• The top two cryptocurrencies are holding their ground today, but altcoins are commanding investor attention.

• Aave (AAVE) appears to have bottomed out and is up 45% from its lows of last week.

• Chainlink (LINK) is up about 7% to trade around $29.

Bitcoin (BTC) is trading around $48,500 after failing to close above its 21-day moving average on Monday, and Ethereum (ETH) is hovering around $1,500 as of midday.

But altcoins continued their relatively strong recovery, with DeFi tokens performing particularly well. Today’s action suggests the bottom is in for altcoins. That being said, there are still quite a few things that need to happen before altcoins get back to the pace that defined their blazing run before the recent correction.

Bitcoin briefly crossed above $50,000 overnight, but it’s back to trading around yesterday’s levels. BTC tested its 21-day moving average yesterday but wasn’t able to close above it. Today, it’s bounced off that resistance. Short-term price action will remain bearish until BTC manages to regain that level.

Here’s BTC in U.S. dollar terms via Coinbase:

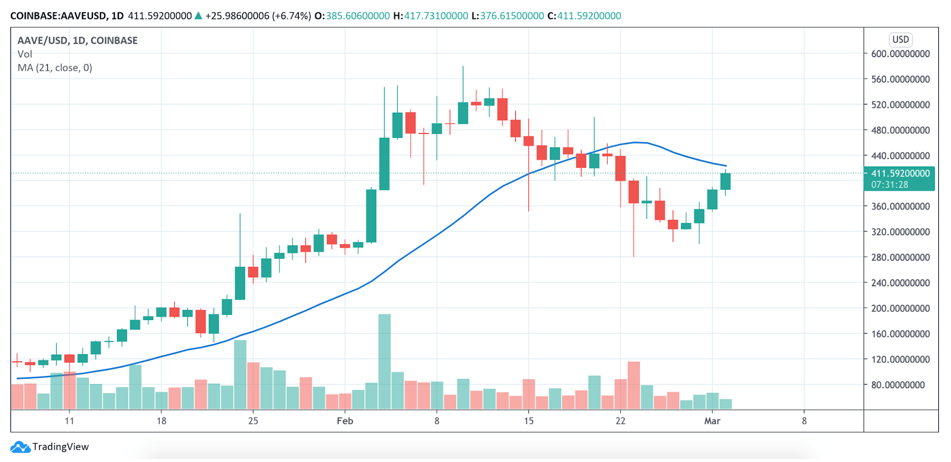

Aave set an all-time high on Feb. 10, trading just north of $560, but fell 50% to $280 on Feb. 22.

AAVE has gained 45% off those lows and is currently trading right around $400. It’s yet another crypto asset trading just below its 21-day moving average. If AAVE can break back above that level and convert the moving average to a support level, it might be able to extend its astronomical rise. We’ll keep a close eye on this asset as the week develops.

Here’s AAVE in U.S. dollar terms via Coinbase:

ChainLink’s recovery was boosted by the news that Blockfi is adding LINK interest bearing accounts to its platform starting today.

LINK is trading up 7% and is knocking on the $30 resistance level. It’s right at its 21-day moving average, and it would be a bullish signal if it’s able to close above that level today. LINK is about 23% below the all-time high it set on Feb. 20.

Here’s LINK in U.S. dollar terms via Coinbase:

Notable News, Notes and Tweets

• Anthony Pompliano tweets a compelling milestone: “The largest asset managers in the world believe it is risky to have zero exposure to Bitcoin.”

• Cameron Winklevoss gets to the bottom line if Apple Inc. (Nasdaq: AAPL) were to allocate 1% of its investable assets to Bitcoin: “… a $1.95B purchase. Just the beginning.”

• Citigroup Inc. (NYSE: C) is starting to see the future: “In this scenario, Bitcoin may be optimally positioned to become the preferred currency for global trade.”

What’s Next

For the past few months, we’ve been expecting a correction for cryptocurrency markets. Bitcoin and the industry at large were overextended; they needed a correction to ease off some excess and recalibrate.

What we’ve experienced recently is a number of small 10% to 20% retracements, with recoveries following in 48 hours or less.

Last week’s action appears to have been the dip we were waiting for; from here, it looks like a healthy development for the crypto market. It may take a few weeks for Bitcoin to start testing new highs again. But this is not “bearish.”

Meanwhile, there is plenty of bullish news. Yesterday, BlockFi announced a plan to support interest-bearing accounts for both ChainLink and Binance Coin (BNB). This is good for LINK and BNB, providing the altcoins greater exposure.

Crypto investors tend to treat these interest-bearing accounts as savings, as the yield is much higher than any traditional bank is offering right now. This could potentially mitigate selling pressure. Combined with the prospect of increasing demand, favorable forces could drive both assets to new all-time highs in coming months.

We’ve seen a decent bounce off last week’s bottom. But this recovery may take some time to fully develop. That means there’s still opportunity to gain exposure to assets that might lead the market when things accelerate.

Stay tuned for more insights into those opportunities.

Best,

Alex