Digital transformation is enabling wild innovations, yet most of these pale in comparison to generational investment themes like the internet and smartphones. That's a problem.

On Tuesday, executives at Mastercard (MA) announced that consumers will soon be able to make purchases in stores with their faces and fingerprints.

The biometric advance is a big deal; however, it's unlikely investors will be coerced back into tech stocks.

The tide's shifted. Cool new features are not enough.

Some of this is a withering response to recent hype. Many investors feel burned by sky-high stock price valuations for biotechnology, electric vehicles (EVs) and Software-as-a-Service (SaaS) firms.

Those stories boomed in 2021 as the pandemic and a wave of neophyte investors pulled forward big digital ideas.

It's been all downhill since. The uneasy realization that the businesses might never live up to the hype sapped the euphoria. Stocks that got rave reviews from Wall Street analysts a year ago have been decimated:

- Editas Medicine (EDIT) traded in January 2021 as high as $90.63.

- Rivian Automotive (RIVN) rallied in November to $179.40.

- And Upstart Holdings (UPST) pushed last October to $401.49.

Those shares could be bought last week at a measly $9.71, $19.25 and $26.78, respectively.

In hindsight, investors were looking past the obvious: The ideas and the players were too small.

Related Post: Microsoft's on Cloud 9 After Earnings

Editas holds key patents to the gene-editing technology that promises to make drug discovery easier and expedite cures for existing illnesses.

Rivian makes a distinctive electric pickup truck that journalists and owners love.

Upstart culls scads of digital data to help loan-seekers with financing.

These are cool ideas … yet they're not really platforms. They're features that could easily be absorbed into larger platforms. The companies may never grow into their 2021 valuations.

As easy as it is to love the growth trajectory at Upstart, a big portion of its sales originates at Credit Karma, an Intuit (INTU) subsidiary. The possibility of Intuit's building a competitor isn't crazy.

That's part of the problem with the current tech environment. There's simply no really big idea on the horizon that will suck in investors for the long haul.

In reality, it seems like we're witnessing a rotation out of growth and into value, as evidenced by the failed hype of Editas, Rivian and Upstart. For an inside look at what stocks provide real value for investors, consider a risk-free trial to Wealth Megatrends. Click here or call our Member Care Team at 855-278-9191 for discounted access to Wealth Megatrends as low as 14 cents a day and get four premium bonus reports valued at $316 at no additional cost whatsoever.

This current situation reminds me of a similar story in past years.

During the 2000s, investors fell in love with the idea of the internet. The so-called information superhighway promised to connect everything.

Ultimately, the one-way Web 1.0 network grew into two-way connectivity. Alphabet (GOOGL), Amazon.com (AMZN), Meta Platforms (FB), Netflix (NFLX) and others gave us personalized web experiences that changed with the data we uploaded to their networks.

The smartphone era that started in the 2010s changed everything again. Billions of people carrying connected supercomputers in their pockets and handbags led to new cloud-first networks capable of machine learning at scale. Real artificial intelligence (AI) became viable.

There's no doubt that the next really big idea is the metaverse. It's the evolution of the internet and smartphones and artificial intelligence. Unfortunately, it isn't here yet. It's too early to build a hype cycle around the virtual world.

Even still, the metaverse is driving biometrics research at Mastercard.

The company, based in Purchase, New York, is doing a lot of innovative things in the field. Ajay Bhalla, Mastercard's president of Cyber & Intelligence, said the company is developing technology to allow gamers to buy items using nothing but their eyes inside virtual reality worlds.

While adding facial recognition and fingerprint scanning into point-of-sale (POS) terminals may seem a bit creepy, the new tech is a direct affront to fraudsters, the credit industry's archenemy.

CNBC reported on Tuesday that the POS program is now live at five grocery stores in São Paulo, Brazil. Rollouts are planned for the U.S., Europe, the Middle East and Asia.

The bigger idea is to make biometrics operable everywhere Mastercard payments are accepted.

Related Post: Pop a Split With Tesla

In theory, a cardholder would be able to travel across physical and virtual worlds, making payments without carrying a card. It's very cool tech.

I haven't been buying any tech shares. It looks like there's too much worry about valuations for smaller companies, and too little buzz about big new investment themes to justify new positions.

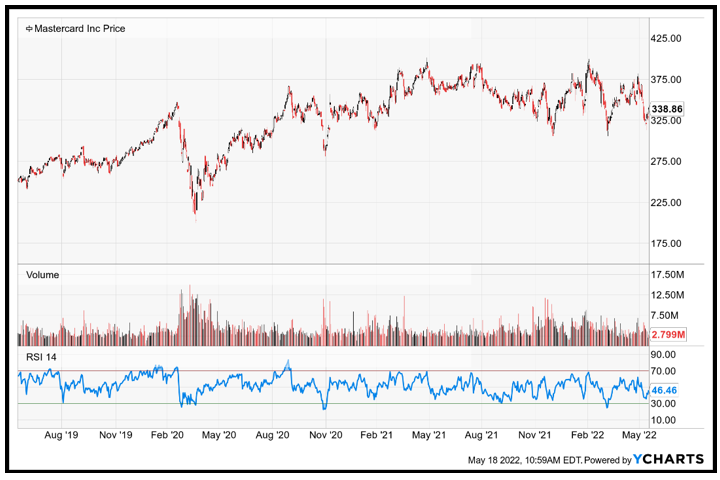

At $338.86, Mastercard still trades at 26.7 times forward earnings and 15 times sales. It's a great business, but now doesn't appear to be the time for new investment.

Remember to always do your own due diligence.

Best,

Jon D. Markman