Chainlink: Putting the 'Smart' into Smart Contracts

|

During the Bitcoin bull run that started in May, most altcoins and tokens tanked.

Chainlink, a token on the Ethereum network, was one of the rare exceptions.

It skyrocketed from 40 cents to $4.50, an all-time high. And even with the sharp setback we’ve since seen in altcoins, it’s still trading near the $1.80 level, up about 350% since May.

Why? Before I answer that question, first a quick refresher on smart contracts ...

Smart contracts have some unique characteristics that set them apart from all other legal contracts:

- They are digital.

- They exist only on the blockchain.

- They are deterministic. In other words, once launched, they determine very specific outcomes. No arguments, no pleading, no exceptions. And it’s very difficult to change them.

For a metaphor, imagine a vending machine.

You insert coins; the machine pushes out the drink. If you don’t pay the full price, nothing happens. If you pay too much, the machine spits out your change. And if you don’t like it, tough luck. You can smack the machine all you want, but it will get you nowhere.

A smart contract is a lot more complex than a vending machine, of course. But it’s also driven by predetermined code.

Which can lead to a problem:

Since Smart Contracts Live Strictly Inside a Blockchain,

They Can Often be Disconnected from the Real World.

To truly be useful, they need input from the real world — accurate, up-to-date, relevant data.

The data could be air and water temperatures ... GPS coordinates of people and things ... real-time prices of commodities, securities or cryptos ... anything that’s crunched by the smart contract to churn out decisions.

Next, let’s focus on the data provider, known as an oracle.

The oracle is the critical link between the decision-making process and the outside world. In the non-blockchain world, some examples of oracles that come to mind are big financial data vendors like Bloomberg, Refinitiv (formerly Thomson Reuters) and S&P Global.

These companies are very successful. But they are centralized oracles. That means their customers have no choice but to trust their accuracy. It is virtually impossible for customers to thoroughly and independently validate the reliability of the data they’re getting.

That may be good enough for today’s traditional, non-blockchain world. But it’s not nearly good enough for the smart economy of the future, where the computer code of smart contracts is making lots of critical decisions for us.

Since smart-contract outputs can determine very consequential outcomes, they absolutely cannot be dependent on centralized oracles.

These centralized oracles must always be trusted for their accuracy and objectivity. That in itself is difficult, but they must somehow be protected from conflicts of interest and bias ... safeguarded from outside influence ... and kept free from manipulation and distortions.

Consider, for example, a cryptocurrency hedge fund of the future using a centralized oracle:

Real-time crypto price data is fed into a smart contract. The smart contract processes the data based on a very precise set of codified rules. And depending on the price patterns, it automatically spits out “Buy” and “Sell” orders.

On a particular day, the price of Ethereum (ETH) surges above a critical level, and the smart contract issues a “Buy” on $1 million in Ether.

Sadly, however, the investment promptly goes south. Not because it’s a bad choice, but because the price surge of that day is the result of a data glitch. In reality, the price of Ethereum has barely budged.

This happens all too often. And millions of dollars are lost.

Thus, no matter how smart the smart contract may be, the bad data creates a classic case of garbage in, garbage out.

Bad Data Can be a Fatal Problem, a True Deal-killer.

And THAT’S What Chainlink Aims to Solve.

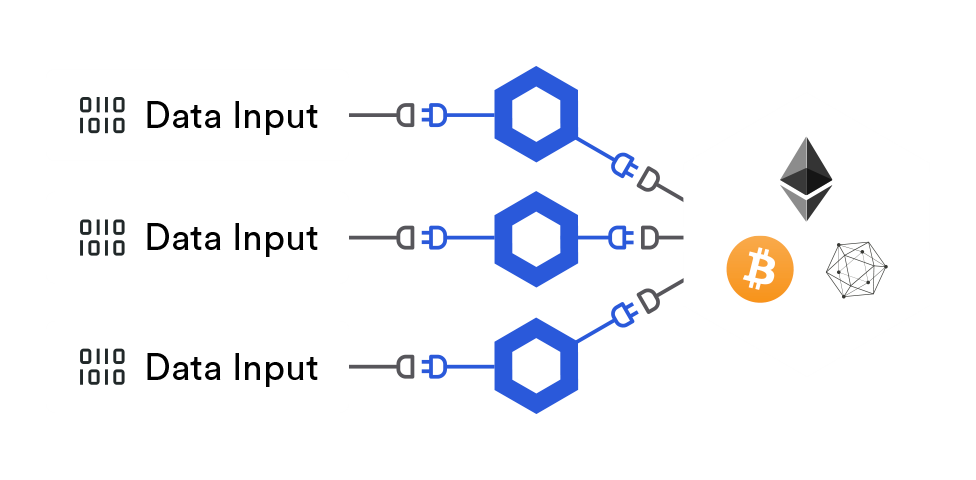

Chainlink aims to create a framework whereby people can run oracles in a decentralized way (Figure 1). Instead of a centralized data provider, think of Chainlink as a group of data providers running three to 10 oracles independently.

The data from these nodes is verified by independent researchers. And the source code managing these data flows is always open to inspection by unaffiliated programming engineers.

|

|

Figure 1: Chainlink decentralizes data provision to smart contracts. |

Question: How does security for Chainlink compare to the security solutions used by centralized oracles like Bloomberg or Thomson/Reuters?

Answer: Chainlink maximizes security by managing incentives. And it does this by leveraging the following four factors:

1. Staking. Each data provider runs a node that stakes LINK tokens. If the node operator behaves maliciously, the stake can be forfeited. This means that node operators have financial incentives to operate honestly.

2. Multiple oracles. A smart contract accepts data input from multiple independent oracles. These, in turn, serve as checks against each other. Outlier data is discovered and rejected. And the aggregation of the data averages out outlier values. Multiple oracles also provide redundancy in case of failure by any individual oracle.

3. Multiple data feeds. A single oracle can have multiple data feeds. This is to prevent reliance on any one particular data feed. For example, an oracle that provides stock prices can take price feeds from both Bloomberg and Refinitiv.

4. Reputation. Chainlink implements a reputation system for each oracle. This system looks at user ratings and other technical metrics like uptime statistics, correctness of data, number of completed requests and response time. The reputation score also creates a built-in incentive; the better the score, the more the oracle can charge for its data.

Thus ...

Chainlink’s Primary Role is to Help Maximize the

Accuracy of Data Inputs to Smart Contracts.

Here’s how it works:

Step 1. A crypto project manager launches a smart contract, which requires data input from oracles.

Step 2. He sets up a Service Level Agreement (SLA) with a group of oracles for data requests.

Step 3. He chooses from several possible security models: He can select oracles based on their reputation ... on the number of oracles ... the number of data feeds ... or some combination thereof.

Step 4. Everything is priced accordingly in the SLA.

Step 5. And everything is paid for with LINK tokens.

Conclusion:

Since the 2017 ICO boom, the crypto space has been plagued by tokens with lots of hype but no real use case.

Chainlink is one of the few that has a working product.

It puts the smart into smart contracts.

Best,

Bruce