Pandemic Panic Turns Federal Reserve Money Spigots into Fire Hoses

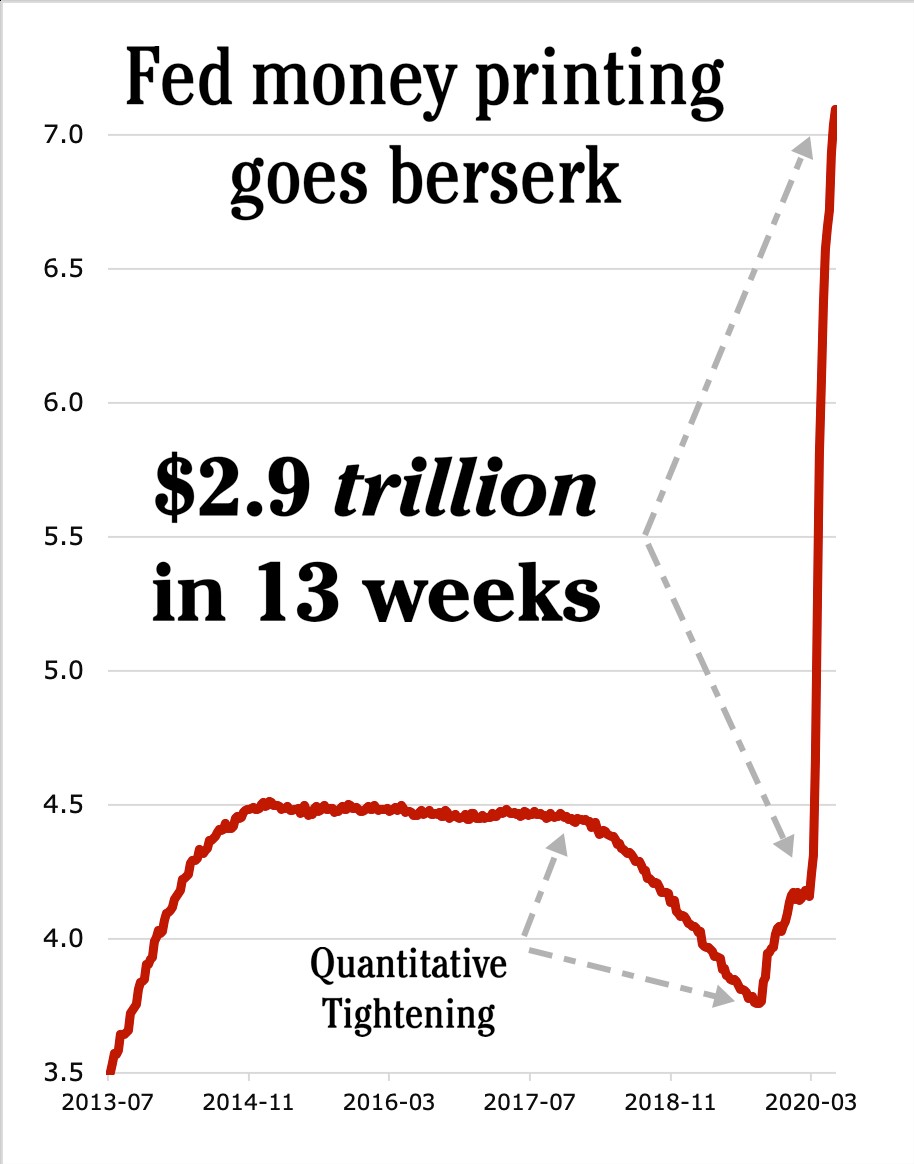

Remember back in 2017, when the Fed announced “Quantitative Tightening?”

That meant selling some of the approximately $4.5 trillion of assets it accumulated on its balance sheet in after the 2008 global financial crisis.

The idea, you recall, was to slowly and safely drain some of the recently printed money out of the economy.

Central bankers always think they can dial the economy up and down like an oven thermostat. This is their central conceit. But economic history shows they almost always get it wrong. And that's exactly what happened.

Once interest rates started inching up from near-zero levels, it didn't take very long before

major cracks appeared in the financial system.

This, now, seems like almost a lifetime ago. But it was only last September that the REPO markets suddenly seized up, threatening to bring the whole American banking system to a grinding halt.

In other words, when Fed officials tried even tentatively to reverse course — they nearly broke the back of the credit markets.

Seeing this, they forgot all about "Quantitative Tightening." And rushed to reopen the money spigots.

Now Comes Pandemic Panic. And the

Money Spigots Turn into Fire Hoses

The low point on the chart above corresponds to September 2019, when the Fed abruptly abandoned Quantitative Tightening. Then when pandemic panic appeared in March 2020, they turned on the fire hoses.

best measure of new money creation. Data source:

Federal Reserve Bank of St. Louis.

The red line shows how the Fed's balance sheet went vertical … blasting off like a rocket to the moon.

An almost inconceivable $2.9 trillion in new money created in only 13 weeks. And, if you can believe it, the Fed's only just getting warmed up.

Last month on 60 Minutes, Fed Chairman Powell pledged to do ... “whatever it takes” to keep the U.S. economy afloat. Which could easily mean printing another $3 trillion before this is over.

Remember back in 2008 — when Fed intervention was counted merely in the hundreds of billions? Now we’re talking trillions. That’s monetary inflation right there.

Mark my words: By the end of 2020, we're going to be talking tens of trillions. Numbers so big, they defy imagination.

What Does All This Money

Printing Actually Accomplish?

Not much.

Does it save the economy? Nope.

While the balance sheets of central banks go up, the economy actually goes down.

America, for example, has record levels of unemployment. The U.K. is looking at the worst recession in over 300 years. And now, popular protests are beginning to emerge across the industrialized world.

The only thing the global paroxysm of money-printing can do is stave off mass bankruptcies.

Ten years of near-zero interest rates led governments and corporations to borrow record amounts of money. Unpayable amounts of money.

Result: Every time interest rates poke up a couple hundredths of a percent, or there's some other scare in the world — real or imagined — this massive credit bubble threatens to pop.

To keep that from happening, the Central Banks stomps on the gas and pumps out even more freshly conjured up cash. And so the cycle continues.

Here's a News Flash:

It's Never Going to End

At least, not before the dollar is completely destroyed.

This is why safe-haven assets — that cannot be debased, manipulated or corrupted at the whim of a politician — are going up.

Gold is making new all-time highs against most major currencies (apart from the U.S. dollar). Ditto for collectibles, like rare coins, fine art and fine wine.

In the end, money desperately looking for a way to escape is going to come pouring into Bitcoin and other Weiss top-rated cryptocurrencies.

At which point it's going to go vertical — just like the Fed's balance sheet! Make sure you own some before that happens.

There are more than 2,000 coins in the crypto universe to choose from. But only a handful are worth investing in. To keep up with which are most promising, check our ratings here.

Best wishes,

Juan Villaverde and Bruce Ng