Grab your forks, knives and spoons and get ready to be served a very valuable lesson on how to create value in today’s modern economy.

On Saturday, Warren Buffett’s Berkshire Hathaway (BRK-A) announced that profits rose 45% year over year to $7.3 billion.

Buffett is the master of the art of creating value … and he’s been doing it for the past six decades.

Now the so-called Oracle of Omaha is giving investors a blueprint for success.

The strategy involves companies with strong cash flow and how executives deploy it. The era of share buybacks is here. Buffett is widely considered to be the most accomplished investor in a generation … and it’s not hard to see why.

After taking control of Berkshire Hathaway in 1962, he transformed the failing textile business into an iconic American investment holding company.

Shares of the Omaha, Nebraska-based business now trade on the New York Stock Exchange (NYSE) for $479,345.

For most of the last 60 years, Buffett was buying up shares of privately held and public businesses with operations in the insurance, banking, industrial and consumer discretionary sectors.

- He invests in a wide array of industries, but there’s one common theme: dollar signs.

He has even dabbled in foreign firms, buying a 7.7% stake in BYD in 2008, a Chinese electric vehicle (EV) maker.

Currently, the company holds sizeable investments in Coca-Cola (KO), Kraft Heinz (KHC), American Express (AXP), Bank of America (BAC) and Apple (AAPL), according to a Feb. 14 filing at the Securities and Exchange Commission (SEC).

- All these firms are prolific generators of free cash flow.

Cash flow is one of Buffett’s first hurdles of investment worthiness. Cash is like security.

He’s famous for the adage “Only when the tide goes out do you discover who’s been swimming naked.”

Related Post: Apple Shares Are Deliciously Ripe

There is something else investors should know about these businesses: Executives are buying back company stock in the open market at a furious clip.

Buybacks bolster earnings by spreading profitability over fewer shares.

The trajectory of earnings per share (EPS) is a closely watched metric by investment analysts. Some consider share repurchases, along with dividends, a method to return capital to shareholders.

And it’s not just Berkshire leading the buyback bonanza ...

- Apple bought back $20 billion worth of stock in the fourth quarter of 2021 alone. For the whole year, purchases topped $85.5 billion.

Berkshire spent $6.9 billion during the quarter on share repurchases.

For the year, the total was $27.5 billion, up from $22 billion in 2020. Even still, the annual report shows that Berkshire ended 2021 with $146.7 billion in cash on hand.

This all leads me to a company that is currently in a position to benefit mightily …

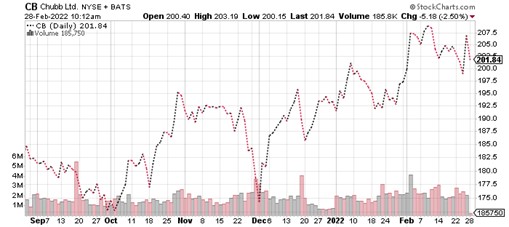

Profits Looking Chubby

I’m talking about Chubb (CB), a Switzerland-based insurance holding company that competes directly with GEICO, a core, privately held Berkshire business.

Chubb isn’t one of the companies held by Berkshire.

- Among publicly traded insurance firms, Chubb is the king.

With a market capitalization of $88.7 billion, it’s the largest property and casualty (P&C) insurer.

And during Q4 of 2021, the firm agreed to buy the insurance assets of Cigna (CI) in seven key Asia-Pacific markets.

The purchase price was $5.75 billion in cash.

- The acquisition means that Chubb is now active in 54 countries, with interests in property and casualty (P&C) insurance, agricultural, commercial, life and reinsurance.

Executives noted on Feb. 2 that profitability for its core commercial business is running at record levels.

The firm has been able to pass on double-digit P&C rate increases and expand underwriting margins, while maintaining strong renewals. P&C underwriting income surged to $1.3 billion, up 31% from a year ago. Operating cash flow during the quarter reached $2.6 billion.

- A large portion of that money is going into share repurchases … highly benefitting shareholders.

During Q4, Chubb executives spent $905 million on share buybacks, according to a filing at the SEC.

Related Post: The World’s Best Company Is in Plain Sight

In a press release last July, the Chubb board of directors authorized a one-time $5 billion share buyback program that will run through June 2022.

Successful longer-term investing requires discipline and strategy. This is harder to do than it seems, especially now with geopolitical and inflation worries in the forefront.

Warren Buffett is giving investors a gift. He’s shinning a light on an investment strategy that is time tested and that works.

Chubb shares trade at only 12.7 times forward earnings and 2.2 times sales. The dividend yield is 1.55%. Shares recently traded around $201.84.

Longer-term investors should consider adding the stock into any weakness. Remember to do your own due diligence before buying anything.

Best wishes,

Jon D. Markman