Why You Should Look Past This Robotics Big Bang Moment

|

| By Jon Markman |

Artificial intelligence is at its Big Bang moment, according to a major investment research company.

Last week, executives at Tesla (TSLA) revealed new upgrades to Optimus, the firm’s bipedal robot. Morgan Stanley (MS) researchers believe a Cambrian explosion is near, leading to explosive growth for Tesla.

This should be a defining moment for anyone thinking about buying shares of the EV giant.

Let’s be clear. Morgan Stanley researchers think that Tesla is onto something really big with Optimus. According to their Dec. 15 research report, the analysts expect a Cambrian explosion moment, when AI moves beyond intense number crunching and chatbot software … toward intelligent, aware humanoid robots.

Scientists know from fossilized data that about 538 million years ago, complex organic life on Earth began. Organisms gained motility, the ability to move independently. This was a Big Bang moment.

Scientists believe that after this moment, everything changed … leading to the evolution of human beings.

Optimus has the potential to be a Big Bang in robotics. Morgan researchers believe it could disrupt 30% of the global labor market, a $30 trillion opportunity.

A lot of things have to fall into place for this to happen.

Optimus was introduced in 2021 to widespread skepticism in the research community. Scientists felt that the claims being made by Elon Musk were unrealistic given that Tesla had not started to hire staff.

Tech journalists reduced the original Optimus announcement to a meme, a dancing human dressed up as Optimus.

Musk introduced Tesla Dojo — a supercomputer built for machine learning — in 2022. He also committed to spending $1 billion for development earlier this year.

The AI supercomputer collects, analyzes and will become the compute engine for all the data from the Tesla full self-driving software suite. Dojo is also the motor for Tesla’s computer vision and processing algorithms.

Morgan researchers see Dojo — and the millions of Tesla vehicles out in the world collecting data — as the foundation to drive the rapid development of Optimus.

Investors should pump the breaks, though.

Focus on What Already Exists

The Morgan Stanley narrative is big and possibly overreaching.

Tesla is miles ahead of competitors when it comes to software development. The popular electric vehicles are software-defined … meaning code underpins every aspect design, development and operation.

Even safety recalls, as per the National Highway Safety Traffic Safety Association, have become simple over-the-air software updates — like fixing a software glitch on an iPhone.

The problem for Tesla bulls is that the EV maker is still predominantly valued as a car company. A real conversation about AI bipedal robots isn’t likely happening any time soon.

Morgan researchers came up with a $380 price target. They base this number on $86 for the core Tesla auto business, $82 for Tesla Mobility — a yet-to-be-released ride hailing service, $41 for third-party software (Tesla operates an app store for the vehicle operating system), $48 for Tesla energy — its solar and battery business, $8 for Tesla Insurance and $115 for Network Services — its premium connectivity business.

This all sounds great. However, Morgan analysts are valuing Tesla shares based on businesses that really do not yet exist.

And while Optimus might be at a Cambrian moment, where organisms gain motility … 538 million years is a LONG time to wait for the fruits of the new technology to show up — even for Musk die-hards. In the meantime, real sales and profits still matter.

Tesla is a wonderful business, run by Elon Musk, a true visionary. Most investors should own Tesla for its automotive story, though. That business is extremely attractive due to great product planning, constant improvement in operational excellence and Tesla’s pole position in the race to EV adoption.

Many Western investors often miss the importance of EVs. They are thinking too provincially. The auto market is global and clearly moving toward EV adoption. Getting there as a company sooner than later comes with clear advantages.

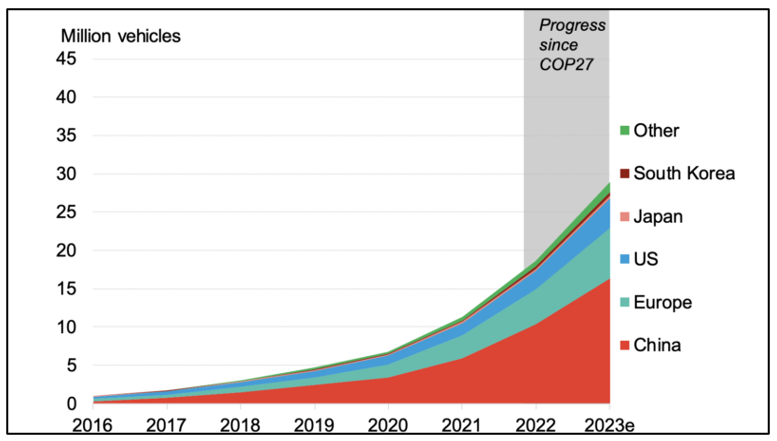

Global EV sales have quadrupled since 2020, to 41 million units. China and Europe are home to 80% of that fleet.

And analysts at Cox Automotive noted in October that sales of EVs in the United States during 2023 are on track for 1 million units, the first time ever.

Legacy vehicle makers are mostly ceding this vibrant longer-term market to Tesla, as they resort to protecting their margins in the short term. This is not a winning strategy.

Traditional car companies need to invest now in software-defined vehicles and electrification to compete on a global stage.

So, while Optimus may start to turn some heads in Tesla’s direction, smart investors should continue to consider buying shares for its dominant EV business.

All the best,

Jon D. Markman

P.S. The Cambrian explosion kicked off the first important cycle for complex life. But certainly, since humans started to form societies, many other cycles have come to leave deep marks on our lives. My colleague, Sean Brodrick, just polished off a presentation explaining why another cycle could lead to a $13 trillion windfall opportunity. Check it out here.