• The crypto market has bounced off recent lows, but there’s been significant volatility throughout the space.

• Over the last week, Bitcoin (BTC, Tech/Adoption Grade “A-”) has traded in a $10,000-wide range between $43,000 and $53,000.

• Ethereum (ETH, Tech/Adoption Grade “A-”) continues to trade sideways in the $1,400 –to $1,600 range, but it successfully recovered from brief lows near $1,300.

Bitcoin and Ethereum led the way for the broader cryptocurrency market despite a recent altcoin explosion. The two largest cryptocurrencies’ in-line performance this week is a positive sign because throughout “altcoin season,” it’s important that Bitcoin and Ethereum maintain momentum.

BTC and ETH are important trading pairs used to buy most altcoins, and their success — despite investors hunting for outperformance in less established cryptocurrencies — is a good sign that new money is flowing into the space.

Institutions are rushing into Bitcoin in waves, with what seems like a domino effect gathering steam. After Tesla, Inc.’s (Nasdaq: TSLA) $1.5 billion dollar investment via the conversion of cash on its balance sheet, rumors are growing that Apple Inc. (Nasdaq: AAPL) may want to deploy a small portion of its cash pile into the No. 1 crypto too.

While nothing’s been confirmed by the second-largest company in the world by market capitalization, analysts point to a major growth opportunity considering its entrance into the fintech space.

Here’s BTC’s chart in U.S. dollar terms via Coinbase:

We’ve seen a major surge in investment in the decentralized finance (DeFi) space, and Ethereum continues to be the dominant smart-contract platform as the top developer ecosystem despite higher fees.

Ethereum 2.0 is coming, and it’s a great sign that developers continue building off of Ethereum’s platform and are shrugging off the high fees.

Here’s ETH’s chart in U.S. dollar terms via Coinbase:

If Bitcoin and Ethereum can regain their momentum, it bodes well for the entire crypto market.

Index Roundup

This week was a nice rebound for crypto after last week’s extension of the correction. Bitcoin is still about 18% off of its all-time high above $58,000. Most of the notable cryptocurrencies performed in line with each other, as the market grouped together tightly.

Bitcoin is trading around $48,500 as of early Friday afternoon, and it looks to have found support after declining off its $58,000 high. Ethereum remains around the $1,500 level.

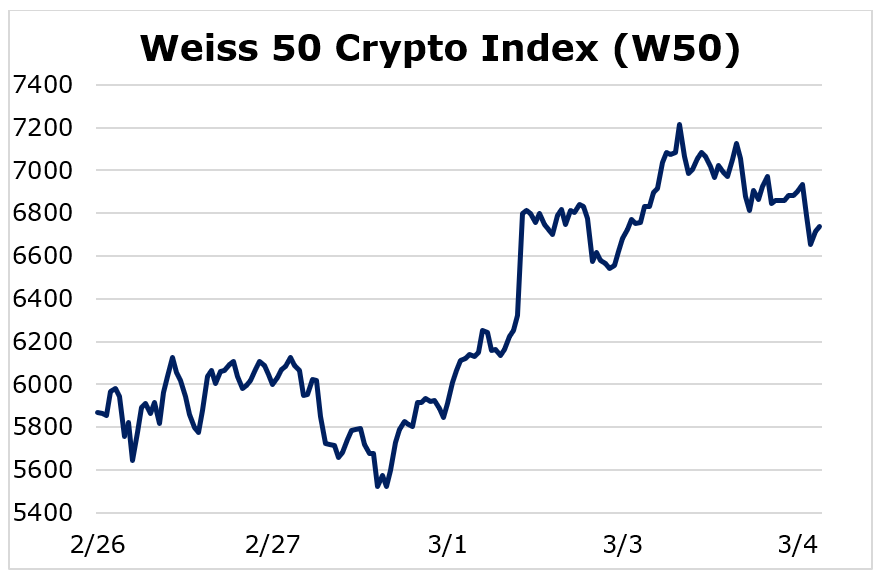

The Weiss 50 Crypto Index (W50) rose 14.77% on strong performance from almost the entire market.

