With U.S. Debt Ceiling Battle Looming, This ETF Could Soar

|

| By Sean Brodrick |

Today, we’re going to talk about the similarities between the U.S. debt ceiling crisis and Godzilla.

America is zip-lining into Godzilla’s mouth again — something you can totally do in Japan right now, by the way, at a theme park on an island near Kobe, Hyōgo Prefecture (where the famed beef comes from).

Does that look like fun? I’d say it looks insane … much like the U.S. debt ceiling battle.

And with apologies to Kobe and its theme park ride, I’ve got a beef with America’s chosen course, and the similarities between the debt ceiling and Godzilla.

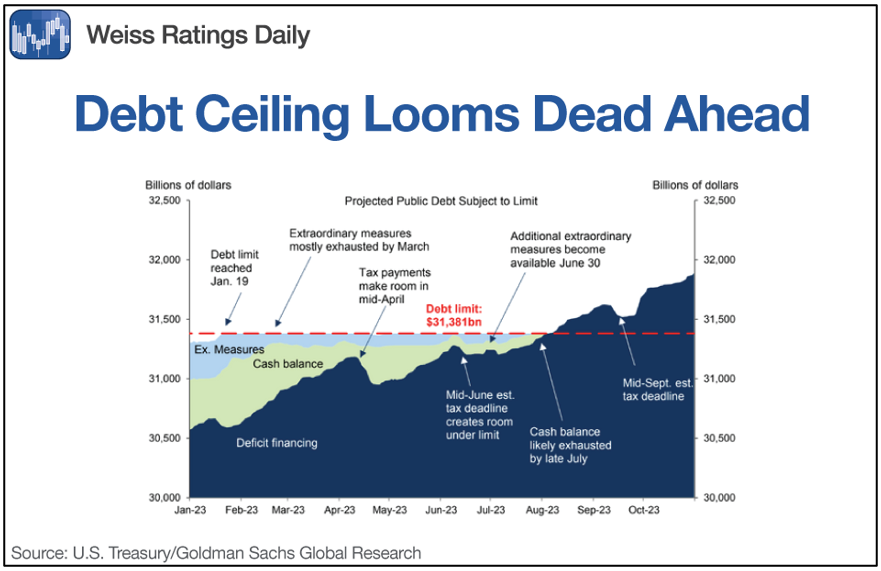

Like Godzilla rising from the ocean bottom, the U.S. debt is rising fast. Using U.S. Treasury data, the following chart with data from Goldman Sachs (GS) shows we’re on a collision course with the self-imposed debt ceiling.

Click here to see full-sized image.

Size Matters

Like Godzilla, U.S. debt keeps getting bigger. When Godzilla first stomped onto the silver screen in 1954, he was scaled to be 50 meters (164 feet) tall. This was done so Godzilla could just peer over the largest buildings in Tokyo at the time.

The buildings in Tokyo have gotten bigger, so Godzilla’s grown in size in successive movies. And once Hollywood got a hold of him, Godzilla eventually grew to 122 meters (400 feet) tall.

Well, the U.S. debt keeps growing, at least in nominal terms, and has done so every year for the past 10 years. It now stands at $31.7 trillion, or:

• About $247,776 per taxpaying American.

• To go along with another $1.2 billion in state debt.

• And $7.2 trillion in U.S. debt held by other countries.

Under President Biden, the debt has grown 13.3%, up from $27.77 trillion. If you’re looking for a bright side, U.S. debt as a share of GDP is now 94%, down from the 105% it was during the Trump administration. Still, that’s WAY too big.

And like Godzilla, the U.S. debt’s bite is quickly getting worse. That’s due to the Fed’s course of raising interest rates to a 16-year high! This is raising the cost of serving the national debt to monstrous proportions.

By that, I mean interest payments on the national debt were $475 billion in fiscal year 2022 — the highest dollar amount ever. That was up 35% from 2021! Does that sound bad?

Well, this year, interest costs are projected to grow ANOTHER 35%! And if we stay on this course, like those civilians scurrying around Tokyo in Godzilla’s path, we are in for a world of hurt. By 2033, the Congressional Budget Office says that we’ll spend $1.4 trillion a year just servicing the debt!

So, both sides in Washington can agree to cut some spending, but if the Fed doesn’t start cutting interest rates, we could end up in worse debt trouble, anyway.

The Republican proposal to cut discretionary spending in return for raising the debt ceiling sounds smart, at first. Until you realize that the debt ceiling is for money we’ve already spent. And the U.S. Constitution mandates that those debts be paid.

I’m talking about Section 4 of the 14th Amendment:

“The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”

No, the fight Congressional Republicans should be picking is with the budget, which is decided every February. That’s when Republicans can make their case for cuts. Choosing to do it now, with the debt ceiling, is just zip-lining into Godzilla’s mouth: You don’t have to do it. It’s a choice.

You know how in every Godzilla movie a bunch of leaders meet to discuss how to deal with the monster? Well, President Biden has called House Speaker Kevin McCarthy and other Congressional leaders to a meeting on May 9 at the White House to discuss how to avert a debt default.

Maybe they’ll reach a compromise. Or maybe McCarthy will lead Congress — and by extension, the rest of America — down the zip line into the monster’s mouth. Only time will tell.

What You Can Do

As an Investor

We’ve seen America default briefly on the debt before in 2011. When that happened, the stock market tanked. At the same time, gold soared, reaching the then-all-time high of $1,920/ounce.

I’m not saying history will repeat. But the thing about those old Godzilla movies is they often follow similar plotlines.

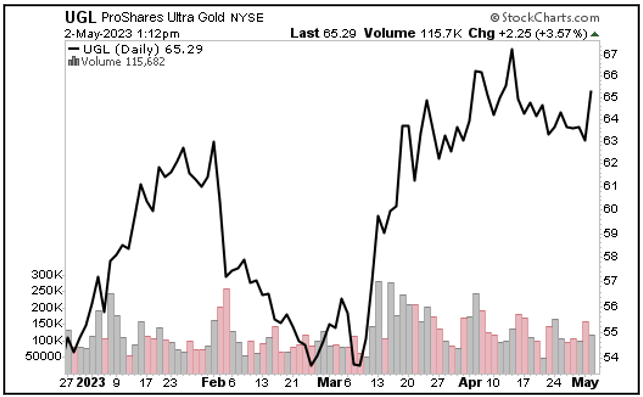

One way investors can prepare is with the ProShares Ultra Gold (UGL), the most liquid double-leveraged gold ETF. It has an expense ratio of 0.95%.

Click here to see full-sized image.

The ETF is up over 44% in the past six months, and if gold can break out of the range it’s been in since March … the UGL will blast off.

Look no further than gold’s year-to-date 7.93% gain. Since the UGL is double-leveraged, it has climbed 16.51% over the same period.

You might want to stock up on some gold before the Earth starts shaking, because Godzilla’s on his way. I don’t know if he can be stopped, so the best thing you can do is move out of his path of destruction and find shelter and protection.

All the best,

Sean

P.S. Back in December 2018, talking heads were calling “the death of crypto.” At the same time, Weiss Crypto Analyst Juan Villaverde was calling the start of the largest bull market of any asset class on the planet.

Spoiler alert: The talking heads were full of hot air. Juan was right. Investors who understood that risk and were glad to buy at bargain prices could’ve seen our list of high-rated coins surge dramatically — 20x, 54x, 102x and even as high as 234x!

How did Juan know to call the start of the next big bull? He’s a student of the cycles, and using his Crypto Timing Model, Juan monitors the cycles to determine when to act. As the next leg of the crypto bull market heats up, you can learn more and join him by clicking here.