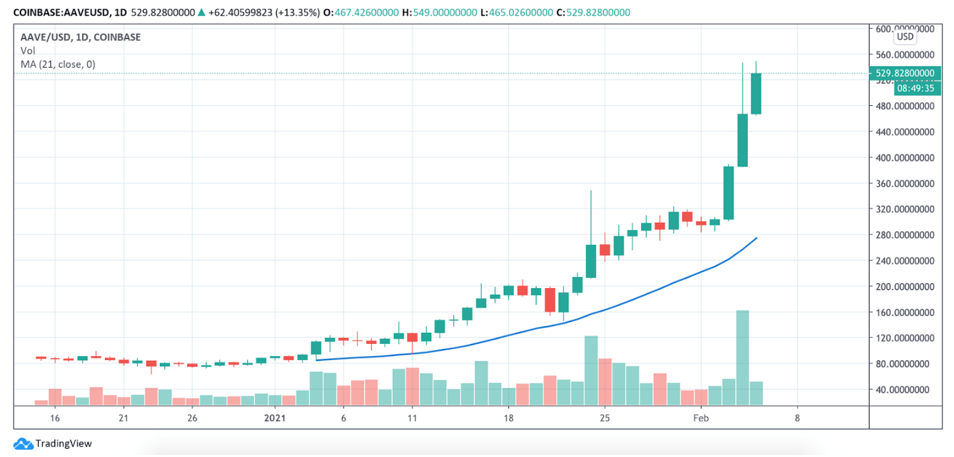

• Aave (AAVE, Unrated) can’t stop, won’t stop: The blue chip DeFi asset has broken through every resistance level, keeps setting new highs and is the fuel for unlimited memes.

• Ethereum (ETH, Tech/Adoption “A-”) pushed even higher, crossing the $1,700 level, potentially on its way to $2,000.

• Bitcoin (BTC, Tech/Adoption “A-”) has crossed back above $38,000, eyeing its next serious resistance level at $40,000.

The cryptocurrency market is green from top to bottom today, with the blue chips setting the pace for the whole industry. It’s hard to say, though, whether Bitcoin and Ethereum are leading or “decentralized finance” has taken the reins.

That’s because blue chip DeFi Aave is on an absolute tear too.

In the 2017 bull market, initial coin offerings (ICOs) were the talk of the town. This time around, it’s most definitely the use case for DeFi that’s commanding attention.

During the crypto winter that occurred after the last big bull market, many new projects emerged to create an entire ecosystem apart from the old-school, centralized system. These were projects with easy-to-understand value propositions that would help change financial markets.

The benefit of these DeFi projects was highlighted during the recent GameStop Corp. (NYSE: GME)/meme stock fiasco, where centralized exchanges like Robinhood halted trading, a demonstration of one-sided legacy power dynamic.

DeFi is an open playing field in comparison, on which anybody can play.

Here’s AAVE in U.S. dollar terms via Coinbase:

Some readers have asked about Cardano (ADA, Tech/Adoption Grade “C+”), as it’s quietly had a very good week of trading.

ADA is up more than 45% on the week and is trading above the 50-cent threshold — its highest price since February 2018. There have been some new releases on Cardano, and the IOHK team has been hard at work trying to improve on the smart-contract platform. Investors are taking notice.

Here’s Cardano in U.S. dollar terms via Binance:

Let’s take a look at Bitcoin and Ethereum before we take the usual spin around the Weiss crypto indexes …

Here’s BTC in U.S. dollar terms via Coinbase:

And here’s ETH in U.S. dollar terms via Coinbase:

Index Roundup

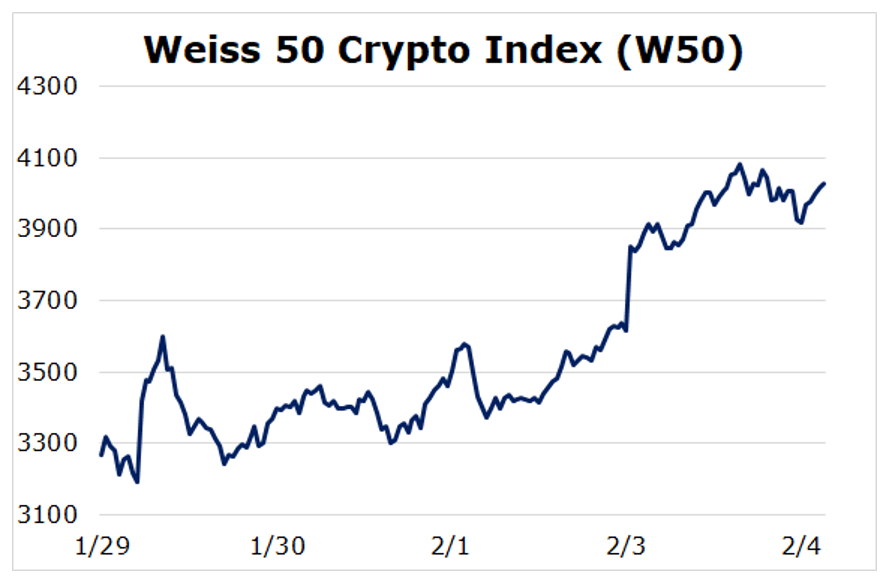

The Weiss 50 Crypto Index (W50) gained 23.27% on the week, as Ethereum set new highs and Bitcoin regained ground, closing in on previous highs.

