|

| By Nilus Mattive |

You know I love to hate on high-flying stocks.

Especially tech-related names that trade more on hope than logic and fundamentals.

And Circle Internet Group (CRCL) is already an easy one for me to hate.

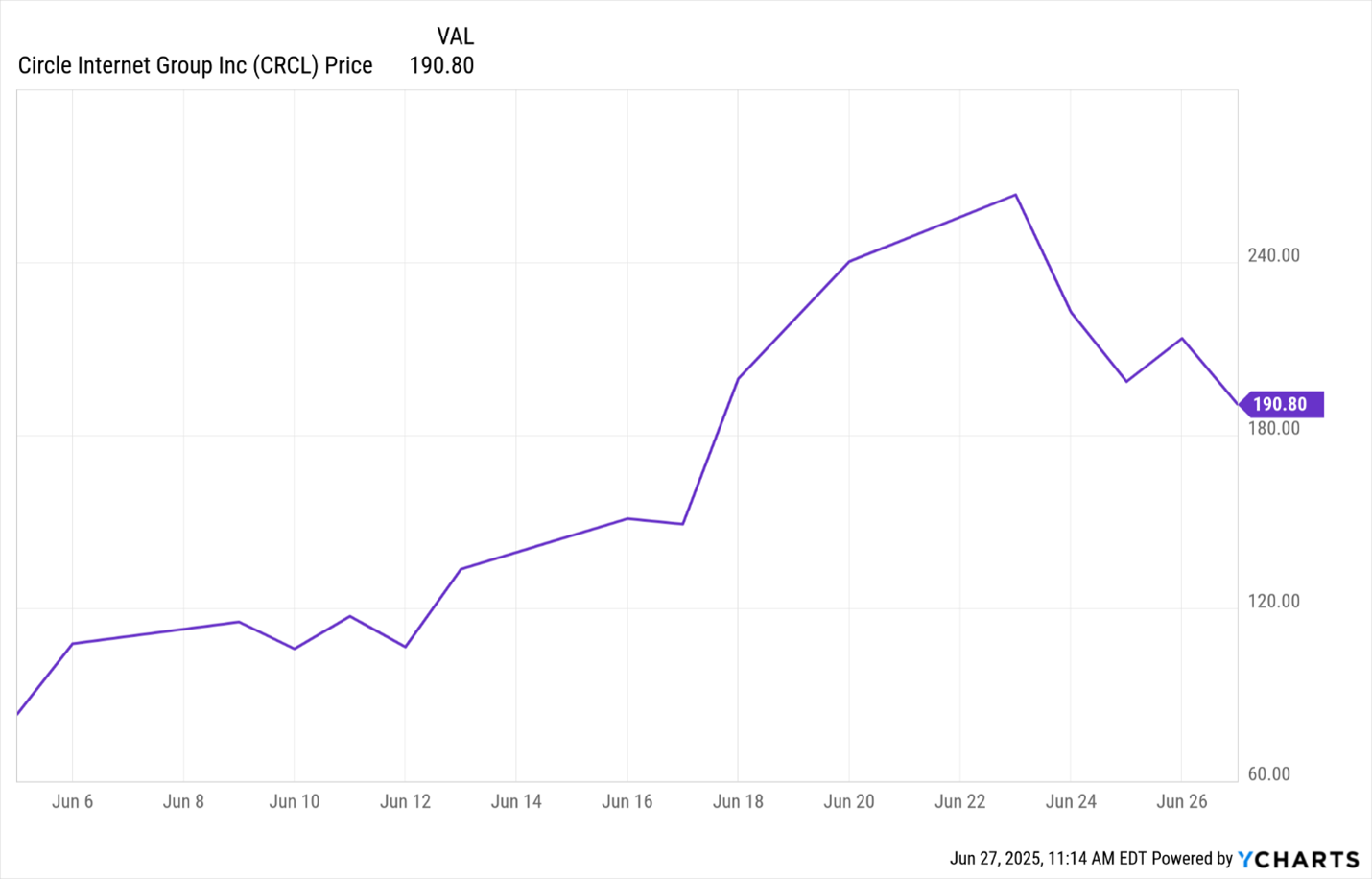

It went public on June 5. So there’s not a lot of trading data available yet on this company, which had one of the most successful IPOs in years.

But you don’t have to be an expert chart reader to see CRCL is off to an auspicious start.

After it soared roughly 700% in a matter of weeks, I disliked it so much that I took the rare step of buying a put option on the shares — a very aggressive bet that they would fall sharply.

