A Look Ahead: How Last Year's Lousy Markets Could Presage a 'Final Crash'

|

The U.S. markets will kick off their first day of 2019 trading in just a little over an hour. And let’s face it, neither the month of December nor the past year itself were what many bulls were hoping for.

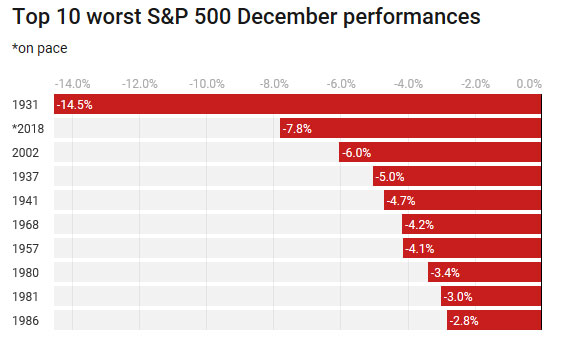

The S&P 500 came within a whisker of trading into bear market territory on Christmas Eve. And even after a post-Christmas bounce, the benchmark average was still down double-digits for the year. That made it the worst December since 1931 and the worst month overall since February 2009.

|

|

Source: CNBC |

Meanwhile, the Wall Street Journal reported that investors were running away from the markets as fast as they could. Investors yanked $39 billion out of global stock funds and $8.4 billion out of investment-grade bond funds in the week ended Dec. 12. That was “the greatest week of redemptions ever,” according to the story.

And if THAT doesn’t sound grim enough, remember what I said at the end of November: 2018 was a “Nowhere to run to, baby; nowhere to hide” market. Some 90% of the 70 different asset classes that Deutsche Bank tracks — from stocks to bonds to commodities and everything in between — were losing money for investors at the time.

Can the bulls expect some relief in 2019? Or were the trials and tribulations of 2018 just a prelude to even worse times ahead?

I believe that anyone expecting the late, great bull market to resume is going to be sorely disappointed. This looks, smells, walks and growls like a new bear market, and it’s unfolding just as I predicted eight months and hundreds of Dow points ago.

To understand why that’s the case, you have to appreciate what drove the bull market in the first place ...

First, the Fed and its foreign counterparts engaged in a global print-fest that ballooned central bank balance sheets to more than $20 trillion. At the same time, they cut interest rates more than 667 times globally in the post-crisis era.

Second, the flood of cheap, easy money those measures unleashed didn’t provoke an explosion of “real economy” inflation like in the 1970s. Instead, just like in the last two major easy-money cycles, it mostly got diverted into the “asset economy.”

Yet unlike the previous two cycles, the resulting boom/bubble wasn’t mostly contained to dot-com stocks or housing. It grew to become one of the biggest, broadest asset bubbles in history.

It not only swept up traditional assets like stocks, bonds or commercial and residential real estate, but also a whole host of esoteric ones. Think artwork, comic books, NFL teams, baseball cards and even vintage whiskey.

Just one telling example: Heritage Auctions hosted a sale of vintage comics and comic book art in Chicago in May 2018. The total take: More than $12.2 million. That was a world-record haul, up more than 17% from the previous record of $10.4 million in 2012.

A single piece of comic art by Frank Frazetta, depicting a horseback-riding barbarian swinging an axe, netted $1.79 million. That was triple the pre-auction estimate, and double the previous record for an individual work of art.

Third, after actively encouraging these developments under the Bernanke Fed, policymakers failed to recognize that things were starting to get overheated again and “lean against” that under the Yellen regime.

Indeed, every time the Dow dropped a few hundred points, they would backtrack on plans to unwind their Great Financial Crisis-era policies — even though the crisis ended years earlier.

Fourth, that helped fuel an incredible amount of wild speculation and madcap risk-taking on Wall Street ...

Fund managers stampeded into high-risk growth stocks to a degree only seen once before in U.S. market history — around the peak of the dot-com bubble.

Investment bankers flooded the public markets with the greatest percentage of money-losing IPO companies ever, and investors were only too eager to ignore the lessons of history and snap them up.

Merger-and-acquisition volume soared to never-before-seen levels. It rocketed 79% year-over-year to more than $1 trillion in the first half of 2018.

And private-equity buyers ... flush with so much cheap cash ... paid record-high multiples to earnings to buy out scores of companies. It was enough to make even the reckless corporate raiders of the 1980s blush.

Fifth, U.S. corporations went bonkers in this cycle, just like mortgage borrowers did in the last one — taking advantage of the easy credit environment to issue all the debt they could. Corporate debt outstanding soared 84% to $6.1 trillion last year from $3.3 trillion a decade earlier.

Worse, a huge chunk of those funds got frittered away on unproductive, short-term-focused things like stock buybacks rather than long-term investments in property, plants, equipment, or research and development.

TrimTabs Investment Research said the 2018 tally of buyback announcements topped $1 TRILLION. Not only was that an all-time record, it was also up a whopping 64% year-over-year.

In sum, my greatest worry ... but also a growing expectation ... is that this has set the markets up for a “Final Crash.” Not final in that stock prices will never, ever drop again. But final in the sense that this will be the third, broadest and potentially biggest bust in the “trilogy” (after dot-coms and housing). As such, it will be severe enough to force real, lasting policy change — to get us off the boom/bust treadmill that reckless monetary and fiscal policymakers keep putting us on.

In practical terms, this means 2019 should be another year where playing defense is the best course of action for investors. That means keeping cash levels high, hedging against downside with inverse ETFs, avoiding over-loved, over-owned, overvalued sectors and stocks, and staying focused on strict risk management.

Have a happy new year, and I’ll be back in touch with more profit opportunities and strategies to keep your money safe in 2019 and beyond.

Until next time,

Mike Larson