|

| By Jon Markman |

I have a special Weiss Ratings Daily for you today. I pushed for and finally got the OK to give you a sneak peek at my new report I am calling, “The Number One AI Stock for 2023.”

I can only share a portion here. But I’ll show you how to see the full report at the end. So, let’s get into it …

The Number One AI Stock for 2023

As an investor, this should make your mouth water: AI is at the same stage of development and adoption as the internet was in 1995.

That’s when Microsoft (MSFT) Cofounder Bill Gates, already the world’s richest person, visited the “Late Show with David Letterman” to promote the company’s first online tool: Internet Explorer.

Back then, only 14% of Americans reported using the web. Today, just 10% don’t use it.

Understandably, Letterman broached the topic with Gates with apprehension, much like the world at large. “What the hell is [the internet] exactly?” he asked.

“A place where people can publish information. They can have their own home page, companies are there, the latest information,” Gates answered. “It’s wild what’s going on.”

Despite the answers Gates gave, Letterman wasn’t sold. He especially wasn’t buying Gates’ prediction about artificial intelligence and how there might be a way to make computers think on their own.

The interview finished with Letterman declaring, “It’s too bad there is no money in [computers and the internet].”

Of course, Gates and CEOs of other companies who embraced the internet early are still laughing all the way to the bank — as are investors in those pioneering companies.

So are early adopters of AI today, and there’s plenty more where that came from.

MSFT rose 43% in 1995 for the role it played in the development of the internet. Shareholders in the company today, the same one behind a $10 billion investment in OpenAI and the creators of ChatGPT, were up 40% just halfway through 2023.

Regardless of what you think of the guy, Gates knows the business of technology. Microsoft’s market cap went from $30 billion in 1995 to $2.5 trillion in 2023. Although he stepped down as CEO in 2008, he has remained in a consulting role with the company ever since.

So, his view of the future of AI in the next decade or so is worth entertaining. Gates published a seven-page open letter on the subject this year, writing: “The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the internet and the mobile phone.”

The development of those technologies had one thing in common: In the very early stages of each, we witnessed the emergence of …

Powerful “Hype Cycles”

Of course, these hype cycles all went on to become essential parts of our everyday personal and professional lives.

That’s what we’re experiencing in real time today with AI.

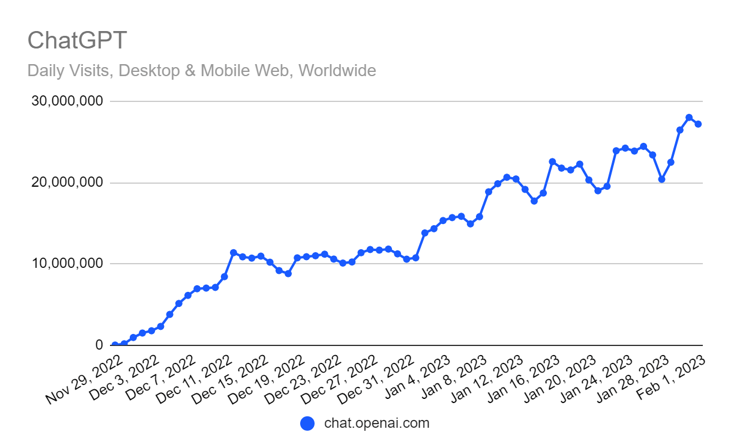

And regardless of what you think of ChatGPT, it only took five days for it to garner over a million users. Two-and-a half months later, that figure surged above 100 million.

ChatGPT put a friendly face on this technology by feeding its AI with large language models, or LLMs, that digitally transform massive amounts of data into answers with a friendly quality that seems like it must have been written by a human.

While it still has its challenges, it is giving us a glimpse into just how much of an impact AI is about to have on our lives.

Next generation software will put intelligent personal digital assistants in our homes, cars and everywhere else as connectivity becomes ubiquitous. AI will allow everything to live in the cloud.

Just as ChatGPT is the tip of the iceberg of AI applications, Microsoft is one of many investment opportunities as the technology evolves and gains acceptance.

Looking forward just six-and-a-half years to 2030, PricewaterhouseCoopers says that global GDP could be 14% higher than today as a result of AI — the equivalent of an additional $15.7 trillion — making it the biggest commercial opportunity in today’s economy.

Plus, analysts anticipate the AI market will explode 80,000% over the next seven years.

Even in the world of big numbers, make no mistake: Those are gigantic guesses, which, if accurate, are going to make a lot of early believers very rich. I hope that includes you.

That brings me to the crux of this report. Now, I’m not here today to recommend companies like Microsoft, NVIDIA (NVDA), Amazon.com (AMZN), Alphabet (GOOG), Broadcom (AVGO), etc.

We already own many of these mega-tech stocks in our Weiss Technology Portfolio, and they’re important companies in AI development. However, they aren’t going to be the breakout stars.

Of course, if you don’t own any of the above stocks, by all means, make them a part of your core portfolio. Conduct your own due diligence, but you’d be wise to buy dips and position yourself for the inevitable and continued growth of these four companies.

The four companies I want to talk about today, however, are well positioned to kick-start and ride the second tidal wave of AI, albeit a riskier group than the mega-caps. Any or all of them could very well be the next NVIDIA, Microsoft or Alphabet, as they mature and evolve over the years.

Each has managed to stay below investors’ radar. But they won’t remain there for long.

To get the full scoop on these names and how to play them, be sure to hurry and watch the Artificial Intelligence Town Hall we held last week before it’s taken down.

All the best,

Jon D. Markman