With the pullback we saw late last week, I’m already up a bit on my puts.

But I could easily lose all my money on the trade. So, I’m not saying you should follow suit at all.

However, I do want to explain why Circle should at least be avoided right now.

And what the current action in the stock says about the broad market.

Let’s start with what the company does and why everyone is so excited about it.

The Inner CRCL

Circle operates one of the largest stablecoins — the USDC token.

It also has a related Internet-based payment platform using blockchain technology.

Stablecoins, in case you don’t know, are digital currencies designed to maintain a steady value. You can think of them like the money market funds of the cryptocurrency world.

In fact, without getting too deep into the technical details of how it all works, Circle essentially holds a bunch of reserves in shorter-term U.S. Treasury bonds to shore up the value of its cryptocurrency.

So, much like a traditional bank, Circle pockets the interest on those reserves.

The good news is this business model has already been profitable.

The bad news?

We don’t have a very long or stable trading history to go on …

And more importantly, it’s very hard to say how profitable Circle will be going forward.

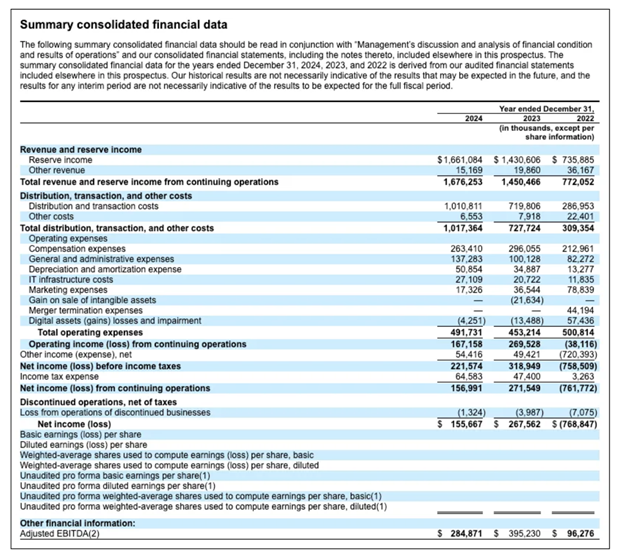

I spent some time looking over the data with our internal research team.

We pored over the company’s prospectus and other SEC filings … and consulted other sources of information …

And it’s still hard to even say what the stock’s current price-to-earnings ratio is.

How can that be?

Circle says it lost almost $762 million in 2022 …

Made $272 million in 2023 …

But then saw profits dip back down to $157 million in 2024.

Encouragingly, the company also says it made almost $65 million just in Q1 of this year.

Still, it’s hard to draw serious conclusions from such a short — and highly erratic — history.

And if you try to construct a price-to-earnings ratio, you will get a wildly different result depending on which set of numbers you use — from the 2024 results … to the trailing twelve-month (TTM) period … to projections of what might be earned going forward.

This is why you will see different P/E ratios depending on where you look right now — anywhere from 264x to 2,340x!

Of course, it doesn’t even matter which is correct.

Even the most conservative version is relatively absurd when you compare it to the P/E on just about any other company inside or outside the space.

Take Coinbase (COIN).

The crypto exchange has a business relationship with Circle that rewards it handsomely when its customers park their money in USDC.

For 2024, Coinbase ended up collecting almost half of Circle’s revenues — $907.9 million of the $1.7 billion recorded!

Although both stocks have been on absolute tears, Coinbase is trading at 70x its TTM earnings.

If Circle is at least several times more expensive, with far less historical data to go on, then we can only infer investors believe Circle has substantially bigger growth prospects than Coinbase or anyone else.

If the company can get a bunch of merchants to start using its payment network, that might very well prove true.

At the same time, I don’t really see that happening quickly … if at all.

Last time I bought something online, the transaction was already seamless and instant.

Sure, Circle might offer substantially lower fees. But the existing payment networks are deeply entrenched. And I’m not sure how many businesses feel the need or desire for change.

In the meantime, let’s talk about Circle’s only current source of real profit — the yields on its reserves.

The U.S. Federal Reserve is still projecting two interest rate cuts this year.

All other things being equal, that means LESS profit for Circle.

Proponents of the stock point to other possible offsets.

For example, if more money goes into USDC from sources outside of costly partnerships like the Coinbase arrangement … then Circle will keep more of its profits.