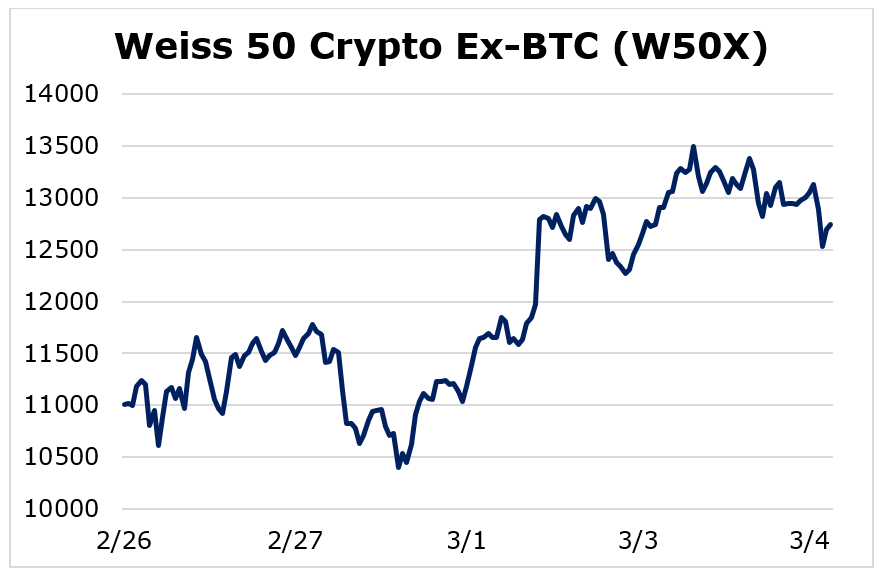

The Weiss 50 Ex-BTC Index (W50X) grew 15.76%, as the broader market narrowly outgained Bitcoin this week. However, this is not especially notable because the rest of the crypto market performed tightly in line with the King of Crypto.

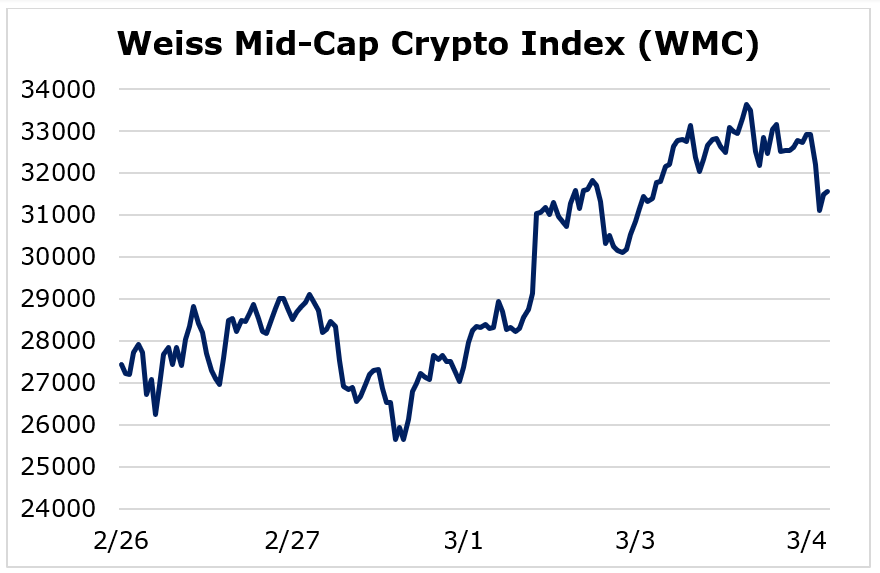

Breaking down performance this week by market capitalization, we saw that cryptocurrencies of all sizes performed in line with each other. Most cryptocurrencies bounced off of their lows from last week, as the market looks to shake off its recent correction.

