How to Survive and Prosper When the Fed Promises to Shrink Your Savings

At the Federal Reserve’s recent summit in Jackson Hole, Wyo., Chairman Jerome Powell made a rather alarming announcement.

He officially scrapped the Fed's decades-long inflation target (previously 2%) without specifying 3%, 8%, 25% — or any other higher ceiling.

This clearly confirms near-zero (and possibly negative) interest rates are here to stay. Ditto for flagrant money-printing. These have now become the Fed's primary tools for stimulating credit creation ... and therefore inflation.

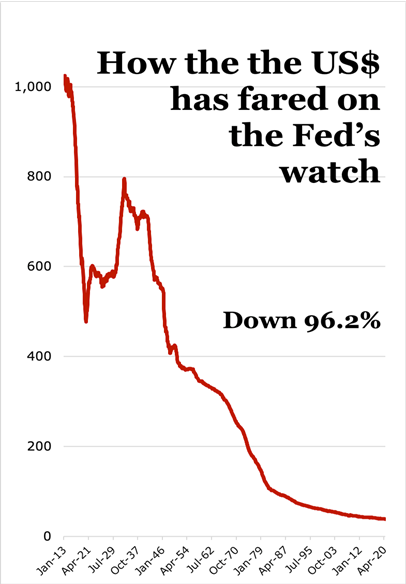

since the Federal Reserve was established.

According to the Fed's own figures!

Click to enlarge. Source:

https://fred.stlouisfed.org/series/CUUR0000SA0R

The Fed has long insisted these policies were merely an “emergency response” to abnormal economic conditions — like the 2008 global financial crisis, the Euro debt crisis, and now the pandemic panic.

But now, they have become the new normal.

This also signals to Congress that the U.S. central bank is going to be OK with record-high budget deficits.

And that the central bank will be willing to print however much money is needed to cover the shortfall — into perpetuity.

And make no mistake, nothing makes politicians happier than being handed a blank check from the central bank.

After all, money buys votes.

The Inevitable Result: The Great

Monetary Inflation of the 2020s

Figure 1 shows the plunge in purchasing power of the U.S. dollar since the Federal Reserve was organized as America’s central bank back in 1913. And this is according to the Fed’s own figures. (Which, of course, means the true situation is undoubtedly even worse!)

However, this decline has been going on for so long — and it’s been so slow and steady — we hardly notice it anymore. The problem is that this is about to change. The familiar slow decline we’ve grown accustomed to … is going to be blown completely out of the water.

President Nixon cut the dollar loose from gold in 1971 — which removed a key restraint on the Fed’s ability to print money. Now that the 2% inflation target has also been abandoned, nothing remains to keep the Fed from printing money with total abandon.

This makes accelerating inflation inevitable. And you can already see it starting to happen.

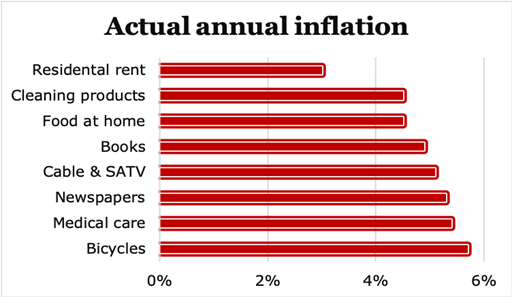

For example, the Fed’s figures say annual inflation for the month of August was only 1.3%.

But anyone with a household budget to keep knows prices are already going up a lot faster than that!

And once inflation starts raging like a California fire tornado, no power on earth can stop it. The Fed won't even try.

They'll just say high inflation is merely offsetting low inflation from years past. It's hard to imagine a more bearish future for the dollar than this.

Historically, whenever investors lost confidence in the future of their paper currency, they turned to gold. This time was no different. Indeed, gold surged to new all-time highs in the wake of the pandemic panic, and many believe it still has much higher to go.

But in 2020, there’s as new kid on the block: cryptocurrencies — which are even better safe-haven assets. Why is that?

Well, gold is heavier than lead, which makes it difficult to transport. And if you own it, you have to buy (or rent) a vault to keep it safe, which also costs money. And even then, it may not be entirely safe from being seized by men with guns.

Cryptocurrencies, on the other hand, can travel via the internet at virtually the speed of light. That’s because they weigh nothing. They exist only as a long string of characters (in an encrypted computer file, or even on a plain piece of paper).

No financial asset has ever been more concealable, more portable, or more un-confiscatable than that.

On top of that, gold generally pays little, if any, interest. Thanks to the frenetic growth of decentralized Finance (DeFi), blockchain lenders are starting to pay interest on crypto assets. For example, stablecoins pegged 1:1 to the U.S. dollar (such as USDT, USDC, and DAI) now yield many times what you can make on a bank savings deposit.

For example:

Current Yield Blockchain lender

----------------------------------------------------------

11.70% Ledn

11.55% Celsius

10.00% Nexo

8.00% Uphold

7.00% BlockFi

Bottom line: When the Fed promises to shrink the value of every dollar you save, you no longer have to quietly acquiesce. Fight back. Get as much of your savings as you can out of paper currency.

Top Weiss-rated cryptos and U.S. dollar stablecoins are the way out. Don’t miss the boat!

Best wishes,

Juan and Bruce