And even if the growth keeps coming from the partnerships, as long as it’s substantial, Circle can still do very well even with much lower interest rates.

I agree. There is absolutely a version of the future where Circle’s stock goes much higher still.

I’m just not betting on it happening anytime soon. And I don’t recommend you do either.

The interest-rate risk is just one red flag.

We also have plenty of competition from other stablecoins, including Tether, which is already bigger in terms of market cap.

Speaking of market cap, Circle is currently trading at a market cap that’s almost as big as the value of all the USDC in circulation!

We also need to consider the fact that all the insiders and early investors remain in a lock-up period that ends six months after the June 5 IPO.

When that lockup period ends, many people will be free to unload their shares.

Indeed, this is precisely why I chose a put option with a January 16, 2026, expiration date.

I figured at least some people will wait until the first few days of the new year to cash in. Which would be smart because it pushes any possible tax liability another year out.

From my perspective, they’d be crazy not to take some money off the table.

All of them — including many company personnel, institutions and venture capitalists — got in at a pre-launch price of $31 per share. Many got in at substantially less than that.

When I bought my put, the stock was trading near $240 … up roughly 8x just since going public less than a month earlier!

This is precisely why it makes a lot more sense to invest in pre-public companies with my friend and colleague Chris Graebe than it does to buy into red-hot IPOs that have already handed earlier investors huge gains.

Indeed, Circle reminds me of a lot of other extremely speculative and hype-laden IPOs that ended in disaster.

