• Following yesterday’s retracement, the market dropped even further today; if yesterday made for a good buying opportunity, today it’s an even better discount.

• Bitcoin (BTC, Tech/Adoption Grade “A-”) followed yesterday’s 5% loss with another drop of about 15% so far in Tuesday’s trading.

• Ethereum (ETH, Tech/Adoption Grade “A-”) fell an additional 20% before settling in at a 17% loss this morning.

Bitcoin spiked to lows around $45,000 before settling back in near $45,500 at the time of writing. BTC has now posted two large red candles in a row, extending the current market pullback to about 20%.

That’s still a relatively shallow retracement in a market accustomed to 30% price corrections during bull markets.

More importantly, Bitcoin has held the ground above its 21-day moving average — although it did dip below it intraday — and we remain heavily bullish as long as BTC is trading above that MA. Bitcoin is still up about 60% so far this year, so the longer-term trend is still looking favorable.

Here’s BTC in U.S. dollar terms via Coinbase:

Ethereum closed above its 21-day moving average yesterday, but it slid below the metric today with a 17% loss. ETH plumbed below $1,400 before regaining some ground to trade around $1,450 at the time of this writing.

ETH has now fallen about 20% in the past two days. In fact, at its nadir, it was down 30% before the bulls pulled it back to the $1,450 level. It’s important that ETH climb back above its 21-day moving average; that would reconfirm our bullish outlook on the asset. Let’s see how the next couple of days play out …

Here’s ETH in U.S. dollar terms via Coinbase:

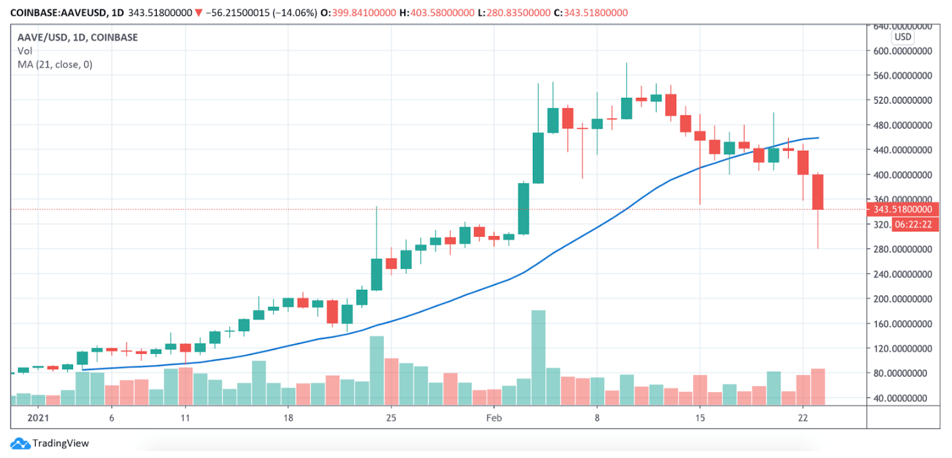

One of the hottest altcoins of the past few weeks is Aave (AAVE, Unrated), a decentralized finance protocol. AAVE surged from about $90 on Jan. 1 all the way to $580 on Feb. 10.

AAVE was leading the way for DeFi tokens and altcoins in general during its blazing price surge. But it hasn’t fared too well in the two weeks after it reached its all-time high. AAVE dropped as much as 50% from that high earlier today, trading at about $280. It’s regained some ground to around $340 at the time of writing.

It fell below its 21-day moving average on Feb. 19 and has yet to rise back above it, which makes sense given the broader sell-off. This is perhaps a great opportunity to consider buying a leader in the DeFi space at a discounted price right before the market recovers and we start the next leg up in the macro bull market.

Here’s AAVE in U.S. dollar terms via Coinbase:

Notable News, Notes and Tweets

• Perhaps squashing one of the biggest doubts of the crypto industry, Tether has finally agreed to an audit of its reserves and has settled its suit with the New York attorney general.

• Anthony Pompliano, founder of Morgan Creek Digital, notes that Bitcoin bears will have to find another reason to be hesitant now that the Tether doubts have been solved.

• Ari Paul of Blocktower sees value in this dip.

What’s Next

We’ve now crossed the threshold of a 20% retracement, which would qualify as a “correction” in traditional markets but is actually just a somewhat shallow dip for the cryptocurrency market.

A “correction” here is 30%, 40%. That’s the typical magnitude we see when these parabolic bull runs unwind. We could still see this market drop a little further as the week progresses. But, as we stand right now, this is just another good buying opportunity within a larger up-trend.

We still believe that one more 360-day bull cycle will take place before the bull market runs out of gas, regardless of whether we drop further from here. And this next bull cycle could see even more drastic gains than what we’ve seen in the 2020-21 bull cycle. Our medium- and long-term outlooks remain bullish, despite this recent price action.

Folks, there are exciting times ahead over the next year or so.

Best,

Alex