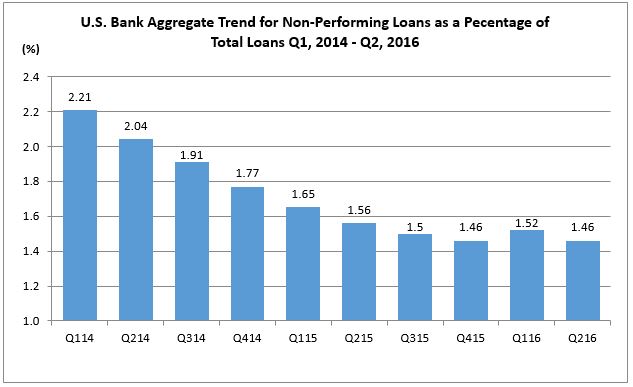

In one of our previous articles, we mentioned the banking industry’s non-performing loans increased slightly in Q1, 2016, raising some concerns about the underwriting quality. As of Q2, 2016, this percentage dropped to 1.46 percent, from 1.52 percent in the prior quarter. At this stage it is not possible to read too much into the trend and we will be focused on the third quarter data as soon as it becomes available.

Out of 5,969 banks rated by Weiss, 4,010 banks or 73.7 percent had better than the national average non-performing loans to total loans.

Below are the five largest U.S. banks and their non-performing loan percentages. Only U.S. Bank National Association performed better than the national average.

Bank Name |

Weiss Safety Rating |

Total Assets in Trillions $ |

Non-Performing Loans/Total Loans % |

| JPMorgan Chase Bank, National Association | B- | 2.05 | 1.77 |

| Wells Fargo Bank, National Association | C+ | 1.7 | 1.97 |

| Bank of America, National Association | B- | 1.66 | 1.64 |

| Citibank, N.A. | B | 1.37 | 1.58 |

| U.S. Bank National Association | B- | 0.43 | 1.27 |

Visit the Weiss Ratings website to see where your bank stands. Type in the name of your bank, click on the name and look under the “Summary” tab. At the bottom of the summary page you will find the “Asset Quality” section with loan performance percentages.