Despite a Stumble, Netflix Is Still Winning the Streaming Wars

Netflix, Inc.’s (Nasdaq: NFLX, Rated “C+”) stock is getting slammed after the SVOD giant reported disappointing subscriber growth.

On Tuesday, the Los Gatos, Calif.-based company announced that it added only 2.2 million new paying subscribers in the third quarter, well below the expected 3.5 million newbies. Shares sank 5% in after-hours trading.

But investors are letting short-term setbacks distract them from the truth: Netflix already won the streaming wars.

True, the company is facing more competition than ever before. The Walt Disney Co. (NYSE: DIS, Rated “C-”) managers have promised to fully embrace streaming video on demand as a business model. This will mean that its considerable library of action films and animated features are headed to the smaller screen sooner than later. Meanwhile, HBO, Amazon Prime and Apple TV+ are getting a fresh lick of paint, too.

Then there is Peacock, a new SVOD service from Comcast Corp. (Nasdaq: CMCSA, Rated “B-”) unit NBC Universal. It’s chock full of episodes of “30 Rock” and “Cheers.” And the base version is free to watch, if you don’t mind advertisements.

However, even with all of the competition from companies with deep pockets and ambitious plans, Netflix remains a skyscraper among little pink houses. That’s important. It means it has network effects, and that goes a long way in media.

Related post: How Netflix Uses Data to Out Duel Disney

If you’re old enough, you’ll remember chatting with friends at work on Friday mornings after the latest episode of “Seinfeld” aired the previous evening. Media people called these watercooler chats. In reality, those chats were a powerful illustration of network effects.

The show became more valuable, culturally and financially, because so many people were watching every Thursday night.

These network effects also play out on Netflix routinely, even when the shows are nowhere near as well-crafted as “Seinfeld” in its prime. “Bird Box” and “Spencer Confidential” starred Sandra Bullock and Mark Wahlberg, respectively. They were dreary and formulaic, but that didn’t stop them from drawing almost 90 million viewers and being talked about endlessly. The same is true of “Tiger King,” the story of an eccentric exotic zookeeper who plots to kill a critic.

The reason Netflix is able to make so much out of so little comes down to its business model. The company knows what its members want to watch because its predictive analytics software watches customers. It keeps track of what shows are being browsed, watched and for how long. In the end, Netflix knows what actors and directors its audience prefers, and even the types of shows best suited to their interests.

Then, Netflix product managers simply produce that programming.

This is not the way projects normally get funded in Hollywood. There, creatives reign supreme. Commerce follows art. Netflix managers flipped that narrative on its head.

And it worked, in a really big way

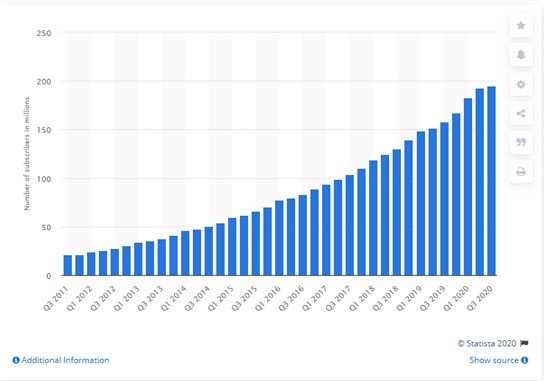

Even with the disappointing 2.2 new million subscribers in Q3, Netflix still has 195 million paying members. The company expects to add another 6 million in Q4.

The brand is so ubiquitous that smart TV makers can’t sell new models without access to a native Netflix application. Getting the company’s seal of approval is a big deal. And the brand-new Google TV, a smart TV dongle, has a physical Netflix button on its remote control.

The shadow Netflix casts over the SVOD landscape is long and dark.

That’s why investors are missing the point when they moan over the latest subscriber growth shortfall.

The company has been missing these quarterly targets since managers made the shift from a mail order DVD rental business to streaming on demand.

After every miss, shares are have trended lower for a few weeks or months, then zipped to record highs. Fun fact, the stock is up a staggering 14,700% since that transition in 2008.

Related post: Why Ads Are the Future of Streaming Media

Also, the quarter was not terrible. The corporate press release notes revenue rose almost 23%, to $6.4 billion year-over-year. Operating income was solid at $1.3 billion, with free cash flow of better than $1.1 billion. The company now has $8.4 billion in cash on hand.

At Tuesday’s closing prices, shares were trading at 59 times forward earnings and 10.4 times sales.

The stock is buyable with recent prices near $491. Netflix shares should be able to reach $725 during the next 18 months based on revenue growth.

This temporary pullback is an opportunity for growth investors.

Best wishes,

Jon D. Markman