The Race to Zero

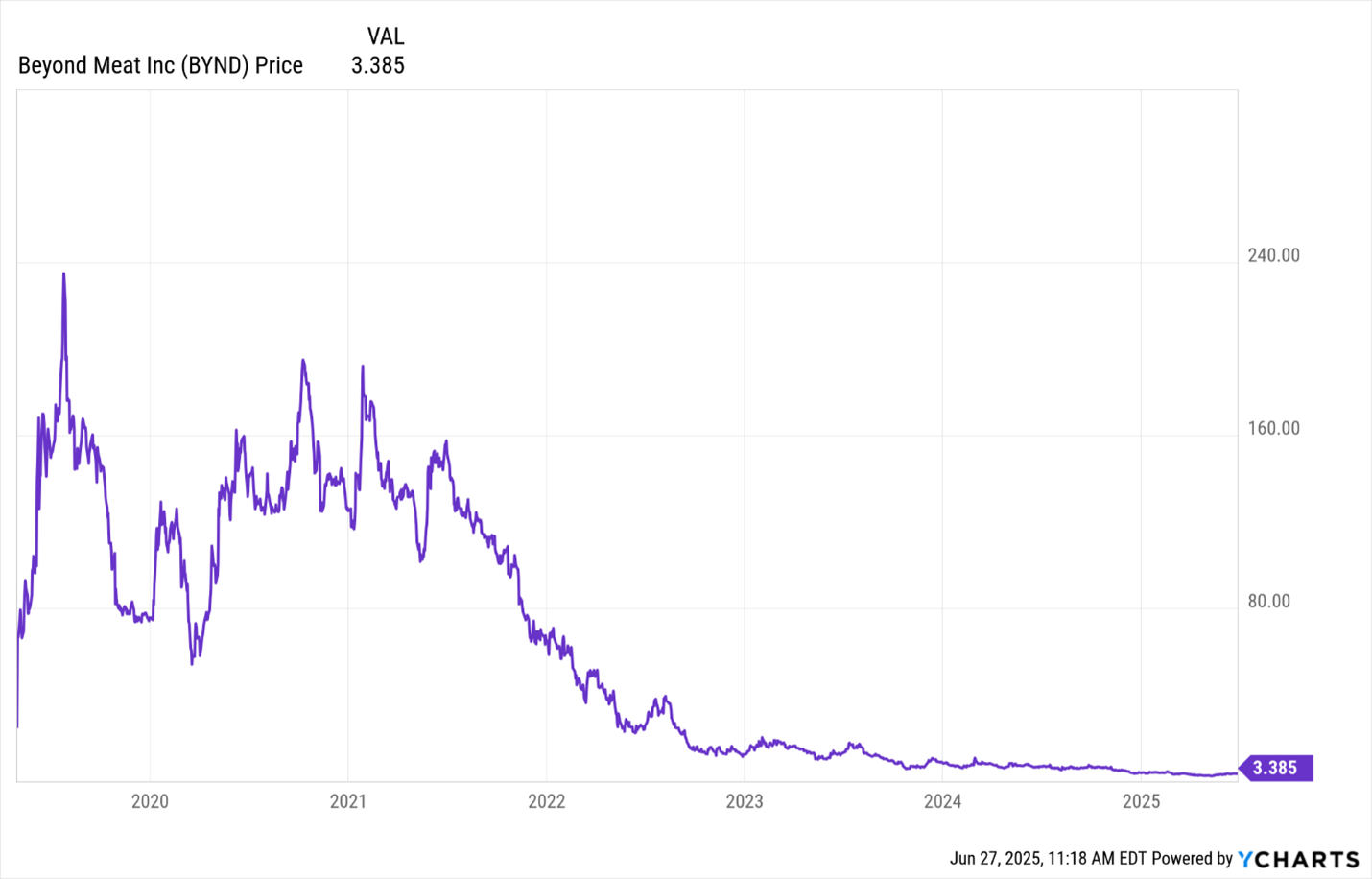

One great example from the recent past is Beyond Meat (BYND).

The company, which makes plant-based meat substitutes, went public back in May 2019 at $25 a share.

By the end of trading that day, it was already at $65.75.

The next day it went to $87 … and within two months it was over $200.

It had a clear path to profitability.

People were extremely excited about the growth prospects not just for the company but for its entire space.

They started calculating how much money was going to be made if plant-based products captured just a reasonable piece of the massive global market for meat.

Sound familiar?

At the time, when the stock was soaring to those lofty levels, I told people it just didn’t make sense based on the fundamentals.

Today, shares of Beyond Meat trade around $3.40.

You read that correctly.

They’ve lost about 99% of their value from that all-time high and currently change hands at less than one-seventh their original IPO price.

What happened?

In a sentence: Plant-based meats failed to disrupt the entrenched industry and profits have remained elusive.

Am I saying Circle will suffer the same fate? There’s no way to tell at this point.

What I do know is that Beyond Meat is just one of many similar stories going all the way back to the original Dot-Com Bubble.

And overall, today’s market feels a lot like that heady time — in terms of valuations, investor enthusiasm and a general “don’t worry, everything is only going up forever no matter what” mindset.

As I’ve said many times before, I was there.

I know what it was like.

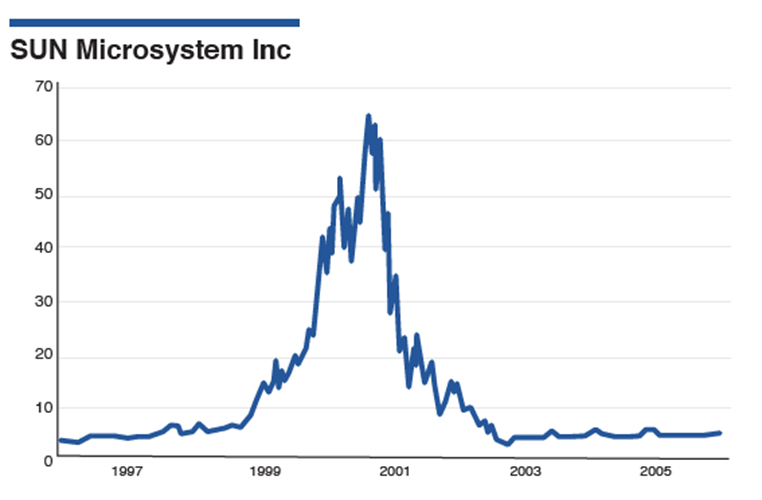

Indeed, I remember when Scott McNealy, the CEO of a red-hot company called Sun Microsystems, openly told investors it was ridiculous that they were buying his stock at 10x the company’s sales.

He ended up being proven correct, and his company’s stock eventually crashed.

Today, as I write this, Circle’s stock is trading at about 30x last year’s revenues … making it 3x crazier than Sun Microsystems was before it tanked.

Hey, maybe Circle will be the rare exception that keeps skyrocketing ahead of equally explosive fundamental growth.

Personally, I’m betting the other way.

Best wishes,

Nilus Mattive

P.S. Insane valuations and investor mania are part of why Dr. Martin Weiss is calling this “The Age of Chaos.”

Which is why I strongly recommend that you watch his entire video on the subject right now.

In it, he explains what’s happening … and the steps you should consider taking to protect yourself right away.

I personally helped him come up with some of those steps … which include stocks and cryptocurrencies that you can consider buying instead of high-flying investments like Circle.