Biggest ‘Buys’ in the Weiss Stock Ratings

|

| By Gavin Magor |

There’s a new stock market sheriff battle going on, and it’s largely due to the rapid growth in AI and cloud computing.

Markets are closed today in honor of Martin Luther King Jr. Day, but last week’s market movements were historic. Microsoft (MSFT) overtook Apple (AAPL) as the largest U.S. company by market value, now trading with a market capitalization of $2.86 trillion. Apple had been the largest for nearly a year-and-a-half.

Microsoft has seen tremendous growth in its cloud-computing division, and a ton of optimism that AI will rocket revenue for its software business. Last January, the company invested $13 billion into OpenAI, the parent company behind the popular AI chatbot ChatGPT.

“Mr. Roboto” may be here and making huge waves in the stock market. And now in our society with AI tools being used on a daily basis, we here at Weiss Ratings will utilize advancements in technology in rational ways … and in unbiased ways.

Our current situation actually reminds me of Styx’s 1983 chart-topping song in many ways, just as it did 41 years ago.

The song is about a man who was persecuted for his individuality and the overall struggle to maintain one’s identity in a society that demands uniformity.

In the investment world, Weiss Ratings will never conform to “groupthink.” We embrace our uniqueness and will always be independent, unbiased and accurate within all of our ratings. You have my word on that.

And speaking of our current ratings, I want to point your attention to the rating of some of the highest current Weiss Rated stocks.

Weiss “Buy” Ratings for the Market’s Mammoths

There are a wide variety of tools to help all investors in their investing needs on our Weiss Ratings Stock Screener Page.

From Warren Buffett to a college student just starting their finance courses, I think all investors could benefit in many ways from our Stock Screener page.

Not only are you getting a stellar rating, but you’re getting a massive amount of data easily presented to you in an easy-to-read format.

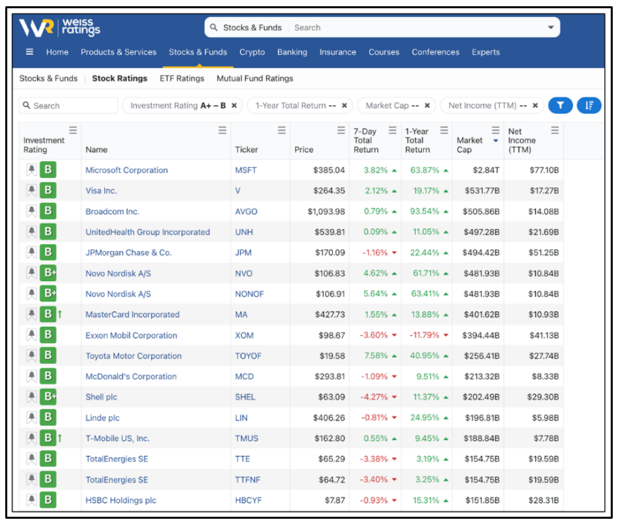

After filtering for an Investment Rating of “A+ to B”, sorting by “market cap” and adding in the columns of “1-year total return” and “net income,” here’s what populated:

Unsurprisingly, we see Microsoft in the top slot. Apple, incidentally, is not on this list due to it having a current “B-” rating.

I am sure you are familiar with many of these names. JPMorgan (JPM) is one of the largest banks in the world, MasterCard (MA) is a payment processing powerhouse, Exxon Mobil (XOM) is an energy bellwether and the list goes on …

My main takeaway is that not only are these some of the largest stocks trading on the market, they are also listed as “A+ to B-range Buys” within our database. I feel that warrants some attention from investors.

Typically, with larger names, we see lots more volume, more profits and more stability. That is not always the case, but as you can see above with Microsoft’s $77 billion in annual net income, it’s a company that isn’t going anywhere anytime soon.

So, with the markets closed today, and with you perhaps getting the day off in honor of the holiday, maybe now is the perfect time to do some investing research with the Weiss Ratings at your side.

And not just with our fantastic Stock Ratings, either. I’m also talking about our ETF Ratings, Mutual Fund Ratings, Crypto Ratings — Bitcoin (BTC, “A”) is up 63% over the past 3 months — Banking Ratings and Insurance Ratings, too.

It’s a crowded and messy financial world out there, and a little guidance can go a long way. The Weiss Ratings is there for all.

Cheers!

Gavin Magor

with

P.J. Amirata

P.S. Do you know why Bitcoin is up so much recently? Well, our expert crypto team just put together a massively important presentation to explain it … and what comes next. Check it out here.