Sales of semiconductors are running red hot, even as the shares of the leading chipmakers swoon.

After the close on Tuesday, executives at Advanced Micro Devices (AMD) reported blowout Q1 earnings and gave strong guidance for the next quarter. However, AMD stock only rose moderately.

Something isn't adding up … but it's a sign of the times when it comes to tech investing.

Chip stocks have been under pressure all of this year. VanEck Semiconductor ETF (SMH), a widely tracked exchange-traded fund that holds shares of most of the largest chip firms, is down a whopping 23.5% so far this year.

The technical reason for the weakness is that the value of future growth shrinks as interest rates rise and borrowing costs increase.

It's a stock market theory that is more self-fulfilling than evidentiary. Many of the largest tech companies have strong balance sheets. Their access to capital is excellent. Microsoft (MSFT) is less impacted by higher borrowing costs than industrial and resource firms, which tend to be highly leveraged.

There is another factor depressing tech share prices: The legacy effect.

Although the sector is continually evolving and new winners are emerging, sentiment is usually driven by the oldest and most well-known businesses.

One prime example of this is with Intel (INTC), which has beena terrible business for a decade. A parade of executives has issued a constant stream of bleak forecasts that color the way investors feel about the sector.

Only a week ago, CEO Patrick Gelsinger pointed to weak PC demand and macroeconomic challenges as the reason for yet another weak quarter. Documents filed at the U.S. Securities and Exchange Commission (SEC) show that revenues decreased by 7% to $18.35 billion.

Related Post: Meet the Metaverse

Analysts immediately began downgrading the entire sector.

Morgan Stanley (MS) researchers surmised that the so-called "COVID pull forward" is a giant headwind akin to the Year 2000/Y2K computer bug.

The big idea is that COVID-19 and work from home forced an acceleration in capital expenditures. Pulling forward those sales into 2022 means there is less money (and need) for future PCs.

It's a cool theory ... for 2010.

Semiconductor demand is so much more than PCs. Chips are now integral in automotive, robotics and infrastructure. And the cloud is the future of computing. Management teams at forward-looking companies have been cultivating those sales for years.

The AMD earnings report on Tuesday paints that picture. Business is great and growing. All its business segments posted double-digit gains. The Santa Clara, California-based company is winning market share from Intel in PCs, while it grows rapidly in the cloud.

Specifically, sales of chips for PCs rose 33% on an annualized basis and were 8% higher sequentially, according to a report at CNBC. Sales of semiconductors sold into the red-hot cloud server, and game console markets rose 88% to $2.5 billion.

Related Post: Investors Yell 'Cut' to Netflix

For context, overall revenue during the quarter was $5.9 billion, up 71% year over year. And the company guided analyst expectations for the second quarter to $6.5 billion, a nice bump over the previous forecast of $6.38 billion.

Despite the impressive beat, AMD shares rose only 4% in after-hours trading. The upshot is share prices are not always about the fundamentals of the underlying company.

More often businesses — good and bad — are swept up in larger narratives. Currently, tech shares are out of favor as interest rates rise. It does help to separate the good companies from bad … and AMD is clearly one of the good ones.

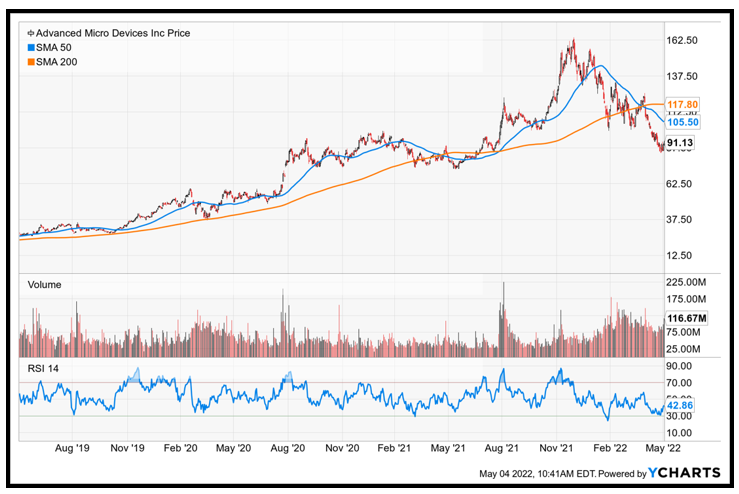

At a price of $91.13, shares trade at only 19.6 times forward earnings and 9.4 times sales. The firm has gross margins of 48.2%, and the return on equity is an impressive 44.9%.

Shares rallied in December to $165. That price is achievable again, yet I would not rush to buy shares at current levels.

As always, remember to do your own due diligence.

Best wishes,

Jon D. Markman