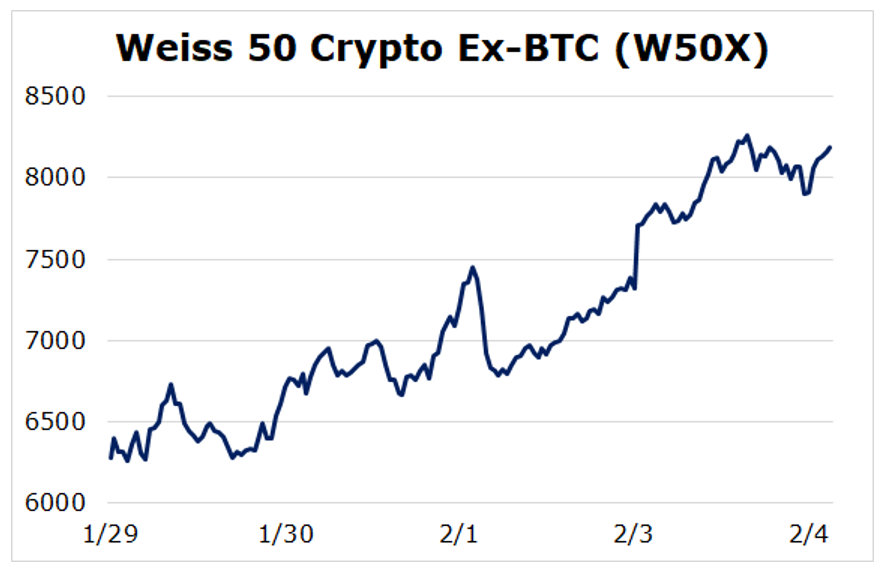

The Weiss 50 Ex-BTC Index (W50X) increased 30.50%, as the broader market slightly outperformed the King of Crypto this week.

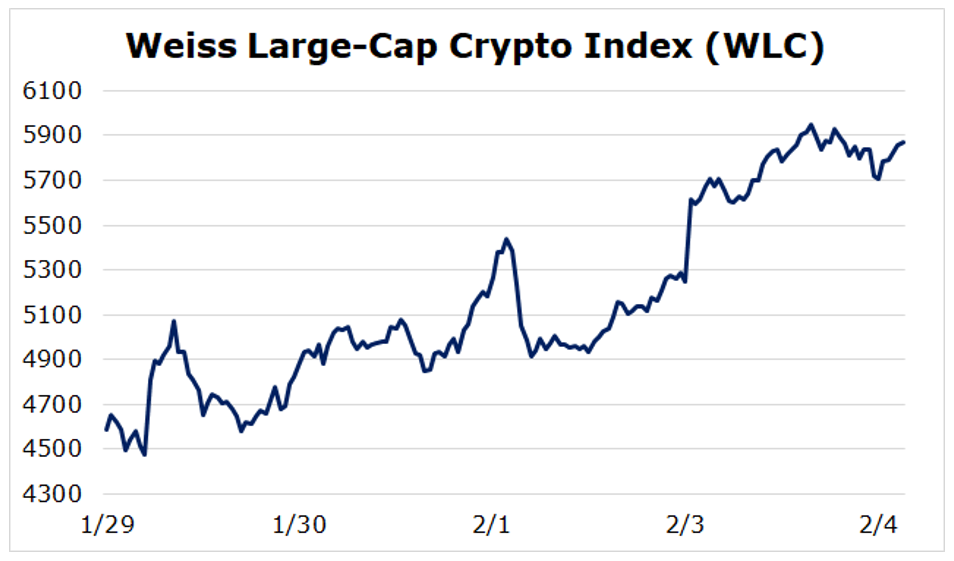

Breaking down this week’s performance by market capitalization, we can see that blue chip cryptos performed very well, as did some more speculative plays.

Small-caps showed the strongest gains, but large-cap cryptocurrencies weren’t far behind. Medium-cap cryptos lagged slightly behind the rest of the market this week.

The Weiss Large Cap Crypto Index (WLC) rose 28.03%, as Ethereum and Bitcoin led the way.

