What the Fed’s ‘No Limit’ Gamble Means for Crypto

Federal Reserve Chair Jerome Powell, from basically the very beginning of the COVID-19 crisis, has been using the phrase “no limit” to describe restraints on his institution’s lending capacity.

Just last week, former Fed Governor Randy Kroszner, now a professor at the University of Chicago’s Booth School of Business, was on Bloomberg TV saying there’s “no limit” to the Fed’s balance sheet.

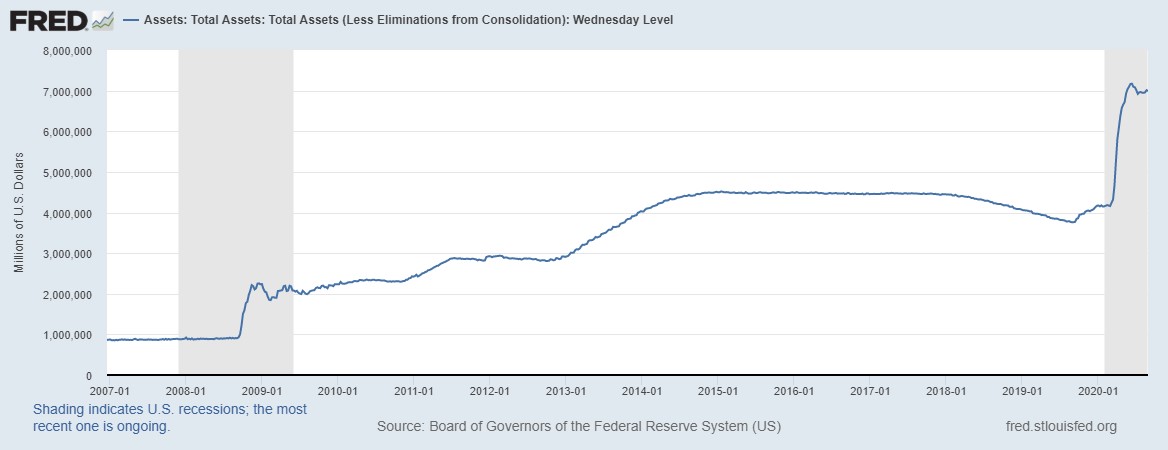

Indeed, the world’s most important central bank is acting as if that is the case: Its balance sheet has more than doubled since March.

Kroszner was on Bloomberg TV the day of Powell’s highly anticipated speech at the annual economic symposium in Jackson Hole, Wyo. That’s where Powell essentially said the central bank will keep interest rates at historically low levels even if inflation exceeds its 2% target.

FED chief is expected to bolster expectations of inflation in a speech Thursday. We don’t think the speech is particularly relevant to what the FED is doing in terms of the monetary policy. Having said that, the monetary policy is clearly inflationary - bad for $ , good for #BTC.

— Weiss Crypto Ratings (@WeissCrypto) August 25, 2020

That nuance is a key conclusion of the Fed’s review of its monetary policy framework, a two-year process, the thrust of which was only accelerated by the novel coronavirus. Here’s how Mohammed El-Erian described it for Bloomberg Opinion:

The result — a self-described evolution (as opposed to revolution) to the dual objectives of the Fed — includes a more “broad-based and inclusive goal” for maximum employment and the flexible use of “average inflation targeting,” which enables monetary policy to “aim to achieve inflation moderately above 2% for some time” following periods when inflation has been below that level.

Powell’s speech was hyped for days leading up to it by Fed-watchers hungry for more runes.

It’s much ado about nothing, as we tweeted beforehand, another way of saying “lower for longer.” Another way to interpret it, as Kroszner also said, is that the Fed doesn’t want to go “NIRP,” or “negative interest rate policy.”

There are two major problems, courtesy of David Rosenberg, with what the Fed’s doing.

First, inflation is running about 1.6%, based on the Fed’s favorite measuring stick.

What is this Powell fixation with an arbitrary 2% inflation goal? In the past 5, 10 and 20 years, core PCE inflation has averaged 1.6%. The range is 0.9% to 2.6% and today is 1%. What exactly is he lamenting about?

— David Rosenberg (@EconguyRosie) August 27, 2020

Second, folks hurt by lackluster wage growth won’t like the consequences much.

The problem with the Fed's quest for higher inflation was vividly illustrated in today's data. The increase in prices robbed the personal sector of any real income gain—taking what was a 0.2% gain in nominal disposable earnings to a 0.1% decline in inflation-adjusted terms.

— David Rosenberg (@EconguyRosie) August 28, 2020

A lot of heat was generated previewing the light Powell was supposed to shed on the course of monetary policy. Altogether — the hype and the speech — it’s more sound and more fury, signifying “debasement.”

And that’s good for crypto.

Look up your favorite crypto assets right here on Weiss Crypto Ratings to see how they’re responding to the Fed’s announcement. Or, use our Weiss Crypto Price Indexes to see how the broad market is moving.

Best wishes,

Juan and Bruce