|

| By Gavin Magor |

Over the past year, the S&P 500 is up around 20%. During that span, a fascinating stock market index phenomenon has been continuing to grow.

There is no denying that the AI and tech investment themes were major drivers of stock market returns last year. But what many investors may not realize is that the S&P 500 and Nasdaq Composite indices have now become even more heavily skewed toward several large stocks.

Why? Because these indices are “market cap weighted." Meaning, the larger the market capitalization of a stock, the greater its representation in the index.

Here in the States, the three most popular and utilized market indices are the S&P 500, the Dow Jones Industrial Average and the Nasdaq Composite Index. Other common, but not nearly as popular indices include the Nasdaq-100, the Russell 2000 Index and the Dow Jones Transportation Average, among others.

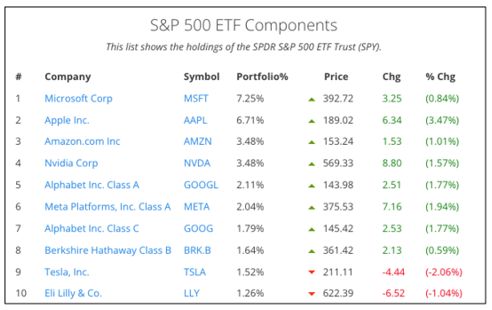

Microsoft (MSFT) now represents the largest weighting in the S&P 500, whilst Apple (AAPL), Amazon.com (AMZN) and Nvidia (NVDA) also are all very heavily weighted. Meaning, when one of these stocks has a large price swing, you can almost be certain it will noticeably impact the performance of the overall index.

The Dow Jones Industrial Average is a price-weighted index. That means it uses stock prices, rather than market caps, to allocate the index.

On the other hand, the Nasdaq Composite is also a market capitalization-weighted index, similar to the S&P 500. But it differs in the fact that it is even more heavily focused on tech stocks.

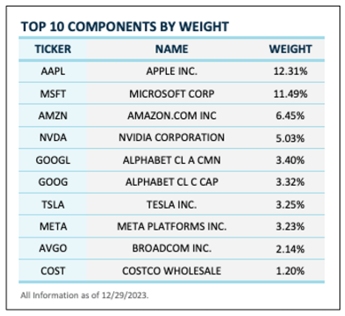

Here are the top components of the Nasdaq Composite by market capitalization (as of 12/29/2023):

Aside from Costco Wholesale (COST) at the bottom of the top ten, that list is a technology all-star team. And what’s even more noteworthy is the actual weightings. Take a look at Apple at 12.31%, Microsoft at 11.49% and Amazon at 6.45%!

In my first column last week, we talked about how Microsoft just overtook Apple as the largest U.S.-based stock based on market cap. Now, you are seeing another major reason why that is important … and why it has major market implications.

How Does This Impact My Investments?

This is very important for us analysts to take into consideration. Because now, these major indices are more weighted toward one stock than another … and in a big way.

For example, when earnings roll out for these major stocks in the coming weeks, they’ll impact the overall market more than before.

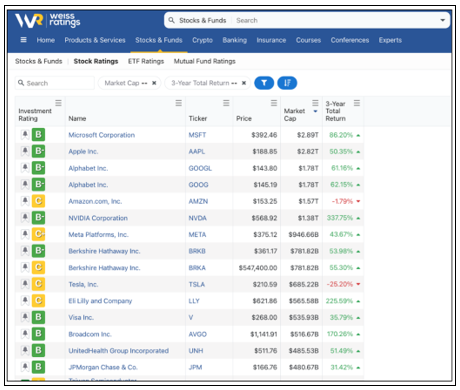

That’s why I find it imperative to find the Weiss Rating of some of these massive index stocks. One of the best ways to do this is to head over to the Weiss Ratings Stock Screener and sort the ratings by “Market Capitalization.”

Here are the top 15 stocks sorted market capitalization, with the largest at the top:

Unsurprisingly, many of these huge stocks are rated as “Buys” or are in “C” territory, which is a “Hold.” Be sure to explore all of our stock ratings because they are always there to offer a helping hand.

Given how large these stocks have become in the major market indices, I really encourage all investors to explore their ratings.

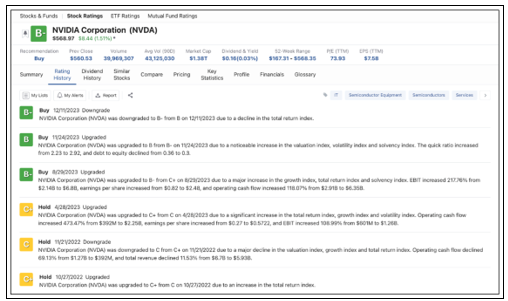

For example, taking a closer look at the sixth largest stock based on market cap, Nvidia, we can see that its rating improved in Q3 of last year due to phenomenal financials and a major increase in profits and cash flow.

Surely, this is a name that Wall Street didn’t miss … and one that I’m sure you’ve heard of over the past year. It is incredibly important to the overall semiconductor industry and AI.

Since Nvidia’s “Buy” upgrade on Aug. 29, shares are up 17%.

So, as the market indices’ weightings change, you can stay on top of the ball. I encourage you to use the Weiss Ratings to help you do so.

Lastly, you may be wondering, does Weiss Ratings rate market indices? The answer is no ... because that’s essentially pointless given their size. It’s also not the purpose of an index to be rated. They are helpful for investors to get a conceptual look at the performance of the overall market.

However, we do rate ETFs that mimic the performance of stock market indices. For example, the SPDR S&P 500 ETF Trust (SPY) mimics the performance of the S&P 500. I urge you to check out all of our ETF ratings by clicking here.

The stock market can sometimes seem like a puzzle with missing pieces that can’t be found. But when you have the Weiss Ratings at your side, you can be sure that you’ll find those missing pieces.

Cheers!

Gavin