Today’s Market Anthem: Nowhere to Run to Baby, Nowhere to Hide

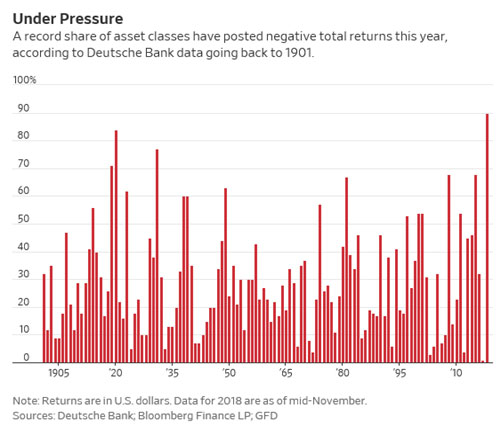

A record 90% of asset classes are losing investors money in 2018.

But here are the handful that offer you safer refuge ...

You know the song by Martha and the Vandellas, right? The 1965 one whose catchy chorus goes: “Nowhere to run to, baby, nowhere to hide”?

Well, that’s been the story of the markets in 2018, according to a fascinating new study by Deutsche Bank covered in The Wall Street Journal. The investment firm noted that, as of mid-November:

* A whopping 90% of the 70 different asset classes it tracked were showing negative year-to-date returns (in U.S. dollars). Stocks. Bonds. Commodities. Other assets. Doesn’t matter. Almost all of them are down.

* That 90% reading would be an all-time record, assuming it sticks through year-end. The only time markets even came close was 1920, when 84% of 37 different types of assets lost money for investors.

* This is also a HUGE negative shift from 2017. Only 1% of asset classes produced negative returns a year ago. That's because we had a near-synchronous march higher in virtually all markets.

|

What’s behind this big shift? The WSJ scratches at the surface when it says:

“The broad pullback in markets is leaving fund managers scrambling to find places to park their money. But with global growth showing signs of slowing and monetary policy expected to tighten further, few are eager to place large wagers and risk compounding earlier failures to generate expected gains. Indeed, the simultaneous failure of so many investment strategies is being viewed by some as a warning of what could come following years of above-average returns.”

But that analysis doesn’t go deep enough. What’s really happening is that the “Uber Bubble” is beginning to unwind! You know what that is because I covered it many times earlier this year, right? For instance, in October I wrote:

“Easy-money policies helped wildly inflate asset markets of all kinds. Not just those we normally think of, like stocks, bonds and real estate. But also esoteric assets — baseball cards, artwork, rare whiskey, classic cars, NFL teams, penthouses and office buildings and mansions in worldly cities like New York, Los Angeles, London, Hong Kong and Monte Carlo.

“My research has turned up an unbelievable series of soaring assets — increases in value and valuations that make no sense given underlying GDP growth, income growth, sales and earnings growth … you name it.”

Now, on top of all that …

You have interest rates rising. You have central banks unwinding trillions of dollars’ worth of global QE programs. You have delinquencies and defaults starting to rise in the loan and bond markets. And you have investors backing away from the very same risky assets they couldn’t get enough of during the bull market.

|

Once the process gets started, it’s like a snowball rolling downhill. It collects snow, dirt, twigs, rocks and more — growing in size and spreading larger, negative impacts throughout virtually ALL capital markets. If you don’t take steps to protect yourself, you’re going to get flattened!

That’s precisely why I’ve been counseling a “Safe Money” approach to investing all year long. I’m pleased to report it’s working out, too.

Despite this year’s incredibly challenging market, in my Safe Money Report, 16 out of 23 positions (over 69%) that were closed out in 2018 were done so at a profit. That includes several, solid single-digit and double-digit gains of up to 25.6%, 26.6% and even 30.5% — in as little as three months.

You can get access to Safe Money and specific “Buy” and “Sell” recommendations by clicking here or calling us at 877-934-7778. Or if you’re not ready to take that step, at least keep the following general suggestions in mind:

1. Raise your cash/cash-like holdings if you haven’t already. I’m personally holding the highest level of those investments in my 401(k) in many, many years. This is NOT the kind of market like we had in 2017, where a rising tide lifted almost all boats.

2. Use tools like put options or inverse ETFs to hedge risk, or generate profits, from downside market moves. Traditional stocks, ETFs and call options can make you money in bull markets. So, why not use similar, inverse investments to make money in BEARISH ones?

3. For the funds you are keeping in stocks, invest in safer, less-volatile, undervalued sectors that had fallen out of favor in recent years. I’m talking about groups like utilities, consumer staples, select Real Estate Investment Trusts with less economic exposure, and so on.

When the bull market was raging, investors wanted nothing to do with these. They only wanted to buy “growthier” sectors like technology, financials and industrials. But that’s changing fast, and value stocks are overtaking their growth counterparts. I think this will be the story for the rest of 2018, 2019 and likely beyond.

Now, if it’s your thing, go put on some Motown classics — and get to work whipping your portfolio into shape for this new, more tumultuous market environment!

Until next time,

Mike Larson