A groundbreaking new development in cybersecurity will send shockwaves through the already surging, pivotal industry.

On Monday, the U.S. Department of State announced it will finally launch the Bureau of Cyberspace and Digital Policy.

The agency will begin with 60 staffers and add 30 additional positions later this year. The investment implications will be huge … investors just need to know where to look.

The need for national cybersecurity infrastructure is not a partisan issue.

Rising ransomware attacks at the corporate level and full-blown assaults on public infrastructure have become commonplace, and they need to be stopped immediately in their tracks.

And what's even more alarming is how attackers are often state-sponsored. A report from Center for Strategic and International Studies found that North Korea, China and Russia were the most prolific sponsors of attacks on Western businesses and government infrastructure.

The digital landscape is the new battlefield for political conflict, and it's bound to get even messier.

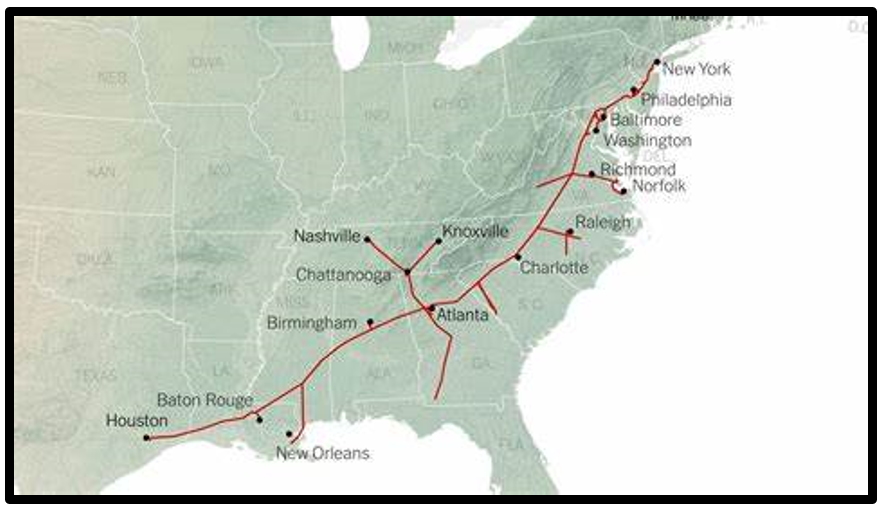

We've seen firsthand how bad things can get. The Colonial Pipeline was devastated in May 2021 by cyberterrorists.

The 5,500-mile pipeline transports 100 million barrels per day of gasoline and other fuel products to the eastern United States.

Attackers distributed malware through email, then demanded a ransom to restore services. Gasoline futures spiked 3% and have remained above trend since that time, according to a report from Reuters.

Two months later, Energy Secretary Jennifer Granholm said that bad actors gained the ability to shut down the U.S. power grid.

Related Post: Power Up With This Chip Champion

Clearly, the threat of this must be stopped immediately. And action is being taken.

On Monday, The Washington Post reported that the Biden administration is jockeying to have an American lead the U.N.'s International Telecommunication Union agency.

The WaPo notes that the agency will set guidelines for 5G, an especially contentious operation given the fallout over worldwide bans on equipment made by China's Huawei technology corporation.

How Investors Can Hack Back

Right now, all cyber roads — in combination with this rapid building out of national cybersecurity infrastructure — currently lead to one company that's uniquely qualified to thrive.

That company is Booz Allen Hamilton Holding (BAH).

The Virginia-based information technology (IT) consulting firm is among the biggest players in government IT contracting.

The business is especially known for its prowess in winning government contracts to speed the transition from analog to digital processes.

Helping to create a workable, national cybersecurity platform would be the ultimate transition.

Government contracts are not like run-of-the-mill enterprise agreements. They take time to negotiate.

Companies must be strenuously vetted, leading to a decidedly narrow field of potential candidates. And when potential new partners do come into view, companies often must contend with internal politics.

Recent examples of this could not offer a better picture.

Project Maven, a joint venture between the Department of Defense and Alphabet (GOOGL), was derailed in 2018 when thousands of Google engineers signed a letter of protest.

They didn't believe that Google intellectual property for artificial intelligence (AI) should be used to program lethal drones. BAH employees feel differently. Working with government agencies is the core of its business, and it's ready to see the money pour in.

And as a consultancy, it has the ability to scale up and down to meet challenges large and small. It offers engineering, data analytics, consulting and cyber expertise.

Those services are going to come in handy as Washington starts to build out a bureaucratic national cybersecurity footprint. With 24,600 employees, BAH has the scale to help build that platform, and it looks likely to happen.

Related Post: AI Stocks Aren't the Answer … Yet

Speaking with analysts in January, CEO Horacio Rozanski told analysts that growth will accelerate as the company builds "scaled positions in critical areas such as cyber and digital battlespace."

Shares have been on a tear since March when they bottomed below $70. At the current price of around $89.19, the stock trades at only 19.3 times forward earnings and a paltry 1.4 times sales.

The company's market capitalization has reached $11.5 billion — the highest level since January 2021.

Given the potential size of the cyber market, the stock still appears reasonable.

Cyber threats are a dire concern. Another equally extreme concern are the dangerous economic cycles we're seeing play out.

My colleague and cycles expert Sean Brodrick sees a multipunch combination of inflation, raging money printing, soaring debt and war all linked to irreversible cycles converging right now.

He recently had an emergency Zoom call with Weiss Ratings founder Dr. Martin Weiss to discuss these cycles.

To help grow and protect your wealth, check this out.

As always, remember to do your own due diligence before entering any trade.

Best wishes,

Jon D. Markman