|

The S&P 500 hit new all-time highs this week!

It’s also true that this is the fifth time the S&P has done so since early 2018. Not one of those moves has stuck. That raises a trio of critical questions for me to answer:

Question 1. Why have none of the previous highs held?

Question 2. Will the pattern change?

Question 3. What should investors like you do about it?

Let’s tackle Question 1 first: Why have none of the previous highs held?

There are two main reasons: Non-confirmation of the move from other markets, and non-confirmation of the move from our own in-house, proprietary Weiss Ratings data.

I touched on the first of those last week. But I’ll do a deeper dive here. My work has always shown that the best stock market breakouts are the ones “confirmed” by other assets.

Take bonds, for example. What you want to see is agreement between equity and credit markets. More specifically, you want to see the cost of corporate borrowing decline in lock-step with the rise in stock prices. That’s a sign that all investors basically agree about a rosier outlook.

Stock investors are “saying” (in other words, investing their hard-earned dollars on the belief) that earnings growth is improving. Debt investors are saying the likelihood of companies defaulting on their debts is declining.

This was the case up until the blow move for stocks in January 2018. But it hasn’t been the case since.

The extra “premium” required by debt investors to accept the risk of buying corporate and high-yield (“junk”) bonds has remained elevated, despite modest new highs in the S&P 500. Spreads on higher-risk, lower-rated “CCC” bonds have also widened substantially.

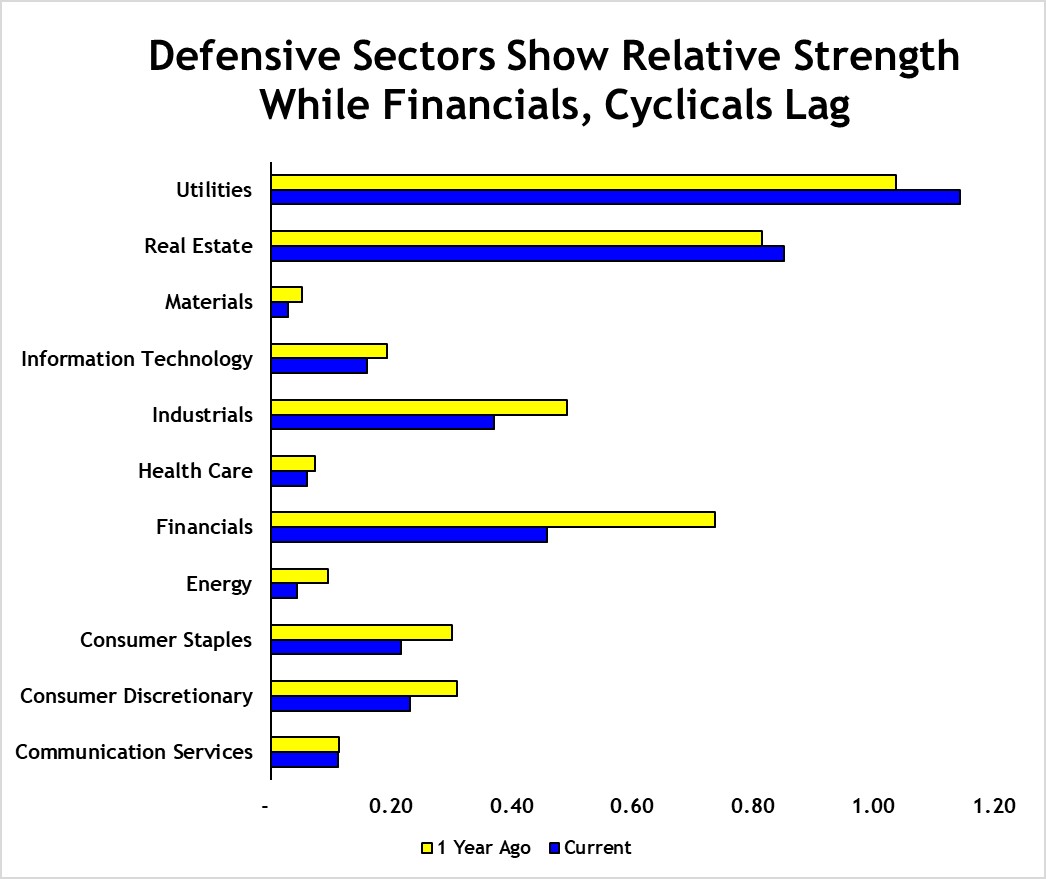

Then there’s the story our Weiss Ratings data is telling. I covered it partially on Monday. But this chart below goes further.

|

You can see that our sector-based “Buy”/“Sell” ratios are improving on a year-over-year basis in lower-volatility, dividend-focused, anti-recession sectors like utilities and real estate.

But the trend remains negative in offensive, cyclical sectors like financials, industrials and consumer discretionary. That shows how the character of the market remains defensive “behind the scenes.”

I’ll be discussing this chart in more detail at the 45th Annual New Orleans Investment Conference this weekend. If you want to make last minute plans to join me, along with dozens of other market experts, analysts, and precious metals company representatives, click here.

Now, let’s tackle Question 2: Will the pattern change?

There’s no question we’ve seen it change in the short term. Bank and transportation stocks rallied strongly in October after underperforming for months on end. U.S. Treasuries also lost value and the VIX index of volatility declined.

But so far, these look like nothing more than corrective moves. They shouldn’t come as much of a surprise following almost two years of going the other way.

It’s also worth noting that we’ve seen this before. At the end of the last two cycles, the S&P 500 notched a pair of “last gasp” upside spurts after the market began rolling over. But those moves in October 2007 and August 2000 ultimately couldn’t hold.

All of this brings me to the third and most important question of all: What should investors like you do here?

I think the smartest move is to sit on your hands.

Stick with what has worked best: carrying higher cash levels ... owning Treasuries versus riskier bonds ... focusing on lower-risk, dividend-paying “Safe Money” stocks ... boosting your allocation to gold and mining shares, etc. and see what unfolds.

Chasing S&P “breakouts” ever since January 2018 has proven to be a mug’s game. While there’s always a chance it’ll be different this time, the data isn’t pointing in that direction yet. I’d rather make investment decisions based off where the data is pointing than be driven by emotions or headlines.

Until next time,

Mike Larson