Search no further because the world’s best company is being built in plain sight.

On Tuesday, executives at Alphabet (Nasdaq: GOOGL) reported that profits in the fourth quarter reached $20.6 billion, up more than a third.

And when you consider that there’s a 20-for-1 stock split on the horizon … things look even rosier at the search giant.

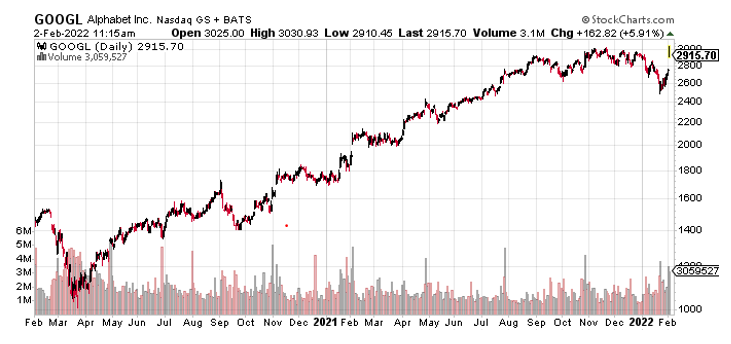

I’ve been a big GOOGL believer for quite some time now, and my Weiss Technology Portfolio subscribers are sitting on a very nice open gain of 317% since my recommendation in 2016.

If you’d like to learn more about that service and my digital transformation picks, click here now.

But the cat’s out of the bag with Alphabet … by now, everyone knows it’s a digital transformation winner, and its future looks even brighter.

As time rolls on, things have changed a lot. Tech journalists now love to hate Alphabet, the parent company of Google.

This wasn’t always the case. The Mountainview, California-based company began in the 1990s as a favorite among reporters.

They loved the utility of Google search and YouTube.

Back in the day, Google was the cute little upstart, battling against big establishment companies like Yahoo! and Lycos.

Then, executives figured out how to make money for shareholders … and lots of it.

- Alphabet’s competitive advantage? Executives hire the best people to build software that consumers actually want to use.

It started with search, email, internet browsers and online videos via YouTube. Then, they gave it all away for free.

That’s the rub. Haters these days say those tools — that they all still use by the way — are not free.

Detractors say the Google part of Alphabet is scraping personal data and selling that information to advertisers.

But this just isn’t true ... it’s not how advertising works. It’s also a childish view of the world where large corporations give away free stuff without any strings attached.

Alphabet and the rest of Big Tech, including Apple (Nasdaq: AAPL), Microsoft (Nasdaq: MSFT), Amazon.com (Nasdaq: AMZN), Meta Platforms (Nasdaq: FB), Nvidia (Nasdaq: NVDA) and Tesla (Nasdaq: TSLA), are winning despite the critics because they build stuff that their patrons absolutely love.

And all these businesses continue to grow quickly.

However, the potential of Alphabet is head and shoulders above the rest. In an era of data science, Alphabet is the undisputed leader because of the talent they attract.

Related Post: Stack Your Chips With This Semi Star.

Executives enlisted Google Mind, its wholly owned artificial intelligence (AI) division, to begin work in 2017 to better monetize YouTube.

The engineers soon discovered that users would be OK viewing far more ads if they were unfolded inside the video, as opposed to the beginning. These calculated risks are paying off big time.

Today, YouTube is a bigger business than Netflix (Nasdaq: NFLX) ... and growing faster, too.

- The official Q4 financial statement shows YouTube logged $8.6 billion in sales, up 25%.

Netflix posted revenues of $7.7 billion over the same period, up 16%.

The same game plan has been ramped up at Google Cloud.

Although Google began life as a cloud-first business, executives didn’t begin selling its excess data storage and computer processing until 2008.

By that time, the company was way behind Amazon Web Services (AWS) and Microsoft Azure, Microsoft’s cloud business.

Thomas Kurian came on as chief executive of Google Cloud in 2019. The former Oracle (NYSE: ORCL) executive immediately got to work hiring staff.

During Tuesday’s Q4 conference call with analysts, Alphabet’s CEO Sundar Pichai explained that the company backlog increased 70% to $51 billion on the strength of new business at Google Cloud.

Deals over $1 billion in annual billings increased 65%. For the quarter, cloud revenue soared to $5.5 billion, up 45%.

- See the obvious pattern? Alphabet hires the best people to help build software customers love … and it’s a strategy that works.

Alphabet hired 6,500 new full-time staff during Q4. The official headcount is now 156,500.

The hires reveal confidence in the direction of the business and future prospects.

The same is true of the 20-for-1 stock split.

Some media talking heads will go out of their way to argue that stock splits don’t impact the financial underpinnings of the business. This is true, but it misses the point.

Related Post: Apple Shares Are Deliciously Ripe

Stock splits tell investors — and potential new hires — that management is confident the share price will continue to rise as future products come to market.

At a price of $2,552.88, shares trade at 24.6 times forward earnings and 7.4 times sales. These metrics look very reasonable given the growth of YouTube and Google Cloud.

Remember to always do your own due diligence, but long-term investors should strongly consider looking for an entry point in coming weeks.

Best wishes,

Jon D. Markman