Applying artificial intelligence (AI) to mundane businesses was supposed to make them special. AI has been hyped as a game-changer, but investors are discovering maybe that isn't so.

Shares of Upstart Holdings (UPST) plunged on Tuesday as executives lowered their full-year outlook and revealed that $604 million worth of loans had been moved to its balance sheet.

Investors were correct to freak out. There is more risk ahead for the company that purports to use AI to determine borrowers' creditworthiness.

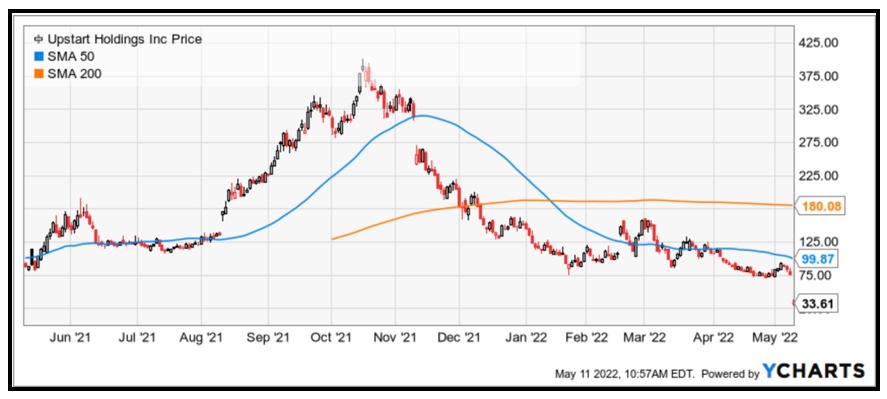

Upstart issued shares to the public in December 2020, and the business was an immediate hit with investors. Underwriters priced 12 million shares at $20.25. The closing price on opening day was $29.47. Within 10 months, the stock reached a high of $401.49.

Related post: Digital Transformation Is Our World

The business seemed too good to be true …

Last October, the company posted Q2 revenues that increased 1,180% year over year. Bank partners were falling over each other to use its AI platform. Partners originated 286,864 new loans during the quarter. There seemed to be no limit to growth.

To be clear, Upstart was built from the ground up to disrupt Fair Isaac (FICO). For decades, banks have used FICO scores to access credit worthiness. Fair Isaac, the clear market leader, collected a nice fee for providing the data. It's been a tidy business with few competitors, until Upstart.

To access creditworthiness, the San Mateo, California-based company inputs data points like employment history, education, credit experience, bank transactions and cost of living into a proprietary algorithm. Dave Girouard, chief executive officer claims higher approval rates, lower defaults and lower loan payments for consumers.

That was the story he was telling last year, when shares were soaring and investors were clamoring to get a piece of the action. This year is different.

On Monday, Girouard told analysts following the Q4 financial results that growth is slowing as rising rates and broader economic uncertainty negatively impact lending.

He also fielded questions about a 232% surge in loans being carried on the balance sheet. Investors were understandably spooked by the increase in loans. Upstart execs billed the company as a software platform with loans discharged to its partners. Credit risk exposure was supposed to be negligible. And that's the rub.

Girouard is adamant that the company has not changed its business model. He says Upstart has always held loans originated on its platform for the purposes of new product testing. The size of the overall business is simply much larger now.

Upstart shares plummeted 56.4% on Tuesday to close at $33.61. The stock is now down 94% from its record high at $401.49. And it's going to get worse.

Allowing the value of loans carried on the balance sheet to balloon to $604 million is a management blunder, especially in this environment where short-term interest rates are rising, and consumers are being ravaged by inflation. Investors are likely to conclude some part of those loans will turn out badly.

Related post: Tech Winners vs. Weaklings

That development would not be terrible for a bank. Loan losses are part of the business model. Unfortunately, investors assumed Upstart's business was an AI-based FICO score that scraped big fees for being a matchmaker between banks and lenders. Those assumptions are now off the table.

For what it's worth, this is not my first go around with Upstart. I recommended the shares in August 2021 at $171.20, with a price target of $280. The stock reached that level in only 25 days, a gain of 64%.

The current price of $33.61, Upstart trades at 9.9 times forward earnings and 3.8 times sales. While these ratios are attractive for a software business, investors are likely to assess the company differently moving forward. Given this, a test of the initial public offering price at $20.25 seems likely.

Investors should consider using strength to liquidate existing positions. As always, remember to do your own due diligence.

As inflation soars and interest rates rise, the cost to service loans for Upstart (and other companies) will balloon, which could lead to significant losses for these stocks.

If you're worried about what this could mean to your retirement account and want to find investments that could thrive in these conditions, consider a risk-free trial to Wealth Megatrends.

Just click here to get discounted access to Wealth Megatrends for as low as 14 cents a day and get four premium bonus reports valued at $316 at no additional cost.

Best wishes,

Jon D. Markman