Inflation has been red-hot, and consumer spending remains robust despite rising interest rates.

That’s not exactly breaking news … but what should be is the looming threat of deflation.

A Consumer Price Index report last week showed 9.1% inflation — the highest level in four decades. Beneath the surface, key CPI components, like airfares, are falling. I believe it’s a sign of things to come.

Betting against inflation right now seems weird. Everyone, including the Federal Reserve, is on the opposite side of that trade.

The headlines are full of stories about inflation surging to the highest levels since the early 1980s. Gloom and doom about the economy, and the view that stock prices will be mired in a funk for the foreseeable future, is becoming the consensus view.

Last week, Bank of America (BAC) analysts slashed their year-end target for the S&P 500 to 3,600 — the lowest marker for any of the big Wall Street investment researchers.

Analysts expect five consecutive quarters of negative gross domestic product growth as the Federal Reserve continues to raise short-term interest rates.

The forecast also predicts the Fed will keep rates elevated even as the economy slips into recession. That may not be a great bet at this point.

Related Post: Level Up With Sony

Federal Reserve Chair Jerome Powell has stated publicly the primary objective at the Fed is fighting inflation.

It makes sense.

Inflation is a hidden tax, especially for the people who can least afford higher prices. Here is the rub, though: Prices at the wholesale level are falling … precipitously. Wagering that the Fed will continue to raise rates aggressively is premature.

Consider some of these numbers:

- Copper prices on the London Metal Exchange, long considered the bellwether for the global economy, fell to levels not seen since November 2020. The key industrial metal is down 22% in the second quarter alone, the biggest loss since 2011.

- Lumber prices, also considered a leading economic indicator, are down 40% in the first half of 2022.

- And gas prices, heading into this week, have fallen for 30 consecutive days.

Some of the commodity weakness is beginning to show up in airfares. Ticket prices fell a seasonally adjusted 1.8% during June, according to the latest CPI report.

The Dangers of Deflation

Demand destruction is another factor in lower airfares. Consumers have been hit with historically high airfares, and a rise in short-term interest rates.

As those rates soar, consumers feel the pinch of larger variable-term mortgage payments. Nonessential travel expenses are an easy cutback. Reduced demand leads to lower prices.

It’s a vicious circle.

Deflation’s certainly not the prevailing narrative among investors. It is far easier to battle the demon that everyone can see at the gas pump.

However, rapidly declining prices kill profits, thereby discouraging investment. The Great Depression of the 1930s was a lesson in the perils of deflation.

Related Post: The Apple of Big Tech’s Eye

Powell wants to squash inflation, while not awakening the forces of deflation.

So, what appears to be the best area to fight back with as an investor?

Healthcare stocks.

Healthcare Can Keep Returns Healthy

Healthcare is dominating the other 10 S&P 500 sectors over the past month, having gained 8.38% (compared with a loss for the energy sector of 17.66%).

Many companies in the sector have carved out lucrative monopolies in the domestic landscape while successfully delving into niche international marketplaces. Profitability growth has been sure and steady regardless of macroeconomic factors like interest rates.

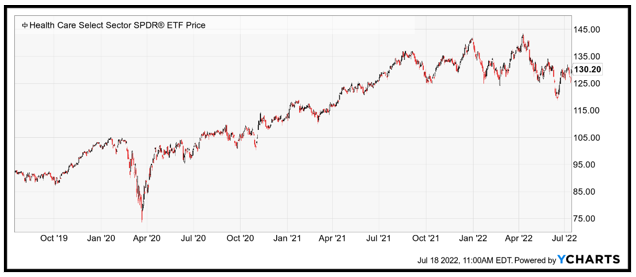

The Health Care Select Sector SPDR Fund (XLV) is home to iconic companies like Johnson and Johnson (JNJ), UnitedHealth Group (UNH), Pfizer (PFE), Abbott Laboratories (ABT), Thermo Fisher Scientific (TMO) and Merch (MRK). The exchange-traded fund has a dividend yield of 1.5%, and shares are rounding out of a short-term downtrend.

Investors should be wary of what the downturn in key commodity prices portends. While the large investment research firms worry about inflation, deflation could be much worse for corporate profitability.

Remember to do your own due diligence before entering any trade.

Best wishes,

Jon D. Markman

P.S. Tomorrow Dr. Martin Weiss will reveal an opportunity off-limits to the public for nearly 100 years. Claim your free spot for this historic event and get first access to one amazing private deal!