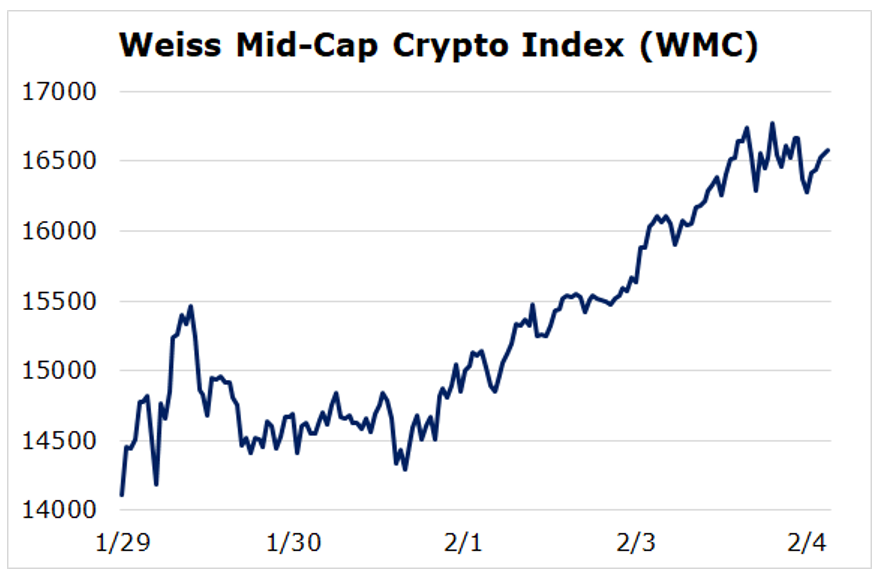

The mid-caps slightly under-performed the large-caps, as the Weiss Mid-Cap Crypto Index (WMC) increased a more modest 17.51%.

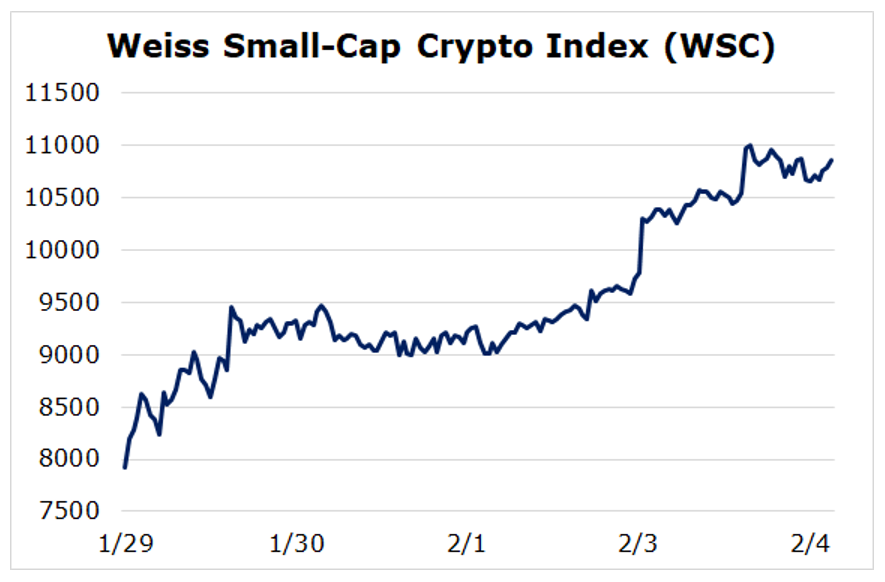

Small-cap cryptos were the top-performers this week, as the Weiss Small-Cap Crypto Index (WSC) gained a staggering 37.04%.

Notable News, Notes and Tweets

• Dan Held from Kraken offers some macro perspective.

• Speaking of Kraken, the crypto exchange served up a great Dogecoin meme today.

• Messari CEO Ryan Selkis speculates that cryptocurrencies will give birth to more than half of the billionaires in the world within five years.

What’s Next

Blue chips had a spectacular week, with ETH setting new all-time highs and BTC breaking back above its 21-day moving average. At the same time, DeFi has stolen the spotlight.

The price rise in these DeFi assets shows the newfound appreciation for this crypto sub-ecosystem, yet we’re still in the early development stages; the real growth is yet to come. Indeed, the future for these assets looks promising.

From an investor’s perspective, for many DeFi assets, there are no clear signs of upward resistance.

Most excitingly, the rise in DeFi appears to have ushered in a new altcoin season. It’s an opportunity for crypto traders, tooled with good market research, to make substantial gains in their portfolios.

So, stay tuned as we begin to explore some potential opportunities within the altcoin market.

Best,

Alex