Being a tech investor is not easy … but the potential reward makes it one of the best sectors to invest in.

Finding the most innovative companies is only the beginning … because disrupting the status quo usually leads to disinformation to try and bring down those winners.

Tesla (TSLA) offers a perfect illustration of this unfortunate situation.

TSLA shares have been under pressure since January when a propaganda campaign to discredit its software began.

Unfortunately, truthfulness didn’t matter.

Related Post: Hop In, the EV Era Is Here

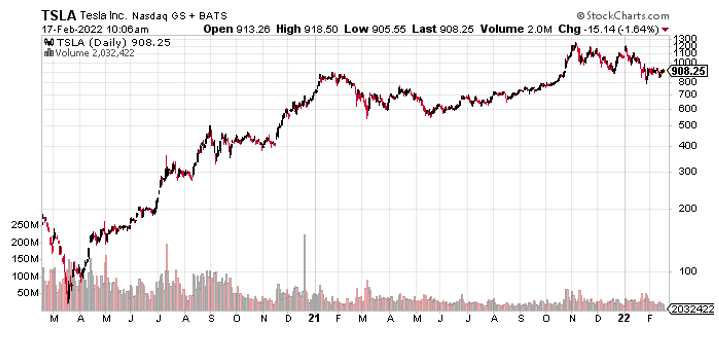

Shares were slammed and have not recovered. Shares are down around 24% since the first week of 2022.

- The lesson from this situation? Narratives usually drive stock prices.

The reality is that Tesla is making the most and the best-quality electronic vehicles (EVs).

The Austin, Texas-based company is also lapping the field in terms of manufacturing prowess.

That is clearly no easy feat.

Competitors such as Ford (F), Mercedes and General Motors (GM) have been making cars and trucks for eons … but they still couldn’t adapt to compete with Tesla.

- Engineers for legacy automakers know how to put together the factories and supply chains to build modern vehicles ... yet they are far behind Tesla, and it’s not hard to see why.

Teslas are not traditional cars and trucks ...

They are electrified, network-connected robots. And quite frankly, that’s the future of the automobile.

The legacy auto companies know this. They admit as much in all-hands meetings and during conference calls.

They know they’re in trouble … and they’re resorting to questionable tactics to compete.

Their strategy now —with the help of their allies in industry and government — is to take down Tesla … unethically.

- They’re not even trying to compete … and it’s not hard to realize why. Tesla simply has too many competitive advantages.

Tesla has the largest charging network: 30,000 stations worldwide.

Related Post: The EV-Maker That Powers Past the Competition

Electrify America, a network owned by Volkswagen, has a footprint of only 500 locations.

Tesla enjoys a software-first platform that allows for over-the-air updates that bring new features such as range enhancement, acceleration tweaking and full self-driving (FSD).

Founder and CEO Elon Musk claims FSD is a game changer because it will permit fully autonomous use and eventually become the basis for a robotaxi fleet.

Better still, most vehicles manufactured after 2017 come equipped with all the required hardware. It’s only a matter of flipping a software switch on Tesla servers.

- It’s a competitive advantage others simply can’t match … and it’s where the unfortunate disinformation campaign begins.

Last September, officials at the National Highway Traffic Safety Administration (NHTSA) asked Tesla to provide information about 12 crashes involving the use of Autopilot ... although drivers are supposed to remain alert and ready to take over at a moment’s notice.

A month later, the NHTSA asked Tesla to issue a recall.

A full-page ad in The New York Times in January claimed that Autopilot was the worst software ever sold by a Fortune 500 company.

The ungrounded basis for this claim is 21 hours of YouTube videos.

- Dawn Project, the company responsible, makes competing software for the automotive sector.

Dan O’Dowd, Dawn’s founder, is conflating FSD with Autopilot … even though the software was never intended as a full self-driving tool.

O’Dowd even admitted during a CNBC interview that he knows this. It makes no sense other than being a smear effort … and Tesla shares have sadly declined around 36% since the Dawn Project ad was released.

Agents for the automotive sector are running a disinformation campaign to discredit FSD.

- They’re going directly after one of Tesla’s key competitive advantages, and they’re having success.

This fear, uncertainty and doubt strategy is standard procedure for legacy companies dealing with disruptive competitors.

Investors should understand that it often works, for a while.

And speaking of strategies that seem to be working, I highly recommend checking out Dr. Martin Weiss’ Weekend Windfalls strategy.

His breakthrough service has one way to give investors an opportunity for a steady stream of weekend cash every week.

If you’d like to learn more, click here now.

Back to Tesla ...

The company unquestionably started with a great idea and plan that has been executed very well.

The company revolutionized motor vehicles with electrification.

Then executives built software that should ultimately do the same for transportation.

It’s a plan that will eventually find even greater success.

Remember: Tesla shares are up around an astonishing 467% over the past two years alone … and it seems like the company is still in its early stages of growth.

Savvy investors should strongly consider buying shares using any near-term weakness. Always remember to do your own due diligence.

Best wishes,

Jon D. Markman