• After touching $45,000 yesterday, Bitcoin (BTC, Tech/Adoption Grade “A-”) rebounded to as high as $51,000 today and is now trading a hair under $50,000.

• Ethereum (ETH, Tech/Adoption Grade “A-”) briefly dropped to lows below $1,400 yesterday but has since regained the $1,600 level.

• Both Uniswap (UNI) and Cardano (ADA, Tech/Adoption Grade “B-”) held their ground well during the market correction.

The cryptocurrency market suffered a sharp drop over the last two days. But, in the most recent trading session, it’s bounced back in a healthy way, suggesting we have hit a local bottom.

Bitcoin briefly dipped down below its 21-day moving average, the key bull/bear metric that we always talk about. But it closed above that level yesterday, and it’s started to add to its cushion.

BTC hasn’t closed below its 21-day moving average since Feb. 1, a sure sign of strength. The next important benchmark is for Bitcoin to trade comfortably above $50,000 and to establish that level as support.

The next few days will be a critical test of Bitcoin and the entire market. Right now, at least for Bitcoin, the favor is still with the bulls.

Here’s BTC in U.S. dollar terms via Coinbase:

Just last week, Ether was showing signs of weakness, as it struggled to break above $2,000. Although it did briefly break above this significant resistance level intraday, it failed to close above it.

And ETH didn’t fare well the last several days, as it fell from just above $1,900 all the way past $1,400, if only briefly. It’s since regained some ground and is trading in the mid-$1,600s.

ETH is, however, trading below its 21-day moving average. That’s now a key resistance level. We’d like to see it smash that resistance and break above $2,000.

Here’s ETH in U.S. dollar terms via Coinbase:

Uniswap is a decentralized finance (DeFi) project we haven’t talked about too much here lately, but it’s an increasingly important contributor to the crypto space.

Its DeFi protocol enables peer-to-peer trading of crypto assets. In fact, Uniswap is the largest decentralized exchange by trade volume. Its UNI token has grown in step with its popularity and trade volume, rising from around $5 on Jan. 1 all the way to near $33 on Feb. 20. That’s a gain of about 560% in less than two months.

During this week’s pullback, UNI spiked to lows of about $18 before settling back in around $25 today. It’s still trading comfortably above its 21-day moving average, continuing to show incredible strength so far this year. This is an altcoin to keep an eye on.

Here’s UNI in U.S. dollar terms via Coinbase:

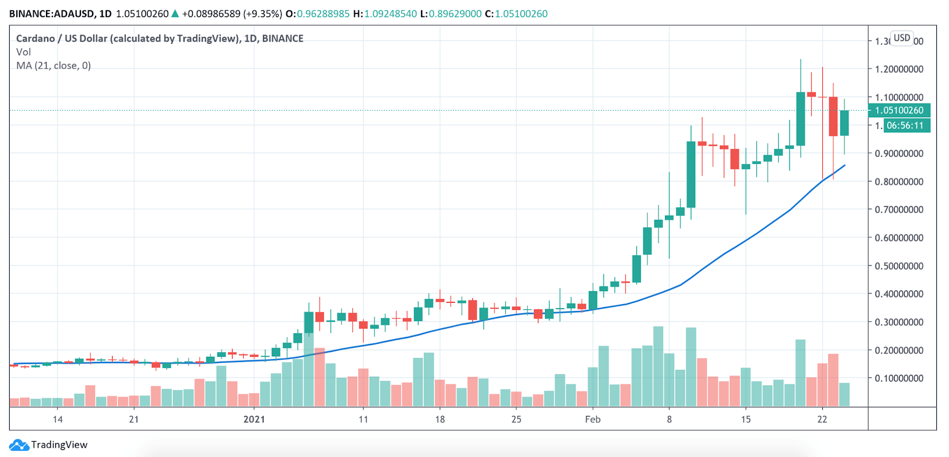

We’ll wrap up this market roundup by checking in on Cardano.

ADA kicked the year off trading around 17 cents before it went on an absolute tear, reaching highs above $1.20 just last week. That’s a parabolic, 600% price run over a short, two-month period.

After closing above 95 cents for the first time on Feb. 20, ADA has since established that level as support. It bounced off that support yesterday before regaining some ground to trade at around $1.05 at the time of writing.

ADA has been able hold above its 21-day moving average since the end of January, and if it can stay above that metric over the next few days, the bulls may be able to reignite this red-hot asset.

Here’s ADA in U.S. dollar terms via Binance:

Notable News, Notes and Tweets

• Canada-based VersaBank said it will become the first North American bank to issue a stablecoin pegged 1-to-1 to the Canadian dollar.

• As MicroStrategy Inc. (Nasdaq: MSTR) buys another billion dollars’ worth of Bitcoin, Anthony Pompliano notes that Michael Saylor has started a historic movement, as more and more companies follow his lead.

• Michael Burry, famous for “The Big Short,” has now joined the NFT bandwagon.

What’s Next

The cryptocurrency market is still a relatively immature market compared to the old-school, traditional financial markets. Volatility is a much bigger factor when trading crypto assets, with big upswings regularly followed by sudden downturns. And those downturns are regularly followed by sudden stabilizations.

In the aftermath of what were two good months in the market, we experienced two days of sudden and sharply negative trading that might have seemed like an end to the bull run for some.

As we’ve often noted, we’re in the midst of a much larger bull run, a multiyear market cycle. Price action like Monday’s and Tuesday’s is to be expected. At the same time, the market can bounce back just as unexpectedly.

Whether today’s bounce signals a local bottom — or is just a day’s reprieve amid a larger retracement — remains to be seen.

Let’s look at it with a broad time horizon, though. During the massive volatility that sometimes happens in these markets, there are always plenty of trading opportunities to be had for the informed investor.

We’re here to help you find those opportunities.

Best,

Alex