After a Wild Week in Finance, Bitcoin and Crypto Take a Breather

• Bitcoin (BTC, Tech/Adoption “A-”) and the rest of the cryptocurrency market is trading sideways this Monday morning, perhaps signaling a necessary time to rest and recalibrate.

• Ethereum (ETH, Tech/Adoption “A-”) is still trading in the same range above its 21-day moving average, as traders have yet to make up their minds about the second-largest crypto asset.

• “Altcoin season” is still in limbo, as altcoins lost ground to Bitcoin over the weekend. It’s now still too early to call, and we’re less certain of an impending period of leadership for the King of Crypto’s acolytes.

It almost feels as though the entire finance world is waiting to see what happens next with Reddit and the r/WallStreetBets crowd this week.

Will they push GameStop Corp. (NYSE: GME) and other “meme stocks” to higher highs? Will they move their money to other exchanges that haven’t restricted trading? Will they switch their attention to silver and precious metals?

Here’s our main concern: Will they discover the value of cryptocurrencies and the potential of “decentralized finance”?

All of these questions have led to some paralysis in markets — which is sort of welcome in the aftermath last week’s craziness.

Most of the market is trading sideways today, with small gains and small losses across the board. DeFi has cooled off, altcoins remain stagnant and BTC and ETH have yet to decide the direction they want to go next.

With that, let’s turn to the crypto market’s head-turner, Bitcoin, and one of the world’s biggest head-turners, Elon Musk …

In his latest move, the Tesla Inc. (Nasdaq: TSLA) founder and future Mars colonizer turned to a new audio chat app, Clubhouse, to talk about Bitcoin on Sunday night. Apparently, Musk has finally jumped on board the crypto bandwagon.

Even with this newfound enthusiasm, Bitcoin was unable to make a significant move. BTC retested its 21-day moving average over the weekend, trying to break out and resume its bullish move. It didn’t happen, and that 21-day is turning out to be a formidable enemy right now. Something has to budge this week.

Here’s Bitcoin in U.S. dollar terms via Coinbase …

Ethereum is somehow still channel-trading above its 21-day moving average, continuing a trend that feels ancient by now. It probably sounds like a broken record by now, but we have to sit back and wait for ETH to make a significant break up or down.

At this point, we seem to be getting very close to the end of this channel. A break above $1,400 or below the 21-day moving seems inevitable, and we expect to see a meaningful change in price within the first half of this week.

Here’s ETH in U.S. dollar terms via Coinbase …

On the DeFi and altcoin front, after a scorching week, things seem to be cooling off right now.

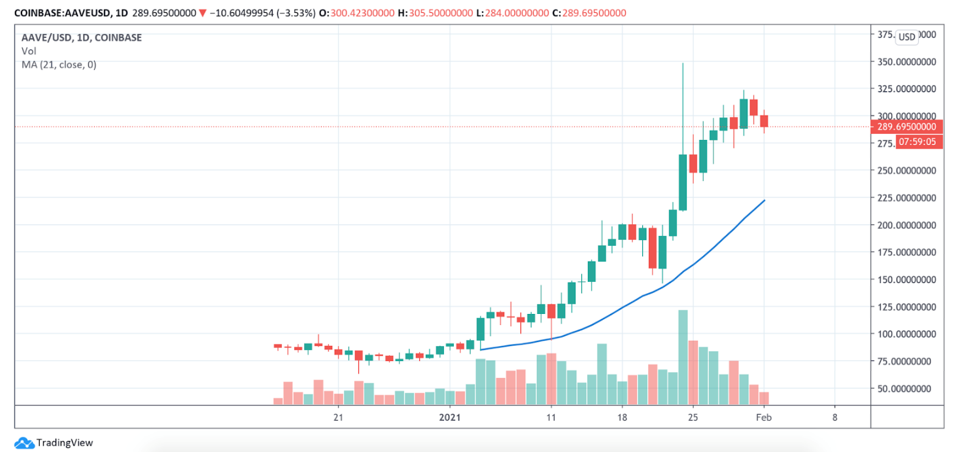

That’s not to say that DeFi and altcoins are down big today, it’s just that they’ve slowed their pace from last week. Aave (AAVE, Unrated) recorded its highest-ever close on Saturday at $325 on Coinbase. Since then, it’s retraced slightly and is trading at about $290 as of this writing.

Here’s AAVE in U.S. dollar terms on Coinbase …

Chainlink (LINK, Availability/Liquidity Grade “A+”) is still trading above its 21-day moving average but is not showing the same strength as AAVE. We remain bullish on LINK and still think it’s one of the assets that’ll signal an “alt season.”

This week will be interesting despite the relatively boring price action we’re seeing today. Here’s LINK in U.S. dollar terms …

Notable News, Notes and Tweets

• Perhaps Anthony Pompliano is trying to entice the Reddit crowd to jump into crypto, DeFi in particular …

• Luke Martin of Venture Coinist is also trying to bring the r/WallStreetBets crowd over to Bitcoin.

• Robinhood’s name and motto have turned into a joke.

• Even Mark Cuban is on the r/WallStreetBets bandwagon, opining that there’s massive upside if they discover the true nature of cryptocurrencies and noting that they’re “applying the principles of the crypto world to the stock market.”

What’s Next

I said last week that we were in a big test for an “altcoin season” as well as the overall market direction. Even with the crazy action in DeFi last week, it’s still too early to call for an “altcoin season,” though this week, again, is a very big test.

We’re most likely getting toward the end of this sideways price action, evidenced most especially by the Ethereum chart. We’ll most likely re-test highs or break under the 21-day moving average on a lot of these assets this week.

It’s to be determined just how involved the Reddit crowd will be in the crypto market. But if they do shift their attention from Dogecoin (DOGE, Technology/Adoption Grade “C+”) to other cryptocurrencies, we might see some higher demand in the market.

One thing is certain: This will be a fun and interesting week for crypto and markets generally. Stay tuned …

Best,

Alex