• The last 48 hours have been a test for the overall cryptocurrency market, as macroeconomic factors appear to be in play.

• Bitcoin (BTC, Tech/Adoption Grade “A-”) has been bouncing around its 21-day moving average for the last two days, as the bulls and the bears appear to be in deadlock.

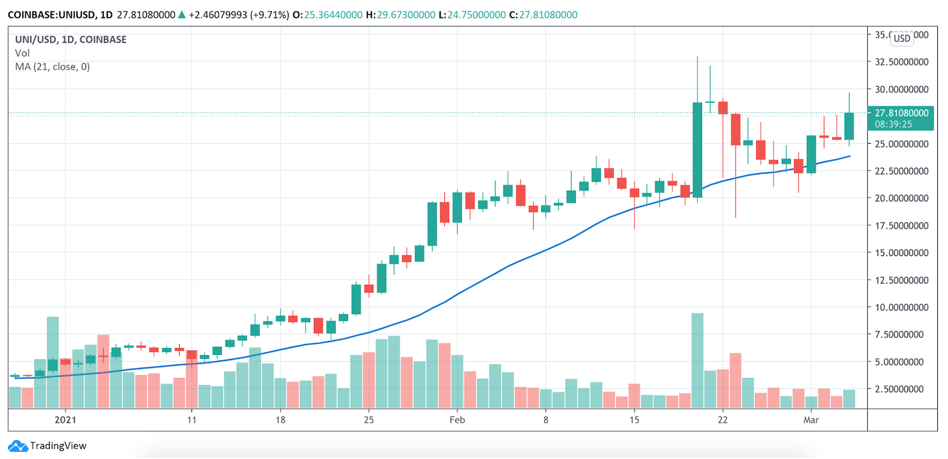

• Uniswap (UNI) has enjoyed an astronomical run to start 2021, and it hasn’t shown signs of slowing down.

Although last week’s general slide has been stemmed, most cryptocurrencies have been stuck in limbo this week, unable to definitively break through resistance or support.

It’s been a week of mostly sideways trading. As we’ve noted, action like this is not atypical for – in fact a necessary part of – a crypto bull market. After prolonged bullish action like we experienced from mid-2020, it was only a matter of time before crypto markets corrected. Now, we’re seeing a break in upward movement; that’s a good opportunity to recenter the market.

With that being said, let’s check in on a few specific assets to see how they’re performing.

Bitcoin has been stuck near its 21-day moving average for about four days, unable to convincingly break above that key level currently acting as resistance. The bears are unwilling to give up ground, though they’re not strong enough to extend the slide. The next most important steps for the BTC bulls are a close above that 21-day moving average and then holding that level for at least three days.

Here’s BTC in U.S. dollar terms via Coinbase:

Ethereum (ETH, Tech/Adoption Grade “A-”) has had a bit more trouble so far this week than Bitcoin. Since breaking below its 21-day moving average, ETH has established $1,400 as strong support but has been unable to close above $1,600 all week. That’s the next important resistance level for ETH to break before it continues its climb back to its previous high of $2,000.

The No. 2 crypto has been a slow mover lately, and each $100 handle will act as resistance until it can break above its all-time high.

Here’s ETH in U.S. dollar terms via Coinbase:

Decentralized finance (DeFi) protocol Uniswap has had one heck of a year, starting 2021 at just over $5 before hitting a high of over $32 on Feb. 20. After bouncing off its 21-day moving average at the beginning of the week, it’s currently trading at just under $28. That’s still a 480% gain year to date.

UNI, a leader in the burgeoning DeFi industry, is blazing hot. As these DeFi protocols gain in popularity, we will see even further gains for Uniswap.

Here’s UNI in U.S. dollar terms via Coinbase:

Notable News, Notes and Tweets

• Perhaps some of today’s market inaction is about concerns over bond yields.

• Brave, the favorite browser of crypto fans everywhere, has now acquired a search engine.

• Dan Held of Kraken offers an internet analogy to showcase how early to the party we are on crypto.

What’s Next

As we start to get beyond the correction and toward the future, critical levels to watch for are the 21-day moving averages.

Specifically, the King of Crypto tends to lead the market in either direction. If BTC can establish itself above $50,000, that key fact may ease some concerns, re-establish investor confidence in the short term and jump-start a return to “more normal” bullish action.

If Bitcoin breaks lower, there’s a chance we could see the rest of the crypto market drift lower as well. Even some of the altcoins we’ve covered this week that have been trading above their moving averages could fall along with it.

Now, if Bitcoin continues its sideways trading, there would be opportunities to make money in altcoin trading. That’s because altcoins tend to perform well when the attention has shifted away from BTC.

Like we said yesterday, now is a good time to recalibrate, as we likely have some time before another large breakout in either direction.

Use your time wisely,

Alex