|

| By Sean Brodrick |

Inflation is last year's problem. Rate cuts are coming. Gold is on the launch pad. Today, I’ll tell you what you should do right now.

The Consumer Price Index, or CPI, which measures the change in prices for a commonly purchased basket of goods and services, dropped 0.1% in June from May.

That helped to slow the annual inflation rate to 3% from 3.3%.

This and other cool inflation stats moved Fed Chair Powell yesterday to tell the Economic Club of Washington D.C. that the Fed won’t wait for its 2% inflation target to be hit before lowering interest rates.

“The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long,” he said.

Well, the market took that as a sign that the Fed will cut rates multiple times this year. Traders are now pricing in close to three interest rates in 2024, starting in September.

This is weighing on the U.S. dollar. Since commodities, including precious metals, are priced in dollars, this is lighting a fire under gold and silver.

Now, I could give you many longer-term reasons why gold should move higher — tightening global supply, lack of new mine discoveries, falling grades at existing mines, the rise of the global middle class and more. All those are still in play.

What interests me now are shorter-term forces that promise to light a fire under the yellow metal.

Global uncertainty is a big one. I’ve talked about the War Cycle before.

Central banks are hedging against geopolitical risk by loading up on gold. In 2023, they added 1,037 metric tonnes of gold to their vaults, just below the record high of 1,081.9 tonnes set in 2022.

In Q1 of 2024, central banks purchased nearly another record 290 tonnes.

And then there are soaring federal deficits. It doesn’t matter which side is in the White House. Both sides like to spend, spend, spend.

In the fiscal year 2025 budget working its way through the Senate right now, Republicans and Democrats have tentatively agreed to boost appropriations by $34.5 billion.

$21 billion of that is more defense spending, and $13.5 billion is for higher non-defense spending.

That means more money printing. I’ll tell you what you can’t print: You can’t print gold!

That brings me back to my point: What you should do right now.

I strongly believe gold is going higher. But you know what’s really going to blast off? Gold miners.

As much as gold prices increased in the past year to new highs, gold miners have lagged badly.

There are a bunch of reasons for this. As an old-timer, I can tell you that it happens in every gold bull market.

Gold miners lag until they don’t. Then they lead. And you’ll want to own them when they start soaring.

The easiest way to get that gold miner leverage is to buy the VanEck Gold Miners ETF (GDX).

If you want to balance potentially more reward against more risk, you can move down in market cap to the VanEck Junior Gold Miners ETF (GDXJ).

Both these have Weiss Ratings of “D+.” That’s because the big rally hasn’t happened yet.

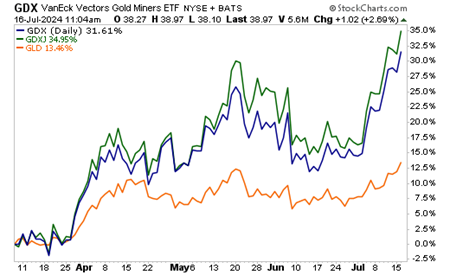

Gold was actually outperforming the miners into April. But then, something happened. Look at this performance chart …

Gold is the orange line. It’s doing fine — up 13.5% compared to the 9.7% gain in the S&P 500 over the same time frame.

But you can see the blue line of the GDX is up 31.78%, and the green line of the GDXJ leads the way with a 35.14% gain.

Just wait until this gold rally really gets rolling. These ETFs will blast off.

You can drill down into these ETFs to find individual stocks for outperformance.

You should get busy, too. Inflation is last year’s story. Rate cuts are coming. The dollar is likely going down … and gold is counting down to blast off!

All the best,

Sean

P.S. I just got word from Dr. Martin Weiss that he’s taking down his interview soon. That’s the one where he unveils the AI Profit Bonanza — a way to beat the market by a factor of 51x. This might be the last chance to check it out. I urge you to do so by clicking here.