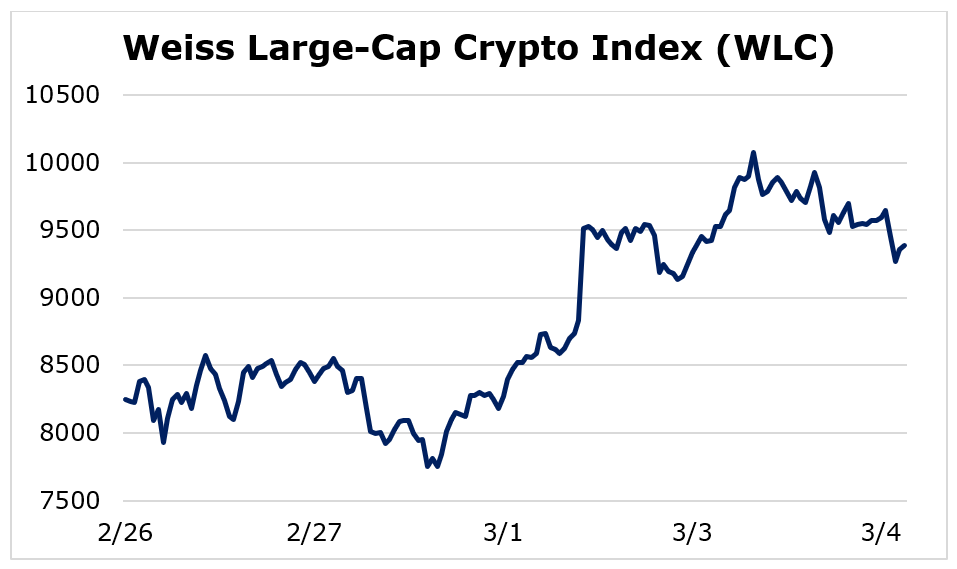

The Weiss Large-Cap Crypto Index (WLC) increased 13.85%.

Mid-cap cryptocurrencies performed the best this week by a narrow margin. The Weiss Mid-Cap Crypto Index (WMC) gained 15.02%

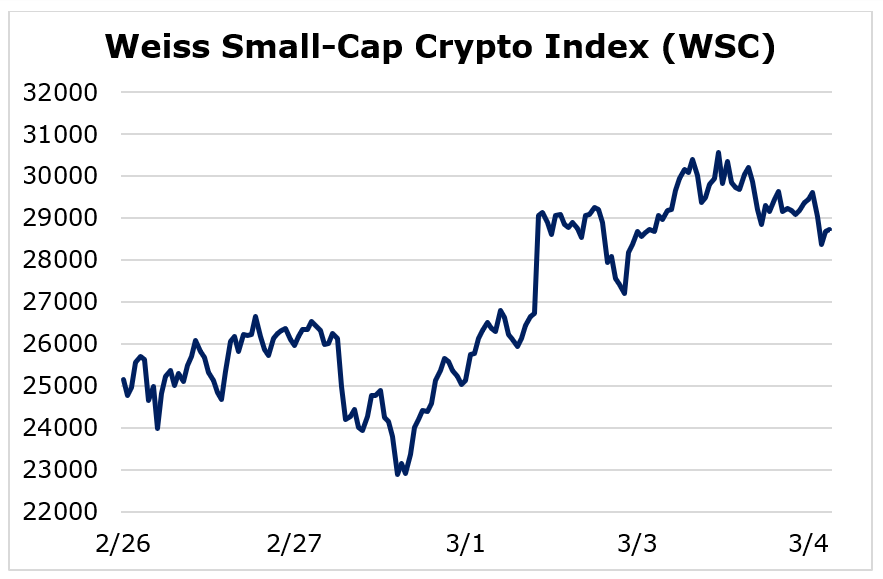

Small-cap cryptocurrencies chiefly shadowed large-cap and mid-cap performance, as the Weiss Small-Cap Crypto Index (WSC) gained 14.23%.

Most of crypto market traded in sync, a good sign that most individual names found support. Again, it’s completely normal to see market corrections of 20%, 30%, even 40% given the volatility in this still-nascent space. Recoveries of greater intensity have, thus far, always followed those downside moves. The long-term bullish trend is intact.

Meanwhile, this correction might not be over. But solid gains throughout the seven-day trading week ending Thursday are good sign. We may be starting to see light at the end of the tunnel. Greener pastures are surely ahead ... it’s simply a matter of time.

Notable News, Notes and Tweets

• Michael Saylor announced that MicroStrategy bought an additional $10 million in Bitcoin.

• A survey from The Goldman Sachs Group (NYSE: GS) showed 40% of its clients have exposure to crypto. As clients continue buying in, banking institutions will have to service their needs.

• Tyler Winklevoss unveiled Gemini Fund Solutions, a toolset for fund managers that provides support for most crypto functions and needs.

What’s Next

While it’s encouraging to see a bump in prices this week, the market may experience near-term volatility. We may not be out of the woods after this week’s slight recovery, as the correction could continue despite our long-term bullish outlook.

It’s difficult to time exact highs and lows within the crypto market, but Bitcoin’s fundamentals look stronger than ever. As inflation fears ramp up, Bitcoin provides a safe-haven with its strictly limited supply.

Traditional equity markets and tech have continued to sell off on fears of inflation, and Federal Reserve Chair Jerome Powell doesn’t look to be changing his tune about quantitative easing.

Unemployment still trails targets despite a better-than-expected jobs report, so the Fed will likely continue its accommodative monetary policy. More fiscal stimulus is likely on the way too, and Bitcoin’s adoption and use-case constantly improves as the printing and spending move full steam ahead.

We’ll be keeping a close eye on short-term choppiness, but our bullish long-term thesis is playing out even more positively than expected.

Best,

Sam