For weeks, I’ve been telling readers that we are undoubtedly, undeniably in a “Safe Money” stock market environment.

Now, The Wall Street Journal is jumping on our bandwagon!

In a hard-hitting story titled “Investors Gobble Up Dividend Stocks During Market Turbulence,” the WSJ chronicles how investors are dog-piling into more consistent, more resilient, dividend-paying companies.

- They’re perfect for today’s economy, and they’re wildly outperforming as a result.

Meanwhile, investors are yanking their money from all the no-yield, no-profit turkeys they previously flocked to.

Why?

Because those are the wrong stocks at the wrong prices in the wrong phase of the economic cycle!

As Chiavarone, head of Multi-Asset Solutions at Federated Hermes, said in the piece:

- “The story of 2022 is the revenge of the boring.”

It’s no secret I’m a Safe Money stock fan.

My newsletter is dedicated to finding the best of the bunch — and that includes my newest pick in the issue that goes to press this Friday (You can make sure you’re on board in time by clicking here).

But now Wall Street is sitting up and taking notice.

A key index that includes the 80 highest-yielding S&P 500 companies was recently showing a GAIN of just over 2% for the year. That compares with a 5.5% LOSS for the average as a whole.

In fact …

- Dividend payers are trouncing no-yield names by the widest margin in 17 years! That has led to enormous inflows: a record $7.5 billion in investor cash flooding into dividend-paying stocks last month.

Is this going to continue? I sure as heck think so!

Dividend-paying stocks that sport better valuations and high Weiss Ratings should shine when the Federal Reserve is raising interest rates and investors are less sure of the economic outlook. It’s all about the economic and market cycle.

I go into much more detail in this month’s Safe Money Report newsletter.

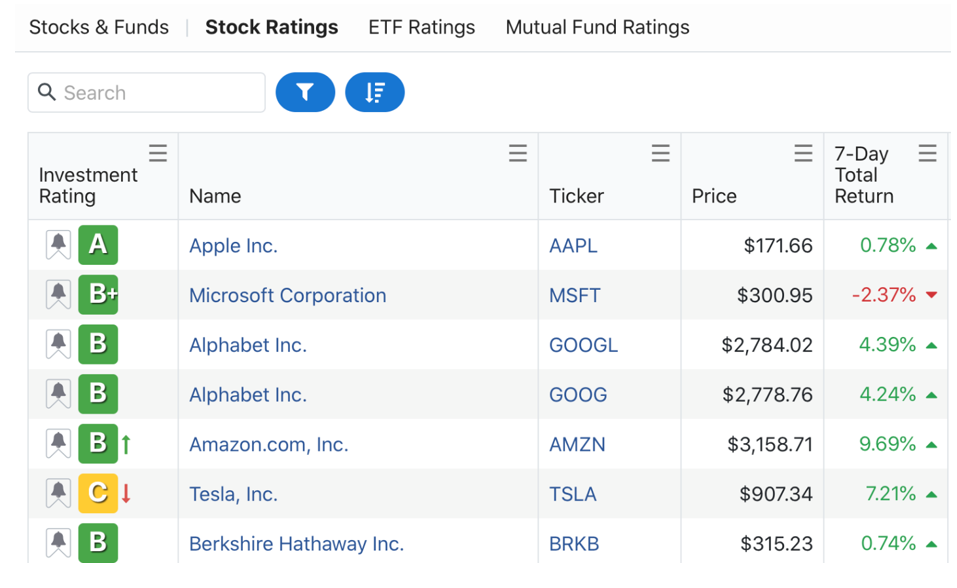

But if you’re not quite ready to subscribe, you can still use the Weiss Ratings website to screen for top-rated, higher-yielding stocks or exchange-traded funds (ETFs).

Just use the filter icon at the top of our stock screener page, then tinker with the “Weiss Ratings” and “Dividend Yield” filters until they show only stocks that meet your specifications.

Just don’t wait too long to make this shift. You don’t want to let this “revenge of the boring” pass you by!

Until next time,

Mike Larson