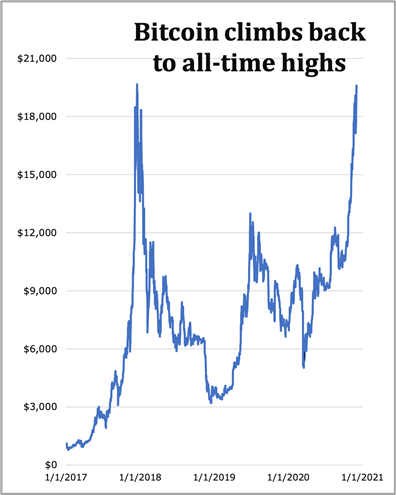

Bitcoin Finally Touches $20,000, Only to Fall Back

The big question on most crypto investors’ minds is … why? Why did the King of Crypto trip just as it neared its next milestone?

Well, prior highs — especially all-time highs — often turn into significant resistance levels. Plus, Bitcoin (BTC, Tech/Adoption Grade “A-”) is already overdue for a medium-term cycle correction.

Because of this, it would not exactly be a surprise if the rally stalled near $20,000.

And after a pause, Bitcoin could blow right past $20,000 — just like it blew right past $17,000, $18,000 and $19,000. That would put it in uncharted territory, where its price path has no precedent.

Be that as it may, one of the key systemic forces pulling Bitcoin higher is ...

A Little-known Positive Feedback Loop

The higher Bitcoin’s price goes, the easier it becomes for its market cap to shoot up even faster and higher.

Allow us to explain.

Right now, institutional funds flowing into crypto come mostly from ...

• Private companies, like Galaxy Digital Holdings and Microstrategy ...

• Billionaires like Paul Tudor Jones, Stanley Drukenmiller ...

• And relatively smaller investments by various crypto-specific hedge funds.

However, the top-tier hedge funds in traditional finance have assets under management in the $10 to $100 billion range.

Suppose such a fund wanted to put 1% into Bitcoin as a safe-haven, or macro hedge. That would be $100 million to $1 billion.

Amounts like this are presently too large for Bitcoin’s current market cap (about $361 billion) to readily absorb without driving prices crazy.

But look what happens if Bitcoin goes to $100,000: Its market cap swells to $1.85 trillion. That’s more than enough to readily accommodate $100 million to $1 billion inflows without roiling the market.

In other words, the higher BTC goes, the wider the door opens for large funds to invest meaningful amounts with only modest-to-low slippage in prices. And, of course, the more money these big-foot funds pour in, the higher BTC is going to go. Which then opens the door even wider.

This is no pipe dream. Big global custodians like Fidelity, Coinbase Custody and Grayscale have been anticipating this for two years.

And they’ve been anticipating the building of infrastructure required to provide crypto custodial services to giant institutional investors — like themselves.

What we conclude from this is simple — Bitcoin is indeed going to $100,000 and above. And because of this little-known positive feedback loop, prices are likely to move a lot faster than you think.

So much for the big boys of global finance. Now, let’s look at retail investors.

Ordinary Individual Investors Have

Yet to Get Involved with Crypto

Admittedly, many may have heard of it. But with just 101 million crypto users worldwide, to say that the broad public is still un-invested is the understatement of the year.

A lot of folks shy away from crypto because they think it’s too risky. Others still think it’s too difficult to get their hands on, even though buying has never been easier than now.

No matter what, Bitcoin is blasting up, and the world is watching. And as it breaks one record high after another, the teeming masses are soon going to be clamoring for a piece of the action.

Demographics Bullish for Bitcoin

This is especially true of newer generations, like millennials and Generation Z. According to one respected analyst, 90% of millennials favor Bitcoin over gold and are keen to add Bitcoin to their portfolios.

This is not hard to fathom. The millennials grew up with computers and smartphones. Plus, they are already familiar with online games — many of which incorporate virtual enhancements players can purchase (like extra lives, weapons, personalized avatars, etc.) to obtain some perceived advantage.

For them, the notion of a purely digital form of money is almost second nature. Whereas for earlier generations, such a thing is totally foreign.

Moreover, since pandemic lockdowns hit, interest in Bitcoin and crypto has reportedly surged among baby boomers and Gen Xers (although the precise extent may still be somewhat difficult to discern).

This is a big deal because these two generations control the overwhelming majority of the world’s wealth.

As earlier generations grow older and retire, they naturally become net sellers of assets. And as younger generations inherit the wealth of their parents, you’re going to see a changing-of-the-guard in popular attitudes towards all things crypto.

No longer will cryptocurrencies be beyond the fringe. They’re going to be Main Street finance. This is as certain — and unstoppable — as the passage of time itself.

So, whether you look at institutional investors, retail investors or demographic forces, everything points in one direction: Dramatically higher crypto asset prices.

Buy some Bitcoin (and other top Weiss-rated cryptos) and enjoy the ride.

Best,

Juan and Bruce