The latest Tesla (TSLA) production and delivery data is out, and it is far below expectations. Today, we'll go over what the numbers mean for investors.

Tesla built 1.37 million electric vehicles during 2022, a significant miss to its internal target of 50% growth. Worldwide deliveries during the quarter also fell short of forecasts.

Bears should not get too excited, though. A big rally is likely coming soon.

Since CEO Elon Musk announced in April that he was interested in buying Twitter — which was delisted from the New York Stock Exchange on Nov. 8 — Tesla shares have been reeling. The problem is not the distraction of running another company, although that narrative has not helped, either.

Click here to view full-sized image.

The real issue for shareholders of the EV maker is the hit to Elon Musk's pristine reputation as an innovator.

Tesla has always been about Musk. From its initial public offering in 2010, investors have been willing to look past losses, new share offerings and perilous investments in new factories because Musk secured a premium as a gifted chief executive officer.

Related Post: Chip Glut Separates Future Winners & Losers

Within a decade, Tesla overcame Toyota Motor (TM) to become the most valuable automobile company in the world. And SpaceX, his rocket company based in Austin, Texas, changed the economics of the aerospace sector with reusable rockets. Musk seemed to have the Midas touch.

However, Twitter shattered that persona of excellence.

Beginning with the initial $44 billion bid, his botched withdrawal and later acquisition, the Twitter buyout has taken on an air of comical incompetence. In fairness, Twitter was a terrible business long before Musk ever expressed interest in buying the social media platform.

Never profitable, it was largely a destination for impolite online arguments and automated spam bots. The operational changes made so far by Musk have made Twitter only modestly terrible by comparison.

However, the process has turned Musk into a more polarizing figure. His accomplishments, like helping the world transition more quickly to sustainable fuel sources or upending the aerospace business, have been routinely diminished by biased critics. Worse, his lofty ambitions have been summarily categorized as opportunistic lies.

Tesla shareholders have paid the price.

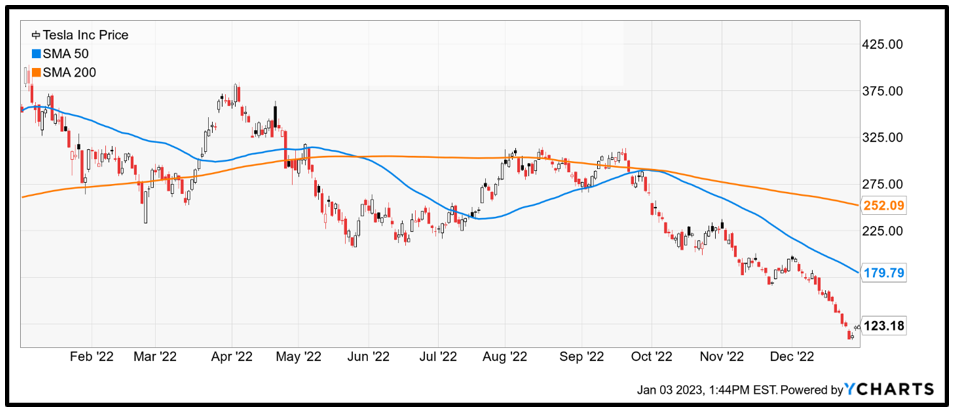

The stock is down from $328.33 on April 14, when Musk launched his bid for Twitter, to $123.18 at the close of 2022. The 2022 production and Q4 deliveries data will give bears even more ammunition to pummel shares.

Bears will be able to advance the narrative that demand for EVs is drying up. They will argue that expensive new production facilities in Austin and Brandenburg, Germany, will soon become cash-sucking liabilities. Some of this will stick.

However, bears have their own problems, too.

Related Post: Top 3 Trends Set to Gain More Strength in 2023

Most of Tesla's near-term demand issues are being caused by tax incentives. Those enticements are going away during 2023 in China, the world's biggest new car market, and they are being phased in stateside.

Beginning Jan. 1, 2023, American buyers of some new Teslas will begin receiving a $7,500 tax credit. It's a reasonable assumption that many buyers put off orders until the new year. It's also reasonable that all of the gloom about demand will subside in the weeks ahead as those orders flood in.

Despite the prospect of tax incentives, Tesla still delivered 405,278 vehicles, against production of 439,701 units, during Q4. Both of these figures set new records, representing year-over-year gains of 24.7% and 30%, respectively. Unfortunately, the median expectation by analysts for deliveries was 427,000, according to FactSet.

At a share price of $123.18, Tesla now trades at 23.2x forward earnings and 5.2x sales. These financial metrics are compelling entry points, given the long-term prospects for EVs and Tesla's considerable lead over the competition.

That said, new trades here are not for the faint of heart. There is resistance in the $160 level and support in $108, the recent low. I fully expect a bounce toward that level over the next several months. Please remember to conduct your own due diligence before entering any new trades.

That's all for today. I'll be back with more soon.

All my best,

Jon D. Markman

P.S. It’s a new year, and with it come new prospects. My colleague Sean Brodrick has identified what he says is the best opportunity in decades, and he’s calling it the Made-in-the-U.S.A. Superboom, and it could be the biggest financial trend of the year (if not the next decade). Click here to find out more.