3 Reasons BTC’s Going Much Higher — Despite Its Recent $11,000 Plunge

Within three days of blasting above $41,900, Bitcoin (BTC, Tech/Adoption Grade “A-”) hit the express elevator going down and plunged by a stomach-churning $11,000 to $30,000 and change.

This occurred against a backdrop of intensifying political upheaval in Washington D.C., and also as minutes of a recent Fed meeting were released, which seemed to say America’s central bankers might try to slow down their money-printing.

In this issue, however, we’re going to step back from the daily news torrent and focus on the big picture. Right away, two conclusions emerge.

|

First, big price declines are nothing new. After going from $1,000 to $20,000 in 2017, Bitcoin plunged nearly 90% (to $3,400) in 11 months.

That’s crypto. Get used to it.

Second, it’s way, way too soon to get cold feet. Bitcoin still has enormous upside, going forward. There are three key reasons why.

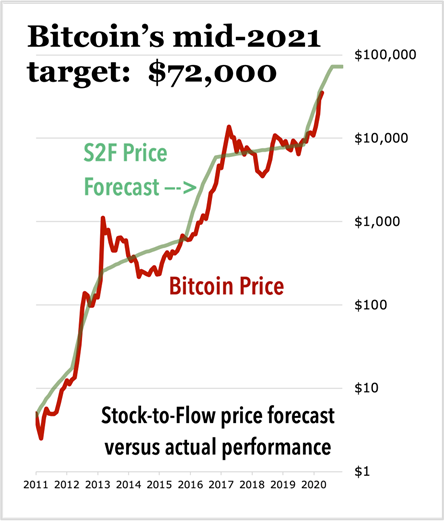

Reason 1: Bitcoin’s Still on Track to Hit $72,000 (or Higher) This Year

This is the forecast of a popular indicator called S2F, or stock-to-flow. It’s based on a common-sense notion: That the scarcer a commodity is, the more valuable it becomes.

Gold, for example, has a S2F of 62. That’s the number of years of current production required to match global above-ground holdings. By contrast, it takes only 22 years of current silver production to equal above-ground supplies.

Being less scarce in this way ... is precisely what makes silver less valuable than gold.

What about Bitcoin?

Well, right now 6.25 new Bitcoin are being created every 10 minutes. At that pace, it would take roughly 56 years for new mintage to match Bitcoin's circulating supply.

Notice how close that is to the S2F number for gold. And it makes sense, because Bitcoin is quickly becoming a major rival to gold as a safe-haven investment in a world gone mad.

As you can see above, the S2F indicator is pointing toward Bitcoin hitting $72,000 — which is roughly double Bitcoin’s current price.

And whether this number turns out to be precisely accurate or not, it’s clearly undeniably bullish.

Reason 2: Bitcoin is No Longer a Fringe Player in Global Finance. It’s Rapidly Fighting Its Way to the Top of the Queue

On Jan. 11, a record shattering $122.3 billion worth of Bitcoin changed hands in a single day (according to coinmarketcap.com). That’s more than twice the trading volume Ethereum (the world’s no. 2 crypto) had the same day.

Of the 170 fiat currencies in the world today, Bitcoin is now bigger than 65 of them!

With a market cap of $650 billion, Bitcoin is worth more than every fiat currency except the dollar, the Euro, the yuan and the yen.

Bitcoin made more money for investors last year than any other major asset class. So naturally, professional investors are starting to pour in.

As you can see below, Bitcoin outperformed gold by 12-to-1 last year, outpaced U.S. stocks and long-term government bonds by roughly 16-to-1 and beat out U.S. Treasuries by a remarkable 99-to-1.

In the hyper-competitive world of investment, outperformance like that does not go unnoticed. Indeed, it’s a key reason a handful of major companies started investing in Bitcoin in last year.

For example, business intelligence firm MicroStrategy invested over $400 million in Bitcoin in August and September.

This week, Morgan Stanley purchased 10.9% of MicroStrategy — precisely to boost its exposure (albeit indirectly) to Bitcoin.

SkyBridge Capital, the investment company run by former White House Communications Director Anthony Scaramucci, is launching its own Bitcoin fund. When a mass zoom call was announced to invite potential investors to participate, more than 6,000 tried to phone in at once, crashing the local network.

Fear of missing out is going to bring legions professional investors pouring into crypto this year. And the weight of these capital flows is going to send Bitcoin soaring far, far above today’s levels.

Reason 3: 2021 Will Be the Year the General Public Rediscovers Bitcoin

Frenzied public interest was the key driver of Bitcoin’s 20-to-1 advance in 2017. But these newbies rapidly lost heart when Bitcoin fell out of bed the following year. And they’ve been noticeably absent ever since. But now, there’re signs they’re starting to tiptoe back in again:

□ A modest uptick has already occurred in Google searches on the term BITCOIN — although it’s still far short of the spike that occurred in 2017.

□ A couple months ago, payment services giant PayPal started offering its 340 million customers an on-ramp for buying Bitcoin. And now, we’ve learned 17% of them have already done so. Indeed, PayPal-related buying has lately been absorbing all the new Bitcoin miners can produce.

□ Kraken, one of America’s top cryptocurrency exchanges, reports a massive surge in new account openings — breaking records set during 2017’s epic bull run.

But there’s a big difference between today and 2017. Back then, there were very few crypto exchanges.

And opening an account was like pulling teeth. In many instances, there were months long waiting lists to get your paperwork approved and accepted.

Today, it’s never been easier to buy Bitcoin.

And because of this … when the general public rediscovers Bitcoin and the feeding frenzy begins anew — as it almost certainly will, sooner or later — Bitcoin is going to hit prices undreamed of today.

The Weiss Crypto Timing Models called for a correction back in December. The pullback we saw in the past week is just that — a correction. These three key factors all support the idea of a bullish 2021 for Bitcoin.

So, if you’re still sitting on the crypto sidelines, this weakness should be seen as an opportunity.

Best,

Juan and Bruce