|

| By Sean Brodrick |

With all the hullabaloo about AI transforming our economy, workers are getting worried. Worried that their bosses might replace them with AI.

Or if not replace them, then replace their kids. Will anyone even have a job when AI enters the workplace?

There IS reason to worry. But there’s also reason to hope.

I know people who have been replaced by AI already. These people made a decent living writing ad copy for catalogs. Very quickly, the owners of those catalogs figured out that AI could do a passable job replicating that.

Is the writing good? No. Is it good enough for a guy who just wants to sell boots and mittens? Yes.

Ridiculous! Oh, and True!

And then there are the stories that might make you roll your eyes. Sports Illustrated was accused of publishing articles generated by fake AI authors.

The magazine angrily rebuked the accusations as ridiculous. Why, Sports Illustrated would never replace human beings with programs!

You know where this is going, right? The Futurism website caught Sports Illustrated doing exactly what critics said it was doing.

“The AI authors' writing often sounds like it was written by an alien,” Futurism writer Maggie Harrison reported. One article warns that volleyball “can be a little tricky to get into, especially without an actual ball to practice with.”

Caught with its hand in the AI cookie jar, Sports Illustrated deleted the works of at least some of its AI “authors.”

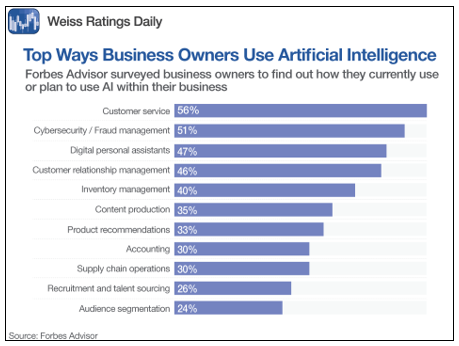

It seems that writing jobs are at risk, at least if editors don’t care about quality. But when it comes to how business owners plan to use AI, writing or content production is only sixth on the list. Take a look at this list made from a survey by Forbes Advisor …

Customer service jobs are most at risk, followed by cybersecurity and personal assistants. Forbes reports:

Other notable uses of AI are … “customer relationship management (46%), digital personal assistants (47%), inventory management (40%) [and] content production (35%).”

Businesses also leverage AI for product recommendations (33%), accounting (30%), supply chain operations (30%), recruitment and talent sourcing (26%) and audience segmentation (24%).

Man, that’s a lot of jobs at risk. But there’s also …

Hope for New Jobs

I also promised hope, didn’t I? And there is.

First, historians point out that technology has a track record of creating more jobs than it destroys. This goes all the way back to the days of the Luddites, British weavers and textile workers who objected to the increased use of mechanized looms. They thought it would put them out of business.

Actually, mechanized looms made the weaving process faster, cheaper and generally less complicated for textile manufacturers. So, clothing became more affordable.

There was a boom in consumer purchases of clothing. More people became employed — though they weren’t the highly-skilled artisans of before. On that point, the Luddites were correct.

What AI could do is cause another job shift. While some jobs disappear, others that involve new skill sets — skills that employ AI — could boom.

The World Economic Forum predicts that while AI may replace around 85 million jobs by 2025, it will also create approximately 97 million new jobs.

Embrace the Change

We can’t know exactly how this will play out. But as investors, we can be smart enough to embrace this change.

In yesterday’s column on artificial intelligence, I offered the Global X Artificial Intelligence & Technology ETF (AIQ) as one way you can play this rally.

Another would be the iShares U.S. Technology ETF (IYW). It has an expense ratio of 0.4% and a Weiss Rating of “C.” And I believe tech stocks could do very well because AI is just the tip of the iceberg of a new tech supercycle.

After all, it’s not just AI companies that will rise in the coming boom. Tech companies that don’t have AI in their business description, but that can leverage the technology to work more efficiently and creatively will also shift into higher gear.

Looking at a weekly chart, you can see that IYW is already ramping up and breaking out.

To be sure, the real outperformance will be in individual stocks and options — like the stock pick I gave my Supercycle Investor Members yesterday. There’s a lot more to come. The potential in AI, and in the new tech supercycle, is extraordinary.

That’s it for today, so Merry Christmas, happy holidays and I’ll be back with more soon.

All the best,

Sean