|

| By Mahdis Marzooghian |

After a record week that made up for the market’s lackluster 2024 debut, stocks seemed to be hanging near their record highs on Friday.

Indeed, the market headed toward the weekend closing its 12th winning week out of the last 13 weeks.

The S&P 500 coasted through early trading after setting a record high for five straight days. The Dow Jones Industrial Average was up 52 points, or 0.1%, on Friday morning, and the Nasdaq composite was 0.2% lower.

Of course, the market is closing out another winning week all thanks to the latest economic data and reports that continue to suggest inflation is cooling while the economy continues to power higher.

This unexpected turn of events rekindles investors’ hopes that the economy will remain resilient, thus pushing profits higher for companies, while inflation tamps down enough to convince the Fed to cut interest rates many more times this year than the three that Powell and Co. have so far indicated.

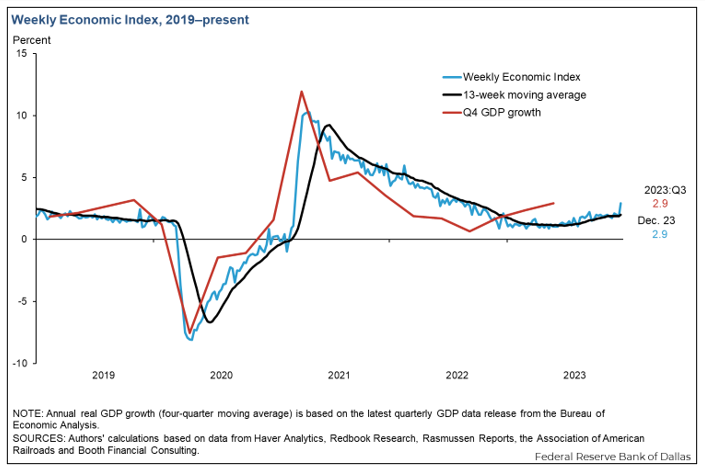

The latest report on Friday showed the measure of inflation the Fed prefers to use behaved just about exactly as expected in December. Overall inflation by that measure was 2.6% during the month, matching November’s rate.

It’s important to note that the Fed pays more attention to the inflation figure after disregarding zigzagging food and fuel prices. That figure cooled to 2.9% from 3.2% and was a bit better than economists expected.

For now, the overall mood on Wall Street is positive — but as we know too well, that can change in a matter of minutes.

That’s why smart investors should turn to the research our experts here at Weiss Ratings present, because they’re almost always positive there’s an opportunity right around the corner, regardless of what the market or economy is doing. In fact, here’s their latest batch of opportunity-filled research …

Weiss Rating a Market Cap-Weighted World

Major stock market indices have been heavily weighted toward a handful of massive stocks. Our Director of Research & Ratings Gavin Magor shows you how this impacts your investments and how the Weiss Ratings can help you stay on top of the ball as the market indices’ weightings change.

How to Play AI’s Newest Challenge

There’s a serious challenge facing the AI development industry. Today, Senior Investment Writer Karen Riccio digs into the potential solutions and how savvy investors can play them.

Doctor Copper Gives a Bullish Rx

Supply and demand dictate that copper is about to have a fantastic 2024. In fact, according to our Resource Expert Sean Brodrick, they call this metal “Doctor Copper” because it takes the temperature of the global economy. Plus, he shows you exactly how to play it.

Buy the Picks & Shovels of the AI Goldrush

While AI developers working on digital assistants are great opportunities, there are even better ways to profit. Our tech guru, Jon Markman, presents investors with a number of pick and shovel plays that are perfect for profitably playing the AI goldrush.

How Nvidia’s Reckoning Could Mean Big Wins for You

2023 was the year of Nvidia. But with so much demand, there’s a reckoning coming. Our Startup Investing Specialist Chris Graebe reveals who wins AI in 2024 — and how smart investors can put themselves on that AI winners list.

Have a great weekend,

Mahdis Marzooghian

Managing Editor

Weiss Ratings Daily