Your Dreams Come True

Netflix is a global leader and giant in movie and TV show streaming. And I don’t think that’s going to change anytime soon.

That said, I do wish the company paid a dividend. But the kind of capital appreciation it’s seen over the past few months is nothing to sniff at.

Next month’s earnings announcement will give us more clues about whether its uptrend can continue at the current pace.

And if Netflix’s trajectory changes, its Weiss rating will no doubt change to reflect that.

So be sure to visit our website every day to see if Netflix — or any stock you’re interested in — makes the grade.

Cheers!

Gavin Magor

P.S. Sean Brodrick’s got a bead on what he says could be the best investment opportunity of the last three decades. It’s a Cycle Convergence that hasn’t happened in 58 years. And today at 2 p.m. Eastern, he’ll share five stocks he believes will lead the way.