You’re Invited to a Profit Party in the Oil Patch!

|

| By Sean Brodrick |

Did you see the news that oil and gas producer Diamondback Energy (FANG) is buying privately held Endeavour Energy Resources?

This $26 billion deal will create a new energy giant in the Permian Basin. And the news sent Diamondback’s share price soaring 9.4% on the day.

It sure made my Resource Trader Members happy. Diamondback is in their recommended portfolio.

But did you know that it’s the FOURTH big deal to take place in America’s oil patch in the past four months?

Yep, there’s merger mania going on in the oil patch right now. Over the past four months:

- Occidental Petroleum (OXY) agreed to buy privately held CrownRock LP for about $10.8 billion.

Holy cow! So, as an investor, you might be asking yourself:

- Why is this happening?

- Will this continue?

- How do I get a piece of it?

The first two questions actually lead to the same answer: Oil and gas stocks are wildly profitable right now. At the same time, Wall Street’s blindness has made many of these stocks incredible bargains.

So, yeah, there are going to be mergers. And while some choice deals are already made, we probably haven’t seen the end of it.

An Embarrassment of Riches

What do I mean by profitable? In 2023, the big three oil majors, Exxon Mobil, Chevron and Shell (SHEL), collectively returned more than $80 billion to shareholders through dividends and buybacks. That’s up from $78 billion a year earlier, even though oil prices were lower.

And bargains? Big oil stocks as a group trade at HALF the valuation of big tech stocks, despite being cash flow machines.

So, the mergers are happening because oil companies have a lot of cash on hand, and they know there are bargains in the oil patch.

But there are MORE reasons oil stocks are primed to go higher, and soon … even though many traders seem dead certain that there will be too much oil sloshing around this year.

Consider the following facts:

- Global oil demand is currently estimated at 103 million barrels of oil per day, or bpd. That’s up quite a bit from the 100 million bpd the world needed in 2019. And demand is forecast to keep rising. S&P Global says global oil demand should hit 105 million bpd in 2025.

- Saudi Arabia is cutting, not raising its oil output. The Saudis currently pump 9 million barrels of oil per day. Saudi Aramco has the capacity for 12 million. The Saudis have also shelved plans to increase capacity to 13 million bpd.

- And while U.S. oil production hit an all-time high of 13.3 million barrels per day in December, the Energy Information Administration is forecasting lower production throughout this year. The EIA said that U.S. oil production would “decrease slightly through the middle of 2024 and will not exceed the December 2023 record until February 2025.”

- Oil is a depleting resource. That means once you pump oil, it’s gone. Globally, oil production from existing wells declines at about a 7% rate. That’s why producers have to keep adding new wells. In the Permian, the decline rate for existing wells is even faster — close to 30%.

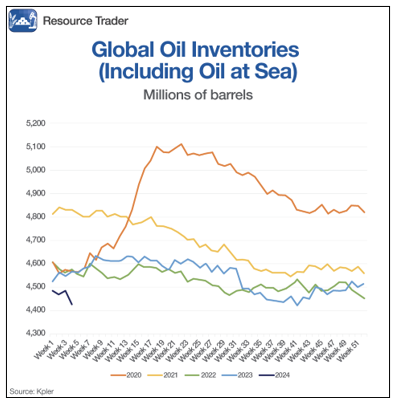

- Global oil inventories are falling fast — down 81 million barrels in the first six weeks of 2024. Compare that to a 40-million-barrel rise in the first six weeks of last year. If you look at this chart from Kpler, you can see how today’s global inventories, tracked by the dark blue line at the bottom of the chart, compare to other years.

You add all this up and the oil space looks quite bullish to me … even if it’s not reflected in current prices. I believe we should see at least $85 per barrel for benchmark U.S. crude later this year, a price we haven’t seen since November. Maybe we’ll even get back above $100.

How You Can Ride this Trend

The best way would be to find stocks involved in the oil patch mergers — like we did with Diamondback Energy in Resource Trader. But if we see the oil rally this year like I expect, you can buy the whole group. They’re on sale!

The easiest way to do that is to buy the Energy Select SPDR Fund (XLE). It carries a Weiss rating of “B-,” and it has an expense ratio of just 0.09% — dirt cheap! And it sports a dividend yield of a whopping 3.57%! Compare that to the S&P 500’s dividend yield of 1.47%!

Let’s look at a daily chart of the XLE …

If XLE can get back above that line of resistance I put on the chart, then it should push higher. You want to own it before that happens.

All the best,

Sean