War in Ukraine is causing an energy reset.

Western governments are rethinking dependence on Russia's oil and gas, and it's a big opportunity for investors.

Last week, Prime Minister Boris Johnson announced that Britain will begin developing small scale, modular nuclear power plants. The new energy path is a big win for uranium assets.

The emergence of nuclear as a clean energy source seemed unlikely.

Nuclear power has been mocked for four decades, but now, that's changing fast.

The number of nuclear power plants globally peaked in 1996 when 17.5% of all electric power was generated in those facilities.

Since then, public opinion soured, and the political will to keep those plants open waned.

The downfall of nuclear energy was caused by a combination of events ...

Environmental movements gained global traction in the 1970s, and nuclear energy was the perfect bogeyman.

Radiation poisoning was invisible and lethal. This was exploited in 1979 by "The China Syndrome," a big budget Hollywood film that mirrored a partial meltdown earlier that year at Three Mile Island, a Pennsylvania nuclear facility.

Although epidemiological studies later showed no increase in cancers in the area, fears of living near nuclear facilities grew exponentially.

Other problematic nuclear troubles haven't been so benign.

A complete meltdown in 1986 at the Chernobyl nuclear reactor led to the depopulation of 68,000 people across 1,000 square miles in northern Ukraine.

And in 2011, 154,400 Japanese citizens were evacuated when a nuclear plant in Fukushima was damaged following an earthquake and tsunami.

Nuclear power plants all over the world began to close.

Today, these facilities generate only 10.3% of the world's electricity. The oddity is nuclear power is clean, green, sustainable and statistically much safer than most other forms of power generation, according to research compiled by Our World in Data.

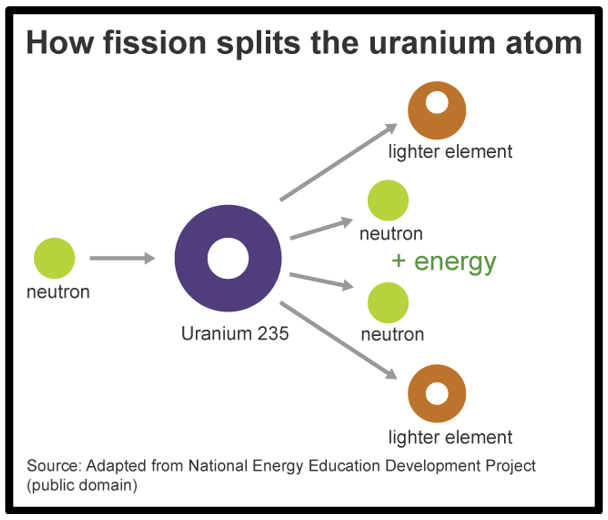

Most people may find the process confusing, but when you break it down at its most elemental level, it's not hard to get: Nuclear facilities are essentially extremely large tea kettles.

The power-generation process begins when a neutron collides with a uranium atom, splitting the uranium atom in half (i.e., fission) and releasing an enormous amount of radiation and heat energy.

Rods of the fissionable material are cooled in water, creating steam that spins a turbine and creates electricity.

Related Post: Raining $ in the Cloud

Using a turbine to create electricity is also used in most coal and natural gas power plants... the difference is that uranium is a far more efficient source of energy.

A single set of rods the size of a fireplace log holds enough energy to power 100 homes for a year.

Uranium is also cleaner. Using it to create electricity does not release carbon into the atmosphere. This is especially important as the world races toward zero emissions.

Britain used to be a hub of nuclear power innovation. The U.K. had 15 nuclear facilities operating in 1997, generating 27% of the country's electricity.

Related Post: Prep for a South China Sea Showdown

By 2024, only two plants will remain. With the help of Rolls Royce (RYCEY), Prime Minister Boris Johnson wants to reverse the trend.

The goal is to build smaller power generation facilities based on Rolls' nuclear-powered submarine engines.

It might be the perfect solution for an economy shying away from carbon emissions, and the perils of dependence on Russia oil and gas.

How Investors Can Go Nuclear

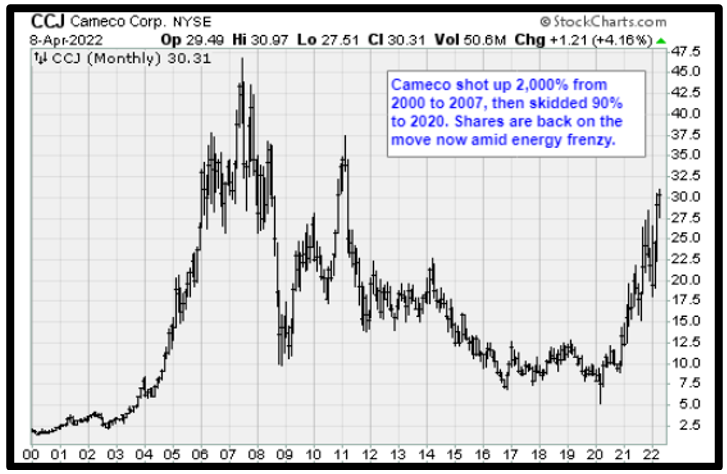

Cameco (CCJ) is uniquely positioned to take advantage of both the current geopolitical crisis and the inevitable transition back to nuclear power.

The Canadian uranium producer holds the world's largest deposits, and executives are strategically removing supply from the market to maximize the value of those assets.

During a conference call in February, CEO Tim Gitzel told analysts that since 2016, Cameco has removed 190 million pounds of uranium from the spot market.

Gitzel notes that the Netherlands, Czechia, Poland, Estonia, Slovenia and Serbia are now studying their nuclear options.

Also, the European Union has labeled nuclear power as a climate-friendly investment, giving environmental, social and governance (ESG) funds a green light to begin investing in the sector.

Uranium prices have risen to $63.50 per pound in 2022, up 46.1%. Cameco is licensed to produce 53 million pounds annually, and the current market capitalization is only $12.1 billion.

Longer-term investors should consider buying Cameco into any further weakness. Remember to always do your own due diligence.

They should also consider watching the recent video my colleague and cycles expert Sean Brodrick recorded with founder Dr. Martin Weiss.

In it, they discuss how factors like inflation, war and money-printing are going to impact the markets and economy for the next several years.

It's only available for a short time, so I suggest you click here now and watch.

Best wishes,

Jon D. Markman