“As chaos and riots sweep across the nation,” we noted in a July 3 tweet, “the Fed is pumping more and more freshly printed money into big, badly managed corporations.”

Indeed, “It reminds us of Emperor Nero singing and playing his lyre while Rome burned to ground around him!”

And the story about the Federal Reserve’s secondary market corporate credit facility (SMCCF) is only just starting to get out. It’s yet another giveaway to Corporate America’s C-suites and old-school Wall Street, as the June 28 disclosure of the first round of details reveals.

On the contrary, the long-term promise of cryptocurrencies is to reflect the will of the majority and to benefit the people.

Consider that the No. 1 individual corporate bond holding on the Fed’s recently disclosed list is AT&T Corp. (NYSE: T, Rated “C-”).

Management reported first-quarter net income of $4.96 billion. But it also OK’d $3.73 billion in dividends and $5.46 billion of buybacks.

In other words, AT&T returned 185% of its net income to Wall Street. Meanwhile, its outstanding debt grew from $176.1 billion on Dec. 31 to $185 billion on March 31.

Sadly, nothing about our monetary system reflects the will of majority or benefits the majority in the long run. This is exactly the problem that true cryptocurrencies like #Bitcoin (#BTC), #Ethereum (#ETH) and #Cardano (#ADA) resolve. They bring democracy to money.

— Weiss Crypto Ratings (@WeissCrypto) July 3, 2020

Other big companies now backed by the state include Berkshire Hathaway Inc. (NYSE: BRKA, Rated “D+”), which is sitting on $173 billion of cash, and Apple Inc. (Nasdaq: AAPL, Rated “B-”), though it has about $183 billion.

It also includes Boeing Co. (NYSE: BA, Rated “D”), Comcast Corp. (Nasdaq: CMCSA, Rated “C”), Exxon Mobil Corp. (NYSE: XOM, Rated “D+”), General Electric (NYSE: GE, Rated “D”), IBM (NYSE: IBM, Rated “C-”) and Pfizer Inc. (NYSE: PFE, Rated “C”), as well as U.S. divisions of numerous foreign companies, including Japanese automaker Toyota Motor Corp. (NYSE: TM, Rated “C+”) and British energy giant BP Plc (NYSE: BP, Rated “D+”).

As we noted in a follow-up tweet, this is morally bankrupt.

A century ago, every paper dollar issued in the U.S. was redeemable on demand for gold. But the politicians eventually found a way to scrap the gold standard. That leaves cryptocurrencies as the only honest alternative to the morally bankrupt monetary system we have today.

— Weiss Crypto Ratings (@WeissCrypto) July 3, 2020

Not only is current Fed policy simply not effective when it comes to “stimulating” Main Street ... its easy money is hurting the very people it purports to help.

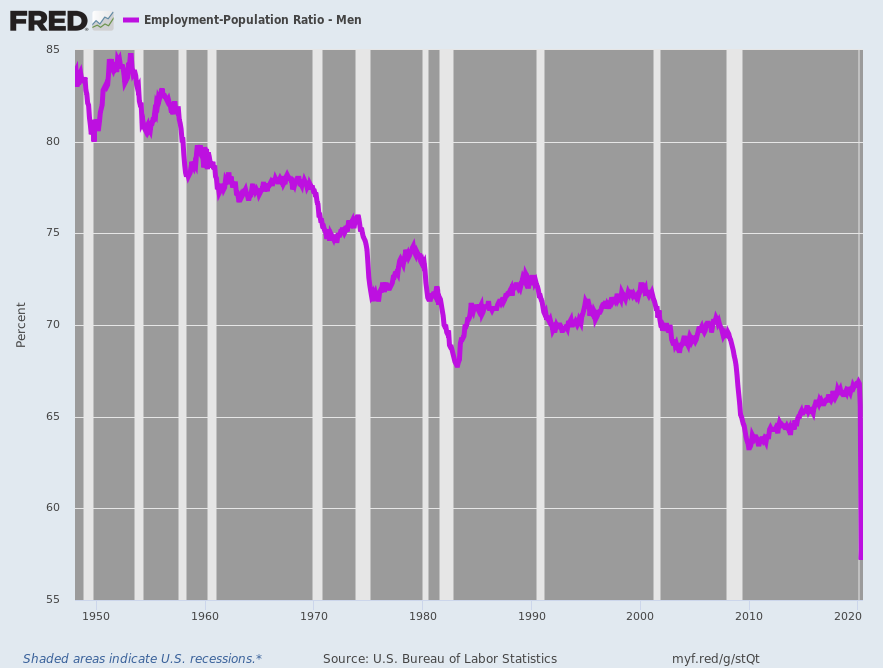

Consider that, while the Nasdaq Composite was ending the second quarter at an all-time high — since eclipsed, of course — the share of American males actually employed dropped to 58.6% in May, an all-time low going back to 1948.

Someday, soon, people will start to take broad notice.

Best wishes,

Juan and Bruce